Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 3%; Australia, Malaysia, Taiwan and Singapore fell more than 1%. Europe is currently mostly down. London, Austria, Norway, Poland, Denmark and Italy are down more than 1%; Germany, France, Russia, Spain and Sweden are also weak. Portugal is doing well. Futures here in the States point towards a relatively big gap down open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is down. Oil and copper are down. Gold and silver are down. Bonds are down.

The Fed has come and gone. More so than any other statement they’ve made they talked about what criteria needed to be in place for them to raise the target range of overnight rates. Even though I don’t think the criteria will be met – commodities would have to rally across-the-board between now and then – the sheer talk about raising rates is on the minds of Wall St. The market’s initial reaction was down…then it surged.

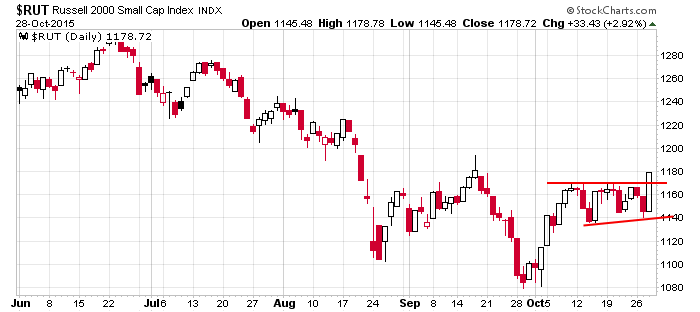

The Russell small caps, which have been lagging, busted out of an almost month-long consolidation pattern. They have yet to even make a higher high, but this is still a great sign.

The large caps lagged the small caps but still did very well.

Oil surged better than 6%…one of the biggest up days of the last couple months.

Gold and silver were up big early in the day but sold off hard and ended the day down.

Lots of big moves, and now the indexes are set to give back a chunk of their gains from yesterday at today’s open. Wall St. is like that. The short term is a crap shoot, but the overall trend tends to stay in place.

In my eyes, the overall trend remains up, so my bias of course remains to the upside. I’m thinking new highs will be made later this year or early next year.

In the very near term the market is very extended (S&P has moved 200 points in one month – one of the best months in a long time), but overall dips are buyable. More after the open.

Stock headlines from barchart.com…

PayPal (PYPL +1.61%) fell 6% in pre-market trading after it reported Q3 EPS of 31 cents, better than consensus of 29 cents, but reported Q3 revenue of $2.26 billion, less than consensus of $2.28 billion.

Allergan Plc (AGN +0.50%) jumped 14% in pre-market trading after the WSJ reported it is considering a merger with Pfizer.

CME Group (CME +2.18%) reported Q3 EPS of $1.06, better than consensus of 99 cents.

Amgen (AMGN +0.43%) rose over 1% in after-hours trading after it reported Q3 adjusted EPS of $2.72, well above consensus of $2.37, and then raised guidance on fiscal 2015 EPS to $9.95-$10.10 from a July estimate of $9.55-$9.80, above consensus of $9.77.

Aetna (AET +0.40%) reported Q3 EPS of $1.90, higher than consensus of $1.77.

FMC Corp. (FMC +3.39%) climbed 1% in after-hours trading after it reported adjusted Q3 EPS of 42 cents, better than consensus of 38 cents.

Yelp (YELP -3.62%) rallied over 2% in after-hours trading after it raised guidance on fiscal 2015 revenue to $545.5 million-$551.5 million from a prior estimate of $544 million-$550 million, above consensus of $545.7 million.

GoPro (GPRO +7.01%) tumbled 12% in after-hours trading after it reported Q3 EPS of 25 cents, weaker than consensus of 29 cents.

Pilgrim’s Pride (PPC +0.26%) fell 4% in after-hours trading after it reported Q3 adjusted EPS of 58 cents, well below consensus of 72 cents.

F5 Networks (FFIV +0.87%) fell over 4% in after-hours trading after it reported Q4 EPS of $1.84, better than consensus of $1.74, but then lowered guidance on Q1 EPS to $1.58-$1.61, below consensus of $1.71.

Vertex Pharmaceuticals (VRTX -0.75%) rose almost 6% in after-hours trading after it posted a Q3 EPS loss of -13 cents, a smaller loss than consensus of -31 cents.

HanesBrands (HBI +2.03%) jumped over 10% in after-hours trading after it reported adjusted Q3 EPS of 50 cents, above consensus of 45 cents, and then raised guidance on fiscal 2015 EPS to $1.66-$1.68 from a prior view of $1.61-$1.66, above consensus of $1.64.

SunPower (SPWR +3.53%) gained over 4% in after-hours trading after it reported Q3 EPS of 13 cents, better than consensus of break even.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 GDP Q3

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

3:00 Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 29)”

Leave a Reply

You must be logged in to post a comment.

what makes the market great is just what Jason said ” in my eyes ”

i perceive Jason to have a bullish bias and beleives in the similarities to the 2011 chart

and thats all right and could be so

as chief of the bears i beleive this fantasy market from 2009 to be made up of kicking the can down the road,with ever increasing debt and no real economic prosperity that make true bull markets

i believe the current chart has more similarities to the 2008 chart

but this wave 2 corrective move has gone up a but 2 far

how ever wave 2’s can retrace 99.9 % of wave 1’s

AT THE MOMENT THE INSTOS–BANKS AND WORLD CENTRAL BANKS HAVE GOT US JUST WHERE THEY WANT US AS EITHER JASON OR I COULD BE RIGHT

its at a point of indecision doji

as a daytrader it doesnt really matter to me who is right as i am a lousy long or medium term trader

–no patients and couldnt sit through a swing trade and know i only have the mind set for daytrading

as a matter of interest,if we go down today we may go up tomorrow

as bank of japan tomorrow with let us know its further QE program

it currently owns a third of all japan share market and etf and much of world shares and thinking of tripleing it–crazy

My models tell me we most likely have room to run. I am normally in too soon and out too soon… Just the opposite of a swing trader. As long as you make money who cares?