Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. China rallied 3.7%, and South Korea moved up 1%. Malaysia dropped 1.2%; India, Indonesia and New Zealand were also weak. Europe is currently mostly down. Greece is down more than 2%. Spain and Italy are down more than 1%; France, Austria, Prague, Hungary, Portugal and Sweden are also weak. Russia and South Africa are doing well. Futures here in the States point towards a down open for the cash market.

Join our email list to get reports and videos sent directly to you.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

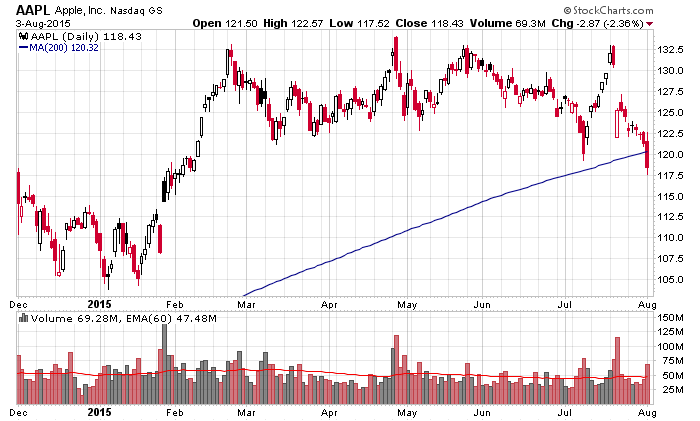

Yesterday’s big development, or at least the event that everyone is talking about, was the movement of Apple. The stock closed at its lowest level since February and beneath its 200-day MA for the first time since September 2013. Big institutions watch key moving averages such as the 200-day, so it’ll be interesting to see what happens here. Snap back or run for the exits? Apple is solid. They have more money than most countries. If institutions that sometimes have a hard time finding attractive investments can’t be enticed to buy Apple at this level, it doesn’t bode well for the overall market.

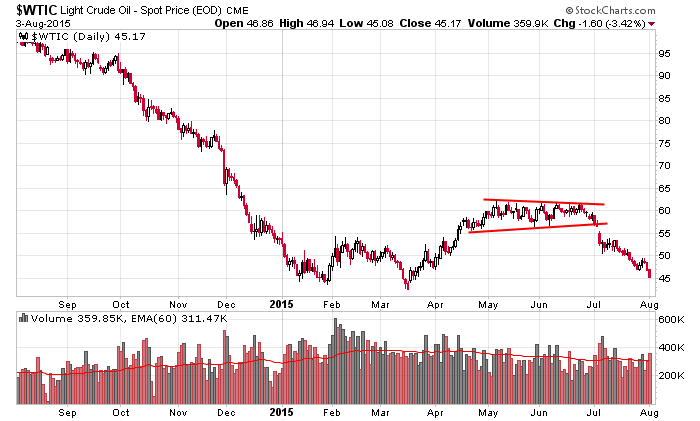

Oil is also an issue. It has almost retraced the move off its low and is causing a lot of pain in the oil sector.

My stance with the market remains the same. Near term anything goes – this is always the case. Looking out several weeks, the market’s upside will be limited until we get improvement from the breadth indicators. When the percentage of stocks trading above certain moving averages is falling, it gets mathematically harder for the market to move up. Too few stocks have to do the heavy lifted, and this just can’t last over time.

So in my eyes the overall path of least resistance will remain down until the internals improve. More after the open.

Stock headlines from barchart.com…

Archer-Daniels-Midland (ADM +0.59%) reported Q2 EPS of 55 cents, below consensus of 65 cents.

CVS Health Corp. (CVS +0.31%) reported Q2 EPS of $1.19, lower than consensus of $1.20.

Coach (COH -2.47%) reported Q4 EPS of 31 cents, higher than consensus of 29 cents.

Vornado (VNO +0.34%) reported Q2 AFFO of $1.30, higher than consensus of $1.23.

Allstate (ALL +0.62%) reported Q2 EPS of 79 cents, weaker than consensus of 96 cents.

D.E. Shaw reported a 5.1% passive stake in Western Refining (WNR -1.68%) .

Point72 Asset Management reported a 5.2% passive stake in Ascena Retail (ASNA -3.51%) .

North Tide Capital reported a 5.7% passive stake in Supervalu (SVU +1.52%) .

Avis Budget (CAR -0.18%) reported Q2 EPS of 84 cents, higher than consensus of 68 cents.

Texas Roadhouse (TXRH +3.53%) fell nearly 4% in after-hours trading after it reported Q2 EPS of 30 cents, below consensus of 37 cents.

LinkedIn (LNKD -3.03%) was initiated with a ‘Buy’ at Topeka witha price target of $260.

Diplomat Pharmacy (DPLO +2.86%) reported Q2 adjusted EPS of 16 cents, better than consensus of 12 cents.

Scientific Games (SGMS -0.26%) reported a Q2 EPS loss of -$1.19, a wider loss than consensus 0f -98 cents.

Netflix (NFLX -1.53%) was initiated with a ‘Buy’ at Guggenheim with a price target of $160.

AIG (AIG +0.05%) reported Q2 operating EPS of $1.39, above consensus of $1.23.

General Growth Properties (GGP +0.37%) reported Q2 FFO of 33 cents, right on consensus, although Q2 revenue of $579.98 million was below consensus of $616.10 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calender

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Factory Orders

Notable earnings before today’s open: ABMD, ADM, AET, AFSI, ALE, ALLT, ALR, AME, ANIP, ARCC, BLMN, BPI, BZH, CAS, CBT, CHD, CHTR, CIE, COH, CRCM, CRTO, CVS, DWRE, EIGI, ELOS, EMR, ETR, EXH, EXLP, EXPD, FRM, FUN, GEO, GLDD, GLT, H, HAR, HCN, HCP, HEP, HNT, HW, HYH, IIVI, INCY, K, KLIC, LPX, LRN, LXP, MDC, MGM, MLM, MNK, MNTA, MOS, MPW, NAO, NCLH, NGLS, NRG, NTI, NWN, NYLD, ODP, OZM, PH, REGN, RHP, RRD, SABR, SCOR, SGNT, SMG, SNI, SRE, STE, STWD, TDG, TGH, TICC, TIME, UNT, USAK, VMC, VSH, VTG, WLK, WNR, WPC, WRES, ZTS

Notable earnings after today’s close: ACHC, ACLS, AFG, AHS, AMSG, ARC, ATVI, AWAY, AWR, BKH, BW, CDE, CENT, CERN, CHUY, CSU, CVG, CWEI, CZR, DIS, DVA, DVN, DWA, ECOM, ECYT, ENPH, ENSG, EOX, EPAM, EPR, ETSY, EXAR, FSLR, FWM, G, GDOT, GHDX, GLUU, GNW, HCI, HIW, HRZN, INAP, INVN, JCOM, JIVE, LBTYA, LC, LF, LGND, MASI, MATX, MBI, MDRX, MHLD, MPO, MRCY, MTDR, NBR, NEWP, NFX, NSTG, NYMT, OAS, OCLR, OFIX, OKE, OKS, PAA, PAGP, PAYC, PBPB, PKD, PQ, PRMW, PTLA, PXD, PZZA, QNST, QUAD, REGI, REXX, RIGL, RLOC, RMTI, RPAI, RXN, SBRA, SKT, SMCI, SUPN, SYNC, THOR, TMH, TRMB, TROX, TTGT, TWO, TX, UNTD, UNXL, USNA, WR, WTR, XEC, XXIA, Y, Z, ZAGG, ZEN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers