Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Hong Kong dropped more than 2%; China, Singapore, Australia, India, South Korea and Taiwan fell more than 1%. Europe is currently mostly down. France, Netherlands, Switzerland, Poland, Denmark, Finland and Hungary are down more than 1%; London, Germany, Belgium, Sweden, Greece and Spain are also weak. Futures here in the States point towards a down open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is up. Oil is flat; copper is down. Gold and silver are up. Bonds are up.

The S&P is now down 6 of 7 days. Commodities remain very weak. Market breadth is weak too.

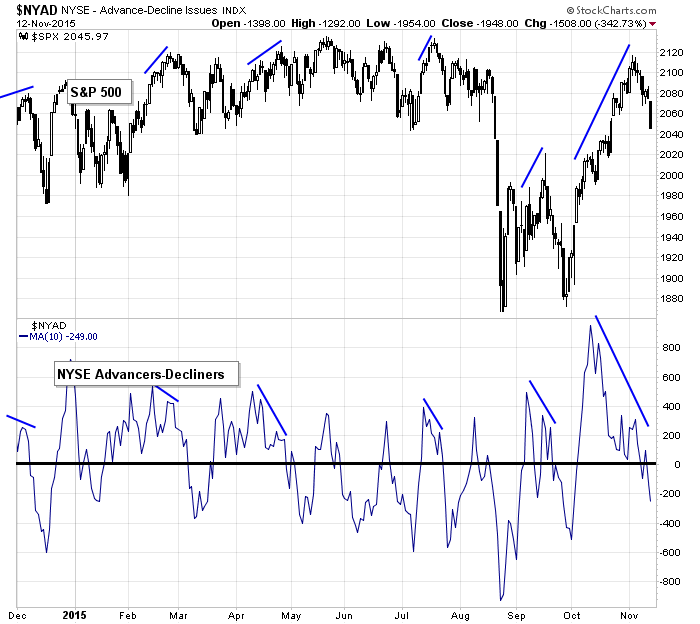

The divergences I pointed out at the beginning of the month are still working themselves out. Here’s the S&P vs. the 10-day of the AD line. I’ve been warning since the beginning of the month there was weakness beneath the surface, so aggressively going long was not a good idea. At this point I’d prefer a mini washout instead of just a random bounce. I’d like to see a little more pain. Too many traders believe we’ll have an end-of-year rally, so more downside to cast doubt would better set the stage for such a rally. Sick? Yeah, but that’s how Wall St. works. Move enough in one direction to shift sentiment and then reverse course.

Nordstrom (JWN) is down 20% in premarket trading. Add it to the list of old-school retailers that have been trending down and have gotten hit hard during this earnings season. Wal-Mart, Dillard’s, Macy’s, Kohl’s are all weak. Of course Sears and JC Penny have been weak for years. The writing is on the Wall. Besides online sales steadily taking market share, these types of big box department stores are yesterday’s business model.

Be patient. Don’t force things. Take only the very best set-ups or sit tight and wait for the charts to set themselves up again. More after the open.

Stock headlines from barchart.com…

Cisco Systems (CSCO +0.04%) is down by more than 4% this morning after, late Thursday, it lowered guidance on Q2 adjusted EPS to 53 cents-55 cents, below consensus of 56 cents, and said it sees Q2 revenue flat to up 2% y/y, weaker than estimates of up 5%.

Illumina (ILMN +0.27%) rose over 3% in after-hours trading after it was announced that it will replace Sigma-Aldrich in the S&P 500 after the close of trading on Nov 18.

Yum! Brands (YUM -1.93%) climbed nearly 5% in after-hours trading after it reported China Oct same-store-sales grew 5% y/y.

Applied Materials (AMAT -1.55%) rose over 3% in after-hours trading after it reported Q4 adjusted EPS of 29 cents, higher than consensus of 28 cents

Nordstrom (JWN +1.85%) plunged 15% in after-hours trading after it reported Q3 EPS ex-item of 57 cents, weaker than consensus of 72 cents, and then lowered guidance on fiscal 2015 adjusted EPS to $3.40-$3.50 from a previous estimate of $3.70-$3.80, below consensus of $3.80.

Syngenta AG (SYT -0.66%) surged over 14% in after-hours trading after ChemChina was said to be in talks to acquire the company.

Fossil Group (FOSL -1.98%) slumped over 10% in after-hours trading after it reported Q3 EPS of $1.19, right on consensus, but reported Q3 revenue of $771.3 million, below estimates of $795.1 million, and said comparable same-store-sales were down -1%, weaker than consensus of up +1.4%.

El Pollo Loco (LOCO -4.71%) dropped over 7% in after-hours trading after it cut its sales growth estimate for the year to 1.7% from a previous estimate of 3%, and then lowered guidance on fiscal 2015 adjusted EPS to 67 cents-69 cents from an Aug estimate of 67 cents-71 cents.

Blue Buffalo Pet (BUFF -4.58%) jumped over 8% in after-hours trading after it reported Q3 adjusted EPS of 17 cents, better than consensus of 14 cents, and then raised guidance on fiscal 2015 adjusted EPS to 60 cents, higher than consensus of 58 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Producer Price Index

8:30 Retail Sales

10:00 Business Inventories

10:00 Reuters/UofM Consumer Sentiment

10:30 EIA Natural Gas Inventory

11:45 Fed’s Mester: Economy and Monetary Policy

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 13)”

Leave a Reply

You must be logged in to post a comment.

nas 100 to test open gap at 4567

and spx 2035

then we will see if europe cancel xmas

marty the marsian just told me spx to close at 2055–dont think i beleive him

The confusion lasts until the Fed does whatever it can. Bounce is due soon, ,but its not a keeper. Meanwhile look to bonds. Shilling has been making money in long bonds (VCLT, TLT) short commodities, long VHT,VPU,UUP. It is the 13th & Friday. I am doing REITS for dividends. Helps if you are nuts. Live it up.

the depth of the drop–yummy

put any new highs very much in doubt

and the start of a deep wave 3 down more likly

my TF chart wants to bounce here. can it take everything to a flat or even green close today and a big gap up monday?

Yeah small caps wanna bounce, but Nas 100 can barely budge. Lots of big cap tech down a bunch.

todays lows could be enough for small wave 1 down of wave 3

with a strugling wave 2 up of 3 to come

but if it wave 3 down it will go to new lows

flat and going to sleep