Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Hong Kong, India, Indonesia, South Korea and Taiwan each dropped more than 1%. Europe is currently mostly down. Greece is down more than 2%; Sweden more than 1%; Norway, Switzerland, London, Turkey, Netherlands and Portugal are also weak. Futures here in the States point towards a down open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are up.

The S&P has fallen 4 straight days – it’s longest losing streak since a 5-day streak into the late-September bottom. The total points lost is only about 35. I’d consider the action to be perfectly normal for an uptrending market, and given the negative divergences I’ve talked about the last week, this shouldn’t come as a surprise.

But just because this would be considered a normal and healthy rest for an uptrending market doesn’t mean you blindly hold. If you’re a trader, be a trader. Take some money off the table, let the charts reset themselves and get ready for the next leg up. If you sit there and stare at losses slowly growing, you’ll be too scared to pull the trigger when the market reverses.

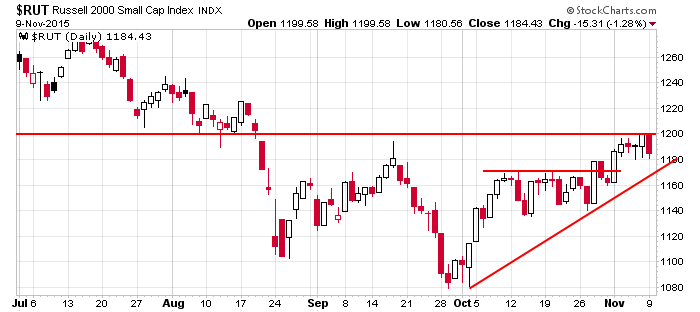

Here’s the Russell. It broke out, took out its September high but then got rejected by a level (1200) that previous acted as support. The index is definitely not “in the clear,” so despite its recent progress, you can’t get lazy.

Long term I still like the market. Near term there are minor concerns. More after the open.

Stock headlines from barchart.com…

The Gap (GPS -2.81%) slid over 4% in pre-market trading after it reported Oct same-store-sales were down -3.0% y/y, weaker than estimates of down -0.4% y/y. Gap then lowered guidance on Q3 adjusted EPS to 62 cents-63 cents, below consensus of 67 cents.

DR Horton (DHI -2.14%) reported Q4 EPS of 71 cents, higher than consensus of 63 cents.

Rockwell Automation (ROK -1.11%) reported Q4 EPS of $1.57, less than consensus of $1.78.

Synchrony Financial (SYF -4.30%) will replace Genworth (GNW +0.42%) in the S&P 500 as of the close of trading on Nov 17.

Foot Locker (FL +0.36%) was downgraded to ‘Neutral’ from ‘Buy’ at Buckingham.

Rackspace Hosting (RAX -4.21%) climbed over 7% in after-hours trading after it reported Q3 EPS of 26 cents, higher than consensus of 21 cents.

International Flavors & Fragrances (IFF +0.80%) reported Q3 EPS of $1.39, higher than consensus of $1.35.

McDermott (MDR -2.60%) rose over 5% in after-hours trading after it reported Q3 adjusted EPS of 9 cents, better than consensus of 5 cents.

Caesars Entertainment (CZR -1.72%) fell over 2% in after-hours trading after it reported a continuing operations Q3 EPS loss of -$5.44 and said that results prior to Jan of 2015 have not been adjusted to reflect its filing for Chapter 11.

Lionsgate (LGF -2.77%) tumbled 6% in after-hours trading after it reported an unexpected Q2 EPS loss of -19 cents, weaker than consensus of a 6 cent profit.

OPKO Health (OPK -0.10%) rose over 5% in after-hours trading after it reported Q3 EPS of 25 cents, much better than consensus for a -2 cent loss.

Jazz Pharmaceuticals (JAZZ -1.82%) fell nearly 4% in after-hours trading after it lowered guidance on fiscal 2015 EPS to $9.45-$9.60 from an Aug estimate of $9.45-$9.75, below consensus of $9.66.

Depomed (DEPO +1.21%) climbed 6% in after-hours trading after it reported adjusted Q3 EPS of 33 cents, better than consensus of 19 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:30 Import/Export Prices

8:55 Redbook Chain Store Sales

10:00 Wholesale Trade

1:00 PM Results of $24B, 10-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 10)”

Leave a Reply

You must be logged in to post a comment.

Jason is right about taking profits

whilst i am not a long or medium term trader ,i would have thought it wise to take profits at just under

last weeks lower highs in spx and dow and new high in nas 100

i disagree with Jason on wave structure as last weeks lower highs could have been corrective wave 2 up

certainly was enough overlapping chop and this down could be start of larger wave 3 down

but Jason is equally right this could be just a shallow pull back and new highs could eventuate

therefore i am watching [whilst day trading ] spx 2050-60 then 2015

and 4567 and 4460 in nas 100 if they eventuatue

Not sure on this market. Selling gap ups and buying gap downs seems to work nicely.

This is a dull market and I do hate going short.

that’s my all-time favorite strategy for stocks (doesn’t work in bonds or currencies or commodities with any consistency). in my trading experience, it is one tactic that always worked under all market conditions. the beauty of it is that, if mastered, one can trade for just an hour or two a day and make a fortune without much stress, risk, loss of sleep, etc. since no positions are carried overnight.

welcome to daytrading even on a 22 hour basis

but their is a lot of waiting for the highs and lows intraday

and on the futures thats 22 hours and divided into asia /europe and usa

so still a lot of form reading