Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. China dropped 3.5%. Singapore, Australia and Indonesia fell more than 1%. Europe is little moved from their unchanged levels. Turkey is up more than 2%; Italy is also doing well. Belgium and Netherlands are down more than 1%; Portugal and Sweden are also down. Futures here in the States point towards a flat open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is down slightly. Oil is up, copper is flat. Gold and silver are up. Bonds are mostly up.

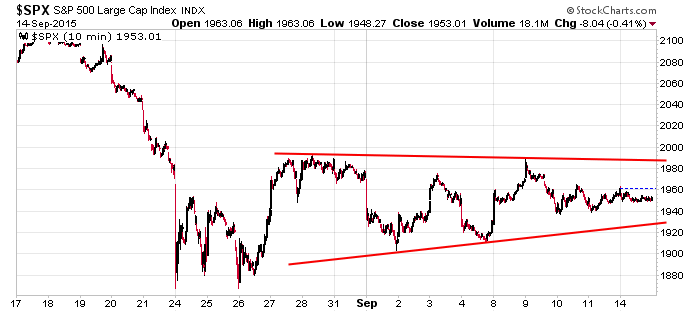

The market traded quietly yesterday – thanks to the Jewish holiday and upcoming FOMC meeting – so the range has continued. The longer it lasts, the more neutral it gets.

And the closer we get to the Fed meeting, the more trading becomes gambling. We don’t know what they’ll do (I suspect they’ll keep rates where they are), and more importantly we don’t know what the market’s reaction will be.

In my opinion, the best trade over the next month will be either going with the next breakout (if the internals support it) or fading the next breakout (if the internals don’t). Trading in the middle is tough. Trading at one of the the extremes offers better risk/reward ratios and better odds of success. Don’t push it right now. More after the open.

Stock headlines from barchart.com…

Owens-Illinois (OI +0.25%) and Weyerhaeuser (WY -0.51%) were both upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Corning (GLW -0.28%) was initiated with a ‘Buy’ at Deutsche Bank with a price target of $21.

The Fresh Market (TFM -0.90%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

Whirlpool (WHR -0.91%) was upgraded to ‘Top Pick’ from ‘Outperform’ at RBC Capital.

Nordstrom (JWN -0.57%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Joy Global (JOY -0.11%) was downgraded to ‘Neutral’ from ‘Buy’ at Axiom.

Commerzbank (CRZBY -0.13%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

UBS (UBS -1.93%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Credit Suisse (CS -2.16%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman Sachs.

Carl Icahn raised his stake in Cheniere Energy (LNG +2.60%) to 9.59% from 8.18%.

Glenhill Advisors reported a 5.9% passive stake in UTi Worldwide (UTIW -1.99%).

Fitbit (FIT -1.23%) was initiated with an ‘Overweight’ at Pacific Crest with a price target of $47.

Bristow Group (BRS -2.80%) was initiated with an ‘Outperform’ at Oppenheimer with a price target of $52.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Retail Sales

8:30 Empire State Mfg Survey

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 Business Inventories

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 15)”

Leave a Reply

You must be logged in to post a comment.

The debt levels worldwide are holding down the future for most people. The us dollar is the reserve currency. SO.. Staying invested in US stocks paying a decent dividend. Earnings on US stocks, S&P really, are about $1.34 for the year. Projecting S&P 2066 eoy. But maybe a little correction this fall. Hang in there.

Really enjoying your very logical market and trading advice.

Happy trading……………….

its in the range for a top of either wave 2 or 4of larger 1

only the size of the drop will tell that

BIS–international swaps tells the would hugh DEBT PROBLEM

and even a .25 % fed hike will cause a inplosion

lets bankrupt the world stating with europe