Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Indonesia rallied 1.5%; Japan, Hong Kong and India also did well. China dropped 1.7%. Europe is currently mostly up. Germany, France, Russia and Italy are up more than 1%; London, Norway, Sweden, Poland, Denmark, Spain and Belgium are also doing well. Greece is down almost 4%. Futures here in the States point towards a relatively big gap up open for the cash market.

Join our email list to get reports and videos sent directly to you.

The dollar is down slightly. Oil is up, copper down. Gold and silver are down. Bonds are down.

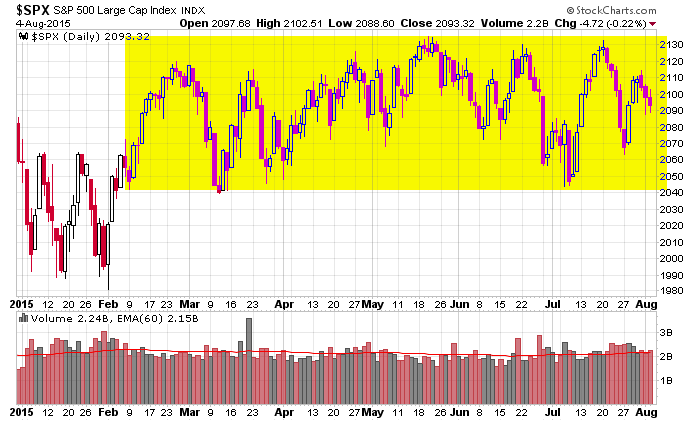

Here’s the S&P 500. I’ve been posting it in these morning comments from time to time to remind ourselves what the overall picture is – flat, range bound and not in a hurry to do anything. Whatever the market’s next trending move is going to be, the first objective is to frustrate as many traders as possible to ensure as few traders as possible participate. Those who are bullish are toning things down. Those who are bearish are getting frustrated every dip gets bought. There has been lots of intraday movement for day traders to feast on, but there has been no net change since February.

Despite S&P futures being up a bunch, AAPL is down pre-market. PCLN, on the other hand, is going to gap up 10% to a new all-time high. FSLR is also going to gap up about 10%. ETSY is going to gap down about 20%. The stock has not had a positive experience since going public.

The internals remain my guide. Day to day anything goes, but beyond a week or two, any move up that is not accompanied by a significant improvement in the internals will get sold into just like every other rally the last six months. Simple as this. Play the range, and try not to be too opinionated. More after the open.

Stock headlines from barchart.com…

IntercontinentalExchange (ICE +0.33%) reported Q2 adjusted EPS of $2.90, better than consensus of $2.77.

Time Warner (TWX -0.15%) reported Q2 EPS of $1.25, higher than consensus of $1.03.

The Priceline Group (PCLN +3.51%) reported Q2 EPS of $12.45, well above consensus of $11.79.

Discovery Communications (DISCA +0.46%) reported Q2 EPS of 47 cents, below consensus of 50 cents.

Cognizant Technology Solutions (CTSH +0.65%) reported Q2 EPS of 79 cents, higher than consensus of 73 cents.

Advance Auto Parts (AAP +0.74%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Hyatt (H -2.63%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Babcock & Wilcox (BW +0.15%) reported Q2 adjusted EPS of 27 cents, above consensus of 21 cents.

Acadia (ACHC -2.90%) reported Q2 EPS of 57 cents, higher than consensus of 52 cents.

Disney (DIS +0.47%) reported Q3 EPS of $1.45, better than consensus of $1.42.

DaVita (DVA +0.61%) reported Q2 EPS of 95 cents, right on consensus, although Q2 revenue of $3.43 billion was above consensus of $3.37 billion.

Activision Blizzard (ATVI +0.59%) rose over 6% in after-hours trading after it reported Q2 EPS of 13 cents, better than consensus of 8 cents.

Cerner (CERN -0.82%) reported Q2 EPS of 52 cents, right on consensus.

Ternium (TX -0.20%) reported Q2 EPS of 21 cents, well below consensus of 34 cents.

AmSurg (AMSG +2.28%) reported Q2 adjusted EPS of 97 cents, higher than consensus of 84 cents, and then raised guidance on 2015 adjusted EPS outlook to $3.52-$3.59 from $3.31-$3.39, above consensus of $3.35.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calender

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 International Trade

8:30 Gallup U.S. Job Creation Index

8:30 Treasury Refunding Quarterly Announcement

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: AMSC, ANSS, ARIA, ARQL, ATHM, ATRO, AVA, AVT, BLT, CEQP, CHK, CLDT, CLH, CMLP, CONE, CRK, CRME, CSTE, CSTM, CTSH, D, DAVE, DISCA, DISH, DNOW, DNR, EE, ENBL, FI, GDP, GTN, HCA, HFC, HSC, ICE, INXN, KATE, KELYA, KERX, LDOS, LG, LINC, LIOX, LL, LPLA, MEMP, MSI, MSO, MWE, PCLN, PWR, RDC, RL, SALE, SBGI, SCMP, SE, SNAK, SODA, SPAR, SPB, SUP, TMHC, TWX, USAC, VC, VLP, VOYA, VSI, WCG, WD, WEN, WIX

Notable earnings after today’s close: ABX, ACAS, ACXM, AEGR, AGU, ALB, AMTG, ANDE, AREX, ARNA, ATO, ATSG, AVG, AWK, AXLL, BEE, BGC, BREW, BRKR, BWXT, CBS, CCRN, CF, CJES, CLNE, CLR, CNAT, CODI, CORT, COUP, CPE, CSII, CSLT, CTL, CUTR, CXW, DCO, DNB, DPM, DXCM, ECHO, ECOL, ENS, EQC, ETE, ETP, FANG, FLT, FMC, FNGN, FOXA, FRT, FTD, FUEL, GBDC, GDDY, GMCR, GPOR, HABT, HDP, HI, HIVE, HLF, HR, IAG, ICPT, IL, IRWD, ITRI, JACK, JAZZ, JONE, KND, KW, LGCY, LHCG, LNT, MCHX, MED, MELI, MG, MITT, MNTX, MRIN, MRO, MUSA, NHI, NKTR, NLY, NOG, NP, OME, OPK, OSUR, PACB, PDLI, PFMT, PGTI, PHH, PMT, PNNT, POWR, PRI, PRU, PRXL, PSIX, RAIL, REG, RGLD, RIG, RLD, RP, RST, RYN, SBY, SD, SGI, SGMO, SGY, SHOR, SLF, SQNM, SSNI, STR, SUN, SWM, SXL, TCAP, TLLP, TRNX, TRQ, TS, TSLA, TSO, TTEC, TTMI, TTPH, TUMI, UHAL, UIL, VVC, WGL, WPX, WSR, WTI, WTW, XNPT, XPO, ZU

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers