Good morning. Happy Friday. Hope you enjoyed your day off.

The Asian/Pacific markets closed mostly down. China fell an incredible 5.5%. Hong Kong, Taiwan, Indonesia and Singapore were also weak. Europe is currently mixed but little moved. Greece and Turkey are doing well; Russia and Hungary are weak. Germany, France, Italy and Spain are up; London is down. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are down. Bonds are up.

Today is a shortened day. The stock market closes at 1:00 pm – 3 hours early. Unless the big drop in China spooks traders, I’m not expecting much to happen.

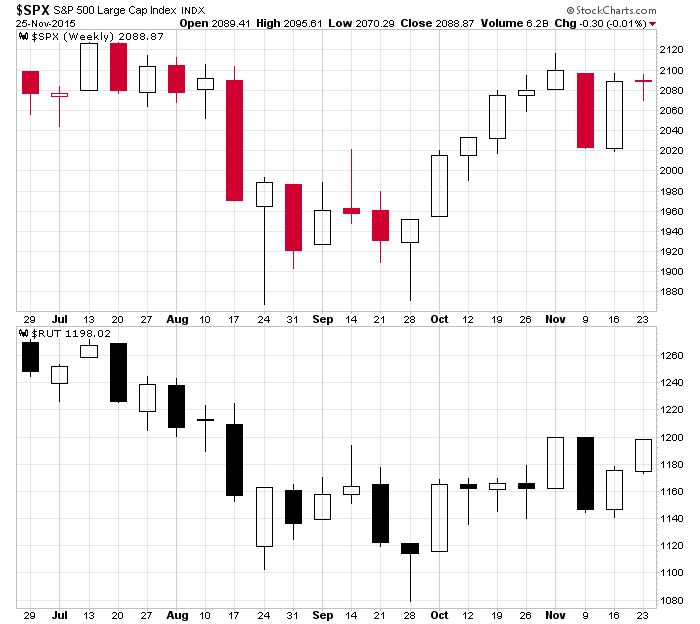

Here are the weekly SPX and RUT charts so far this week. Flat trading with a relatively small range for the S&P…and the current level isn’t much different than Monday’s open. The small caps are posting a solid gain and are sitting just under a resistance level (1200). We do not want resistance to be taken out today. There won’t be the volume to forcefully bust out…and there isn’t enough time left this week to follow through. It’d be better for a breakout to occur early next week.

Various groups will come out with retail sales numbers in the coming days. Whether they can be trusted or not doesn’t matter. They can influence the market’s movements.

Don’t force trades right now. Be patient. Only trade the best ones. This isn’t a time to swing for home runs. Lots of little wins add up. This is what I’ve been telling myself.

Stock headlines from barchart.com…

Amazon.com (AMZN +0.62%) rose 0.5% in pre-market trading after Adobe Systems reported a surge in e-commerce sales on Thanksgiving day with an expected $1.7 billion expected to be spent online, a +22% y/y increase.

Volkswagen AG (VLKAY +4.69%) was upgraded to ‘Buy’ from ‘Hold’ at LBBW.

Infineon Technologies (IFX) was upgraded to ‘Buy’ from ‘Reduce’ at Alphavalue.

SunEdison (SUNE -21.12%) rose over 2% in pre-market trading after Wednesday’s 21% plunge.

KaloBios Pharmaceuticals (KBIO +44.73%) surged over 70% in pre-market trading after CEO Shkreli said he’s “decided to stop lending” shares in the company until he understands “the advantage of doing so.”

Imagination Technologies LLC (MIPS) fell over 2% in pre-market trading after JPMorgan Chase downgraded the stock to ‘Neutral’ from ‘Overweight,’ citing lack of growth.

American Capital (ACAS +9.50%) rose over 1% in after-hours trading after Elliot reported that it increased its stake in the company to 9.1% from 8.4%.

Amazon.com (AMZN +0.62%) said it plans to add other online networks to it Prime Instant Video service as soon as next month, according to people with knowledge of the plans.

Zagg Inc. (ZAGG +3.59%) dropped over 5% in after-hours trading after it filed to sell $100 million of common stock.

Eros International (EROS +0.98%) climbed over 1% in after-hours trading after Jupiter Asset reported a 5.14% passive stake in the company.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

NYSE close at 1:00 PM

SIFMA close 2:00 PM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 27)”

Leave a Reply

You must be logged in to post a comment.

a doji near a top is another bad sign

dont have a bias

complacentcy is a bias of blindness