Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Taiwan and Australia each dropped about 1%. Singapore and South Korea each rallied about 0.6%. Europe is currently down across-the-board. London, Germany, France, Austria, Belgium, Netherlands, Sweden, Switzerland, Czech Republic, Poland, Turkey, Denmark, Finland, Spain, Italy, Portugal and Russia are all down at least 1%. Futures here in the States point towards a moderate gap down open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

Yesterday was a fairly nondescript day. Other than an obvious divergence between the large caps and small caps, the indexes traded in a range and didn’t move much from their unchanged levels.

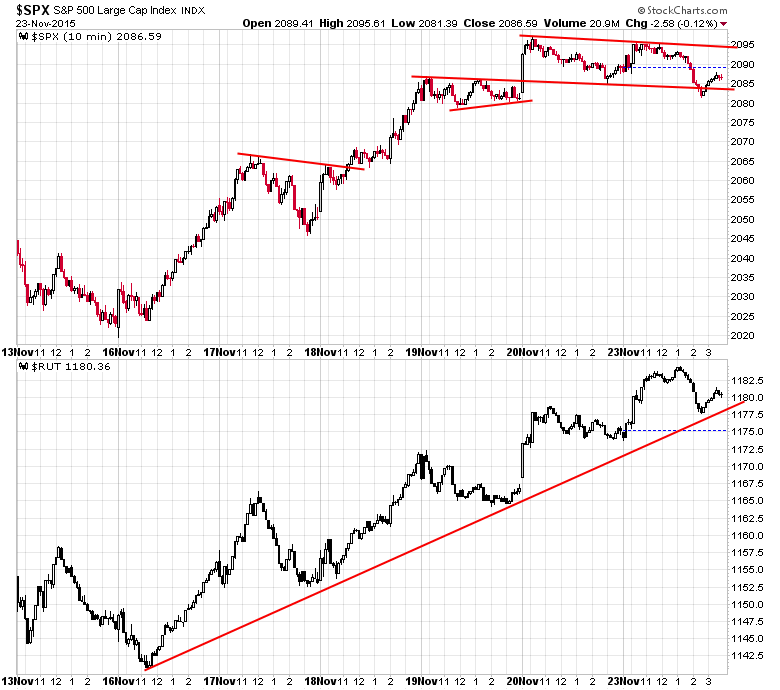

On the intraday charts, the S&P put in a lower high and lower low while the small caps put in a higher high and higher low. As a trader who likes to back up a little and look out a couple weeks, this type of intraday divergence is notable but not something that causes me to make an abrupt change. Here are the intraday charts going back seven days.

Turkey shot down a Russian military plane, citing a violation of its airspace.

Despite what’s going on in Europe and the Middle East, the US market has pretty much ignored major military/terrorist events. Whether that’s a good idea or not remains to be seen. It’s worth noting Wall St. expects everything to work out just fine. It may have priced in a rate increase; it is not pricing in an escalation of tension around the world.

Don’t get lazy. No resting here…unless you’re mostly in cash. The market has moved straight up an straight down enough to condition us to take profits too soon instead of too late. Swing for singles. Better set-ups will come later. More after the open.

Stock headlines from barchart.com…

Carnival Corp. (CCL -0.37%) and Royal Caribbean Cruises Ltd. (RCL +0.97%) both fell over 1% in pre-market trading after the U.S. State Department issued a global travel alert due to terror threats.

Tiffany & Co. (TIF +1.88%) reported Q3 EPS of 70 cents, below consensus of 75 cents.

Hormel Foods (HRL +1.60%) reported Q4 EPS of 74 cents, better than consensus of 69 cents.

CSRA Inc. (CSRA) will replace Computer Sciences (CSC +0.23%) in the S&P 500 after the close of trading on Friday, November 27.

Cubic (CUB +1.33%) reported Q4 adjusted EPS of 74 cents, below consensus of $1.00 and then lowered guidance on fiscal 2016 EPS to $1.30-$1.55, below consensus of $2.47.

Brocade Communication Systems (BRCD +2.44%) tumbled over 6% in after-hours trading after it reported Q4 adjusted EPS of 26 cents, better than consensus of 24 cents, but said it sees Q1 adjusted EPS of 23 cents-25 cents, weaker than consensus of 27 cents.

Xerox (XRX +2.77%) jumped more than 6% in after-hours trading after billionaire activist investor Carl Icahn said he has taken a 7.13% stake in the company.

Valeant Pharmaceuticals (VRX -3.95%) climbed nearly 3% in after-hours trading after Pershing Capital Management disclosed that it raised its stake in the company to 9.9% from 5.7%.

JM Smucker (SJM +0.12%) slid over 1% in after-hours trading after Tigress Financial Partners downgraded the stock to ‘Neutral’ from ‘Buy.’

Dycom (DY +3.15%) reported Q1 adjusted EPS of $1.24, higher than consensus of $1.01, and said its sees Q2 revenue of $530 million-$550 million, above consensus of $527.6 million.

Post Holdings (POST -2.19%) declined over 1% in after-hours trading after it reported Q4 adjusted EPS of 6 cents, well below consensus of 26 cents.

Palo Alto (PANW +0.61%) rose over 3% in after-hours trading after it reported Q1 adjusted EPS of 35 cents, above consensus of 32 cents, and said it sees Q2 revenue of $314 million-$318 million, above consensus of $310.7 million.

Tarena International (TEDU +2.84%) gained over 5% in after-hours trading after it said it sees Q4 revenue of $54 million-$56 million, above consensus of $53.6 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 GDP Q3

8:30 Corporate Profits

8:30 International trade in goods

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $35B, 5-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 24)”

Leave a Reply

You must be logged in to post a comment.

the 2nd GDP guess (2.1%) shows nothing reassuring except that inventories are up, but unsold. Now is the time to watch and wait. We have few reasons to believe the Fed has a clue that doing anything will not have to be undone. Holding dividend stks, index etfs, and tax frees. Old men live slowly. Humble pie diet for holidays.

Yes the small caps are doing well. Bullish.

the bears have all turned to bulls and conceed a xmas rally

yet to me thats a warning sign the instos being on the other side of trades ,are getting ready to drop the markets,knowing that the greatest ponsi on earth can not go on forever

and that the debt bubble and liquidity are about to implode

flocks of black swans are everywhere and are swamming over europe and constantinople and mid east

usa markets trade dureing thanksgiving

thats what gives the cash markets that are closed the gap ups or down

todays up was impressive so was the down