Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to upside, but movement was mostly minimal. Hong Kong rallied 2.4%; Singapore dropped 0.8%, and China fell 0.5%. Europe is currently mostly down. France, Austria, Norway, Prague and Spain are down more than 1%; London, Netherlands, Sweden, Italy and Czech Republic are also weak. Futures here in the States point towards a down open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold is down slightly; silver is up slightly. Bonds are up.

The market has dropped 4 of 5 days. The selling hasn’t been extremely intense, and the net loss hasn’t been great. In my eyes the market is working off the negative divergences I pointed out at the beginning of the month.

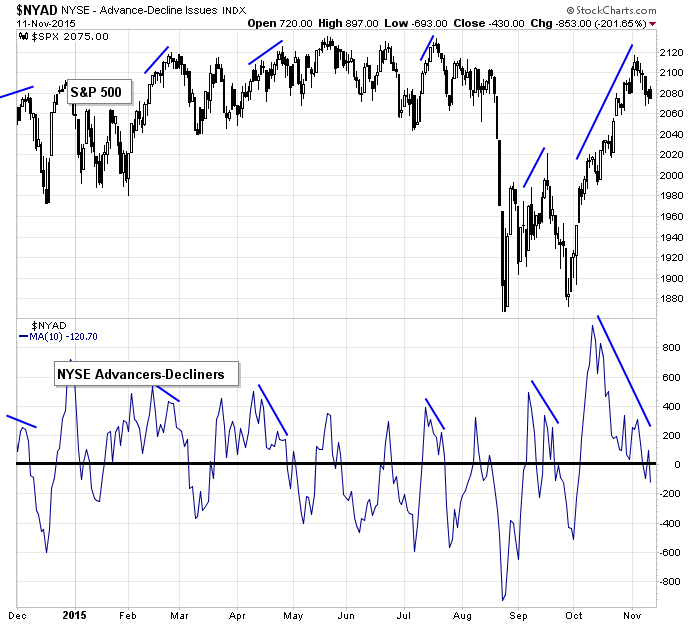

While the S&P pushed to a higher high, the 10-day of the AD line put in an obvious lower high. With this in place, we’ve known the upside was limited until this, and others, worked themselves out.

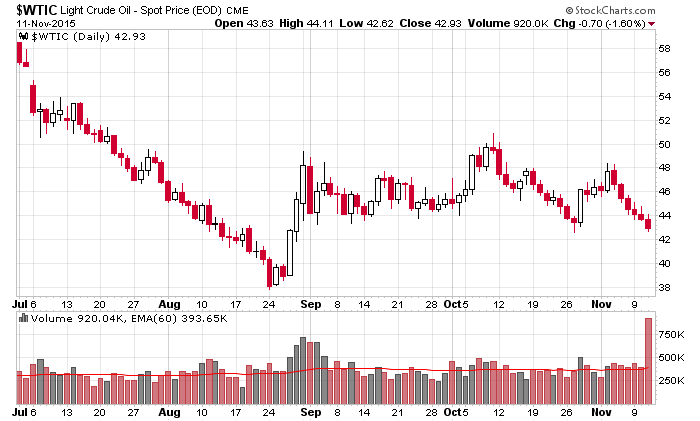

Oil has dropped six straight days and will start today in the red. You have to go back to March to find a similar losing streak. Many stocks looked very good two weeks ago when they broke out from little consolidation patterns. They don’t look too hot right now.

There’s so much talk about the Fed and when/if they’ll raise rates, it needs to be mentioned several Fed officials speak today. There could be some sudden moves. Wall St. is already pricing in a December hike, but that hardly matters in the near term. Knee-jerk reactions can be big, even if they quickly reverse.

Patience is needed here. Don’t over trade. More after the open.

Stock headlines from barchart.com…

Kohl’s (KSS -5.35%) reported Q3 EPS of 75 cents, higher than consensus of 69 cents.

Advanced Auto Parts (AAP +0.29%) reported Q3 EPDS of $1.95, below consensus of $2.09.

Viacom (VIAB +1.96%) reported Q4 EPS of $1.54, less than consensus of $1.55.

Helmerich & Payne (HP -5.31%) reported Q4 EPS of 4 cents, below consensus of 5 cents.

Flower Foods (FLO -1.19%) dropped over 3% in after-hours trading after it reported Q3 EPS of 23 cents, right on consensus, but then lowered guidance on fiscal 2015 EPS to 96 cents-98 cents from an Aug estimate of 96 cents-$1.01, below consensus of $1.00.

NetEase (NTES +2.01%) climbed 2% in after-hours trading after it reported Q3 net revenue of $1.05 billion, higher than consensus of $883.8 million.

NCR Corp. (NCR +0.26%) rose over 4% in after-hours trading after Dow Jones reported that Blackstone is near a deal to pay $800 million for a 15% stake in the company.

Popeyes Louisiana Kitchen (PLKI -1.56%) jumped over 5% in after-hours trading after it reported Q3 adjusted EPS of 47 cents, better than consensus of 45 cents.

Shell Midstream Partners LP (SHLX -1.73%) slid over 4% in after-hours trading after it announced that it plans a 8 million-unit offering to fund its Pecten deal.

JetBlue Airways (JBLU +0.08%) reported that preliminary passenger revenue per available mile (PRASM) for the month of October fell -2% y/y.

IAC/InterActiveCorp offered to buy Angie’s List (ANGI +1.02%) for $8.75 a share, a 10% premium to Wednesday’s closing price of $7.92.

Freshpet (FRPT -4.99%) slumped over 15% in after-hours trading after it reported a Q3 EPS loss of -5 cents, wider than consensus of a -3 cent loss, and then lowered its 2015 sales estimate to $115.5 million-$117 million from a previous estimate of $117 million-$119.5 million, below consensus of $118.4 million.

Mast Therapeutics (MSTX unch) vepoloxame drug to treat sickle cell disease may be on the market in the U.S. by 2017 and 2018 in Europe according to Maxim.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:05 Fed’s Bullard: “Rethinking Monetary Policy”

9:30 Janet Yellen speech

9:45 Fed’s Lacker: “Rethinking Monetary Policy”

9:45 Bloomberg Consumer Comfort Index

10:00 Job Openings and Labor Turnover Survey

11:00 EIA Petroleum Inventories

1:00 PM Results of $16B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

6:00 PM Stanley Fischer

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 12)”

Leave a Reply

You must be logged in to post a comment.

its not all about the fed its about the world

0.25% will put presure on world credit and debt problems

QE in europe and japan is only talk at the moment and the question is can they afFord it and will that make things worse

have central banks ran out of money to buy shares and futures to prop the world equitY markets up

DOW AND SPX STILL HAVE WAVE 2 LOWER HIGHS

still watching spx 2050-60

Go AussieJS

Copper,crude, current interest rates on housing are cautioning all that we can still have new lows in the indices. Bonds may hold their ground,if not, try cash..

Looking at weekly crude oil futures and its seems likelier for a lower low is bounded,(prior low is 37.75). Today at 11AMET EIA Petroleum Status Report came out and Crude inventory builds more than expected. Crude +4.2M barrels vs +1.1M consensus, +2.9M last week. Gasolin -2.1M barrels vs -0.6M consensus, -3.3M last week.Futures down -1.72 with heavy momentum likely to follow.

if spx 2051 can hold,we could see a strong push to the upside

if not then 2023 and 2015

dow already broke support at 17655 so now looking for 17200

london hit hard probably from the arabs on oil–ftse futures now 6160

dax now below 10800 on futures

nice call..looks like spx wants to hold..

maybe i spoke too soon