Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. China and Japan posted decent gains, but Australia and Indonesia fell more than 1%, and India, South Korea, Hong Kong and Taiwan were also weak. Europe is currently mixed. Portugal is down more than 2%, but otherwise movement is minimal. France, Switzerland and Denmark are down; Norway, Greece, Turkey and Hungary are up. Futures here in the States point towards a gap down open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is down. Oil is up, copper is flat. Gold and silver are up. Bonds are down.

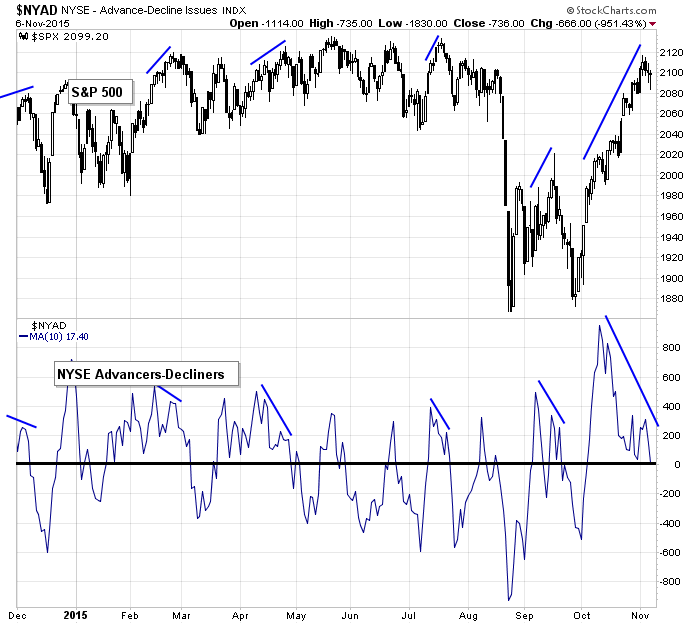

We enter this new week with the market doing just fine overall but with some divergences that are too obvious to ignore. The market doesn’t have to immediately respond to such divergences, but they do hover over the market and often limit the upside until they play out.

The 10-day of the AD line put in an obvious lower high while the underlying market put in a new high.

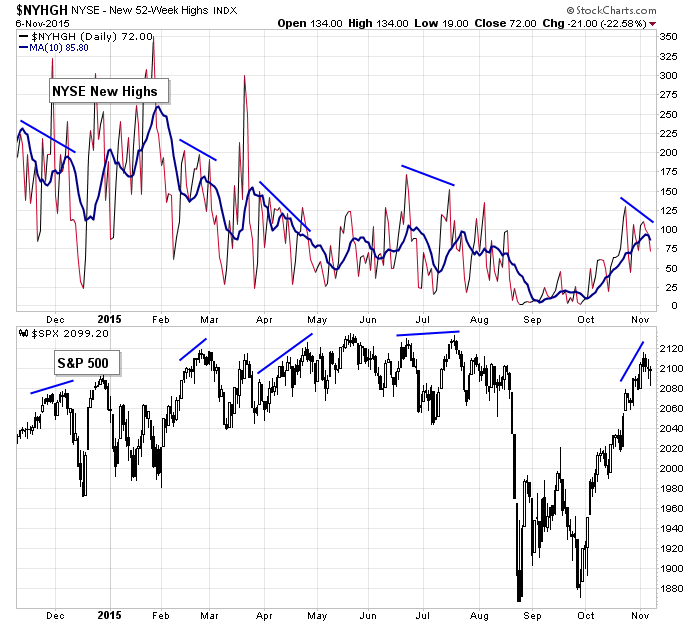

New highs have climbed the last month, but on the market’s most recent move to a new high, less stocks accomplished the same.

I like the market overall and believe odds favor the market rallying to a new high this year or early next year, but in the near term I’m less confident the market is just going to gallop forward.

It’s also worth noting Apache (APA) is the target of an takeover. If strong oil companies start trying to take out the weak, there could be a flurry of activity in the coming months.

Stock headlines from barchart.com…

Alcoa (AA -1.20%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

Priceline Group (PCLN -0.87%) reported Q3 adjusted EPS of $25.35, better than consensus of $24.19.

Scripps Networks Interactive (SNI +1.34%) reported Q3 EPS of $1.06, higher than consensus of 98 cents.

Affiliated Managers Group (AMG +0.89%) reported Q3 EPS of $2.93, better than consensus of $2.87.

Sanofi (SNY -7.58%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Marathon Oil (MRO -3.74%) said it will sell some its Gulf of Mexico assets for $205 million.

Apache Corp. (APA -3.25%) jumped 11% in pre-market trading after it said it rejected an unsolicited $18 billion offer for the company.

Hertz GLobal (HTZ +4.27%) reported Q3 adjusted EPS of 49 cents, weaker than consensus of 52 cents.

Kronos Worldwide (KRO -0.37%) reported an unexpected Q3 EPS loss of -10 cents, weaker than consensus of a profit of 6 cents.

Weight Watchers (WTW +35.20%) rose 4% in after-hours trading after Point 72 Asset reported a 6.0% stake in the company.

BioCryst Pharmaceuticals (BCRX -4.28%) climbed nearly 4% in after-hours trading after Baker Bros. said they raised their stake in the company to 19.5% from 15.8%.

WhiteWave Foods (WWAV -0.96%) rose over 1% in after-hours trading on optimism over the company’s Q3 earnings results that are expected before the opening of trading on Monday, Nov 9.

Acadia Pharmaceuticals (ACAD -11.53%) fell nearly 2% in after-hours trading after its Chief Medical Officer, Roger Mills, resigned.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

10:00 Labor market condition index

12:30 PM TD Ameritrade IMX

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 9)”

Leave a Reply

You must be logged in to post a comment.

No 60/40 portfolio, more stocks and dividends and fewer bonds. like new reit WY/PLC, what is dividend? More up in market of stocks Jason says, but why?

Live it up

The market doesn’t always need a reason to go up. 🙂