Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down, but losses were minimal. India, Australia and Hong Kong were weak; Japan did well. Europe is currently mixed, and movement is minimal there too. Greece is down 2.5%. Otherwise, Belgium, Russia and Finland are doing the best; Netherlands, Turkey, Hungary and Spain are weakest. Futures here in the States point towards an up open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is down. Oil is up, copper is down. Gold and silver are down. Bonds are down.

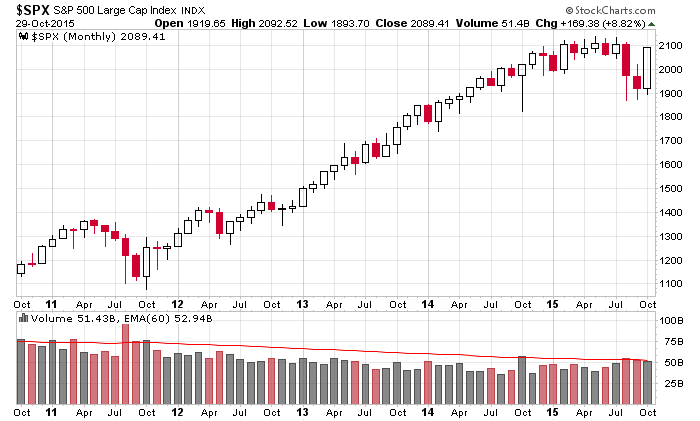

This is the last day of October. Barring a flash crash type event the market doesn’t recover from, the month will close with the biggest monthly gain in many years. In September the sky was falling, and everyone said the uptrend was over, and a new downtrend was in its beginning stages. Now, a month later, the tone has completely changed. Worst case scenario now is a big range that lasts many more months before breaking down. Here’s the monthly S&P.

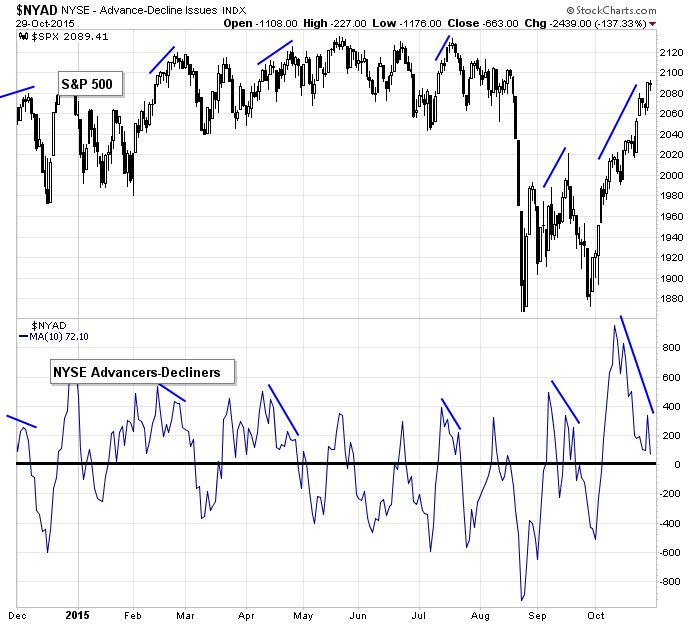

Despite my bias firmly being to the upside overall, near term I’m less confident. A couple indicators have diverged from the price action, and a few others have moved directionally long enough to justify a reversal in the near term.

Here’s the AD line. While the market has moved up, it has trended down, suggesting a lack of support for the market gains. It doesn’t imply anything about the long term, but in the near term hints that the market may need to rest and reset.

Besides indicators like the AD line pulling back, we have a lack of good set ups to play. Some are too far gone to chase…others have earnings coming up so are not playable…many aren’t trading in recognizable patterns.

I like the market overall, but I don’t see much to do in the near term. More after the open.

Stock headlines from barchart.com…

Weyerhaeuser (WY -0.38%) reported Q3 EPS of 35 cents, higher than consensus of 25 cents.

Phillips 66 (PSX +1.81%) reported Q3 EPS of $3.02, well above consensus of $2.25.

Valeant Pharmaceuticals International (VRX -4.70%) slid 7% in pre-market trading after Phildor RX Services LLC, a pharmacy that fills prescriptions for Valeant, was said to have altered doctors’ prescriptions in order to get more reimbursements out of insurers.

Linkedin (LNKD +1.78%) surged 13% in pre-market trading after it reported Q3 adjusted EPS of 78 cents, well ahead of consensus of 45 cents, and then raised guidance on fiscal 2015 EPS to $2.63 from a previous estimate of $2.19, higher than consensus of $2.23.

Live Nation (LYV -1.10%) jumped over 7% in after-hours trading after it reported Q3 adjusted EPS of 44 cents, better than consensus of 43 cents.

Starbucks (SBUX -1.59%) fell over 1% in after-hours trading after it said it sees Q1 EPS of 44 cents-45 cents, below consensus of 47 cents, and said it sees revenue growth of 10% on a 52-week basis, below consensus of 12%.

Expedia (EXPE +1.00%) rose 7% in after-hours trading after it reported Q3 adjusted EPS of $2.07, better than consensus of $2.02.

Fluor (FLR -1.42%) dropped over 1% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $3.50-$4.00, below consensus of $4.07.

Genworth Financial (GNW -0.95%) slumped over 12% in after-hours trading after it reported Q3 operating EPS of 13 cents, weaker than consensus of 22 cents.

Solarcity (SCTY -0.70%) tumbled over 15% in after-hours trading after it reported a Q3 EPS loss of -$2.10, a wider loss than consensus of -$1.91.

Lending Club (LC -2.71%) climbed over 5% in after-hours trading after it reported Q3 adjusted EPS of 4 cents, double consensus of 2 cents, and then raised guidance on fiscal 2015 operating revenue to $420 million-$422 million from a previous estimate of $405 million-$409 million, above consensus of $408.5 million.

Fiesta Restaurant Group (FRGI -3.79%) dropped nearly 7% in after-hours trading after it reported Q3 adjusted EPS of 33 cents, below consensus of 37 cents.

Deckers Outdoor (DECK -0.44%) jumped over 10% in after-hours trading after it reported Q2 EPS of $1.11, higher than consensus of $1.06, and then raised guidance on fiscal 2015 EPS to $5.18 from a July estimate of $5.15, above consensus of $5.14.

YRC Worldwide (YRCW +3.13%) surged over 15% in after-hours trading after it reported Q3 EPS of 61 cents, nearly double consensus of 31 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 GDP Q3

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

3:00 Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

//

0 thoughts on “Before the Open (Oct 30)”

Leave a Reply

You must be logged in to post a comment.

T/A is distorted atm owing to massive money flows out of europe/asia and emergency central bank stock buying -this is helping some usa stock buying but it is selective, hence some internal usa indicators

and other divergences –i dont see this lasting that much longer ,then usa may experiance a real

”HANGOVER ‘

OTHER WORLD INDEXES ARE DIVERGING FROM USA

if dow can get to 17900 and spx to 2106 we should end it –we got close during asia /usa index buying

i am getting short to medium term bottoming, at least stabilization, signals from both the oil and esp. natgas pits. i wouldn’t be surprised if energy complex started to run a bit into year-end.

The gas station nearest my house is pretty good at calling movements in oil. Gas has steadily declined from $2.85 to $2.09. I want to see the price tick up at the station before going long.

Now below 2 bucks.