Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed with a lean to the upside. China dropped 2.7%, and Japan fell 1.6%. Malaysia rallied 2.3%. India and Indonesia also did well. Europe currently leans to the downside. Netherlands, Sweden and Greece are down more than 1%. Italy, Portugal, Czech Republic and Norway are also weak. Futures here in the States point towards a flat open for the cash market.

S&P Select – Week in Review

The dollar is up. Oil and copper are down. Gold is flat, silver is down. Bonds are up.

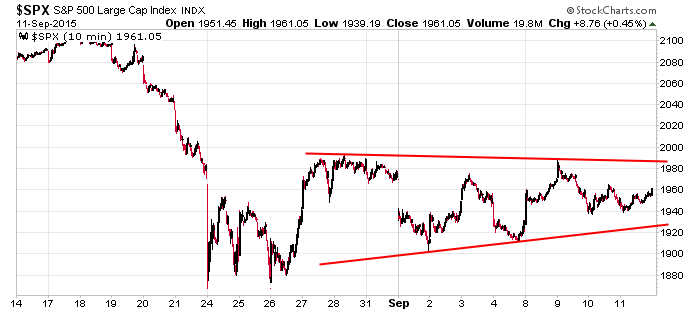

I don’t have anything to add to the comments already made in the weekly report posted yesterday. The market has moved in a sideways consolidation pattern for about three weeks. Pops have gotten sold, dips have gotten bought. There have been lots of gaps and sudden reversals, and after three weeks the indexes are very little changed. Here’s the 10-min S&P chart.

Volatility remains high, but if there was a reason for it to dampen, now is a good time. Today and tomorrow are are Jewish holiday, and then the Fed meets on Thursday. I’ll talk about the Fed later in the week.

I’ve pretty much laid out what I’m looking for. A rally attempt needs to be accompanied by a significant improvement in the breadth indicators. If it happens, then perhaps a move can last, but if it doesn’t, the lows will be tested and likely taken out.

No need to guess. The charts will tell us what’s brewing beneath the surface.

For now the market is in the middle of a range, and I’d say the odds of a move up are approx. equal to a move down – perhaps slightly higher. Risk is elevated in the middle, so don’t push it right now. More after the open.

Stock headlines from barchart.com…

Solera Holdings (SLH +3.86%) jumped over 8% in pre-market trading after Vista Equity Partners agreed to buy the company for $6.5 billion.

Wisconsin Energy (WEC +1.35%) was upgraded to ‘Buy’ from ‘Hold’ at Argus.

Brean Capital reiterated its ‘Buy’ rating on Salesforce (CRM +0.44%) and said the stock should be a core holding.

H&R Block (HRB +1.20%) was downgraded to ‘Neutral’ from ‘Buy’ at BTIG.

Exelon (EXC -0.17%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Marvell (MRVL -16.21%) was downgraded to ‘Neutral’ from ‘Buy’ at B. Riley.

AstraZeneca (AZN +0.06%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Alexion Pharmaceuticals (ALXN +0.16%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

Xilinx (XLNX +0.38%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Nokia (NOK -0.61%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman Sachs.

BHP Billiton (BHP +0.38%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

Chico’s (CHS +0.13%) said it is contemplating a sale of the company after offers from private-equity buyers including Sycamore Partners, according to Bloomberg.

Monster Beverage (MNST +0.40%) announced a new $500 million share repurchase program.

Baker Brothers reported a 39.6% stake in Aquinox (AQXP +4.86%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

none

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 14)”

Leave a Reply

You must be logged in to post a comment.

As we sit around twiddling our thumbs awaiting the Fed verdict….oh yeah-We have a new Prime Minister !

yes,australia has a new primeminister,but he does not know how to run a country in a depression

i used to drink with him 20 years ago,in sydney and he is a academic and only interested in big side of town and not small business that creates growth

its not worth trading these slow sideways moves,but a sideways triangle [usually wave 4 ] will follow the trend—thats down

thank you…waiting for a test of recent highs…sure feels like the buyers are far and few between…now the HFT sure have a knack on runnning stops at key locations…seems like 40-50 points can be the norm….patience is key…