Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside. Singapore dropped 1.1%; Japan, Hong Kong, Australia and New Zealand were also weak. Indonesia and Malaysia did well. Europe is currently mostly up. Germany, France, Belgium, Netherlands, Switzerland, Denmark and Italy are up more than 1%; Greece is down more than 1%. Futures here in the States point towards an up open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold is flat, silver is down. Bonds are mixed.

There isn’t much to say here. With tomorrow being a day off and the market closing early on Friday, today will be slow. The minds of traders and investors are elsewhere – especially with the market moving up and over the first two days this week. There isn’t a huge sense of urgency to do much today. The action is likely to be slow, both in terms of price movement and volume.

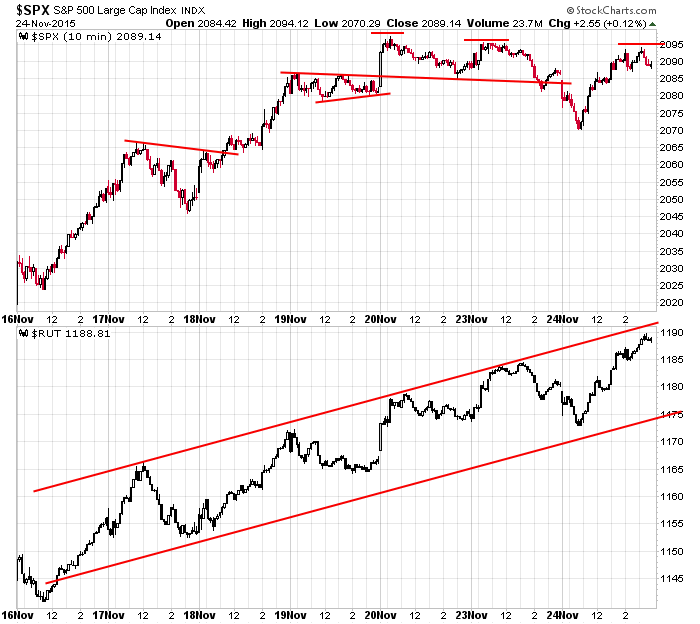

The small caps have moved up 5 of 7 days…the large caps 4 of 7 days but have been mostly flat the last three. Here are the intraday chart of the S&P and RUT.

No big bets right now.

Have a great Thanksgiving weekend. I’ll be around on the Message Board today. If you’re taking the day off, see you Friday or Monday.

Stock headlines from barchart.com…

Deere & Co. (DE +2.32%) jumped nearly 5% in pre-market trading after it reported Q4 EPS of $1.08, higher than consensus of 75 cents.

Hormel Foods (HRL +2.97%) was raised to ‘Overweight’ from ‘Equal weight’ at Stephens.

SunEdison (SUNE +37.33%) dropped over 7% in pre-market trading after it was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Terraform Power (TERP +5.50%) was cut to ‘Sell’ from ‘Neutral’ at UBS.

Valspar (VAL +2.25%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Caleres (CAL -0.48%) reported Q3 adjusted EPS of 80 cents, higher than consensus of 78 cents.

TiVo (TIVO +1.20%) fell almost 1% in after-hours trading after it reported Q3 EPS of 6 cents, below consensus of 8 cent, although Q3 net revenue of $132.3 million was higher than consensus of $123.3 million.

Hewlett Packard (HPQ +2.88%) slid nearly 8% in after-hours trading after it said it sees Q1 adjusted EPS of 33 cents-38 cents, below consensus of 42 cents, and then lowered guidance on fiscal 2016 adjusted EPS to $1.59-$1.69 from an earlier estimate of $1.67-$1.77.

Hewlett Packard Enterprise (HPE -1.16%) rose nearly 2% in after-hours trading after it reported Q4 pro forma revenue of $14.1 billion, higher than consensus of $13.5 billion.

Guess (GES +2.14%) climbed over 7% in after-hours trading after it reported Q3 adjusted EPS of 15 cents, higher than consensus of 11 cents, and then raised he lower end of its fiscal 2016 EPS estimate to 93 cents-$1.02 from a previous estimate of 89 cents-$1.02.

Pinnacle Foods (PF -1.46%) agreed to buy Boulder Brands (BDBD +8.44%) for about $710 million.

Veeva Systems (VEEV +0.51%) rose nearly 5% in after-hours trading after it reported Q3 adjusted EPS o 12 cents, better than consensus of 11 cents, and said it sees Q4 adjusted EPS of 11 cents, higher than consensus of 10 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Initial Jobless Claims

8:30 Durable Goods

8:30 Personal Income and Outlays

9:00 FHFA House Price Index

9:45 PMI Services Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 New Home Sales

10:00 Reuters/UofM Consumer Sentiment

10:30 EIA Petroleum Inventories

11:30 Results of $29B, 7-Year Note Auction

12:00 PM EIA Natural Gas Inventory

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 25)”

Leave a Reply

You must be logged in to post a comment.

The numbers this morning are noncommittal, hold little promise, but the hope is for a major drive into year end. Maybe, but 2016 has its own destiny which will turn on the fed and the consumer. Betting on indices, dividends and tax frees. Suspect US is in for an adjustment down then a run up into July. Best

how would i read the 10 min spx chart above

since the 20/11 their has been a small 5 wave wave 1 down to spx 2070

then a wave 2 up to 2095 for a third lower high

now providing it does not break the 20/11 high then we have a down trend 10 min

with a large wave 3 down to come

usa futures i believe are open thanksgiving

may all eat plenty of bull and watch out for europe black swans