Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. Indonesia dropped 2.5%, and South Korea fell 1.9%. Taiwan, Australia and Malaysia were also weak. Europe is currently mostly up. Denmark is up more than 1%; Germany, France, Norway, Sweden, Spain and Italy are also doing well. Futures in the States point towards an positive open for the cash market.

—————

S&P Select Week in Review

—————

The dollar is up. Oil and copper are up. Gold and silver are up. Bonds are down.

Last week the Dow, Nas and S&P were flat or up a little, closing on Friday close to their Monday opens. The small caps and mid caps posted solid gains.

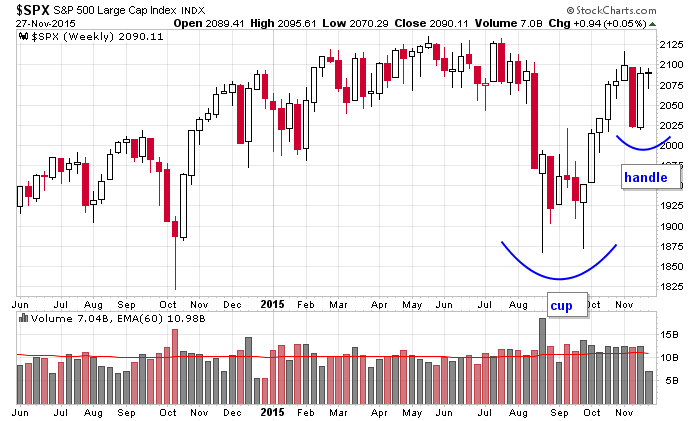

I’d consider the first three to be in consolidation mode – the August drop and subsequent October rally formed a “cup,” and the last couple weeks have started forming a “handle.” Here is the weekly S&P chart. The set up is bullish, but not overly bullish. There’s lots of resistance overhead and this handle can last many months. It’s not bearish either. I don’t see anything that would suggest the market is going to fall apart.

The internals improved some, but the quality and quantity of good set ups isn’t very good. When the market is super healthy, I typically have a hard time narrowing down my list. Now, it’s hard just to find a couple decent trades.

My bias remains to the upside. I like the market, but I don’t love it. It’s doing fine but isn’t offering us many opportunities. More after the open.

Stock headlines from barchart.com…

Helmerich & Payne (HP -1.93%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim.

Microsoft (MSFT +0.45%) was raised to a ‘Strong Buy’ at Raymond James.

Diamond Offshore Drilling (DO -3.62%) and Transocean (RIG -2.49%) were both raised to ‘Buy’ from ‘Neutral’ at Guggenheim.

Dynavax Technologies (DVAX -0.64%) was rated a new ‘Outperform’ at RBC Capital Markets with a 12-month price target of $48.

Prologis (PLD +0.83%) was downgraded to ‘Market Perform’ from Outperform’ at Wells Fargo Securities.

Marriott International (MAR -0.50%) and Starwood Hotels & Resorts Worldwide ({=HOT were both cut to ‘Hold’ from ‘Buy’ at Evercore ISI.

Raytheon (RTN +0.54%) was cut to ‘Equal Weight’ from ‘Overweight’ at Barclays.

FMC Technologies (FTI -1.56%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim.

Lululemon (LULU -0.85%) was cut to ‘Under Perform’ from ‘Market Perform’ at FBR Capital.

Paccar (PCAR +0.47%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital Markets.

Quest Diagnostics (DGX +0.34%) won dismissal of a class action lawsuit brought by consumers claiming it monopolized the Northern California diagnostic labs market.

According to Catchpoint Systems, Neiman Marcus’ (NMG) webpage was down for nearly the entire day on Black Friday.

According to people familiar with the company’s plans, American International Group (AIG +0.84%) is considering the sale of blocks of life policies.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

9:45 Chicago PMI

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Survey

3:00 PM Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 30)”

Leave a Reply

You must be logged in to post a comment.

If the Fed were to begin raising interest rates again, which it keeps threatening it might eventually do, it would significantly tamp down on investor appetite for risky, high-yield emerging market assets. The merest prospect of a quarter-point raise is enough to send junkie-like convulsions through the investment community. As the IMF warned in its Article IV consultation with Mexican authorities, “a surge in financial market volatility, triggered for example by a disorderly normalization of U.S. monetary policy, could lead to a reversal of capital flows and an increase in risk premia.”

If that were to happen, the consequences could be dire, not only for Mexico but for the broader Latin American economy (zero hedge) I agree things could become chaotic for dollar denominated assets for a while — never trust the fed.

what is the percentage of cup and handle bulls

because it could also be considered a lower high bearish as is doji indicision close to a high

and black swans swamming from Whidbeys high yeild and junk bond feasko on xmas scroge fed

and greece again saying something will have to be done