Good morning. Happy Tuesday. Happy December.

The Asian/Pacific markets closed up across-the-board. Indonesia rallied more than 2%; Taiwan, South Korea, Australia, Japan and Hong Kong gained more than 1%. Europe currently leans to the upside. Austria and Turkey are up more than 1%; London, Greece, Denmark, Finland, Spain and Italy are also doing well. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is down. Oil is flat and copper is up. Gold and silver are up. Bonds are down.

November ended on a down note, but the entire month was either flat or up, depending on the index you keyed on. That’s not terrible. October was the biggest up month in years, so holding the gains constitutes a decent victory.

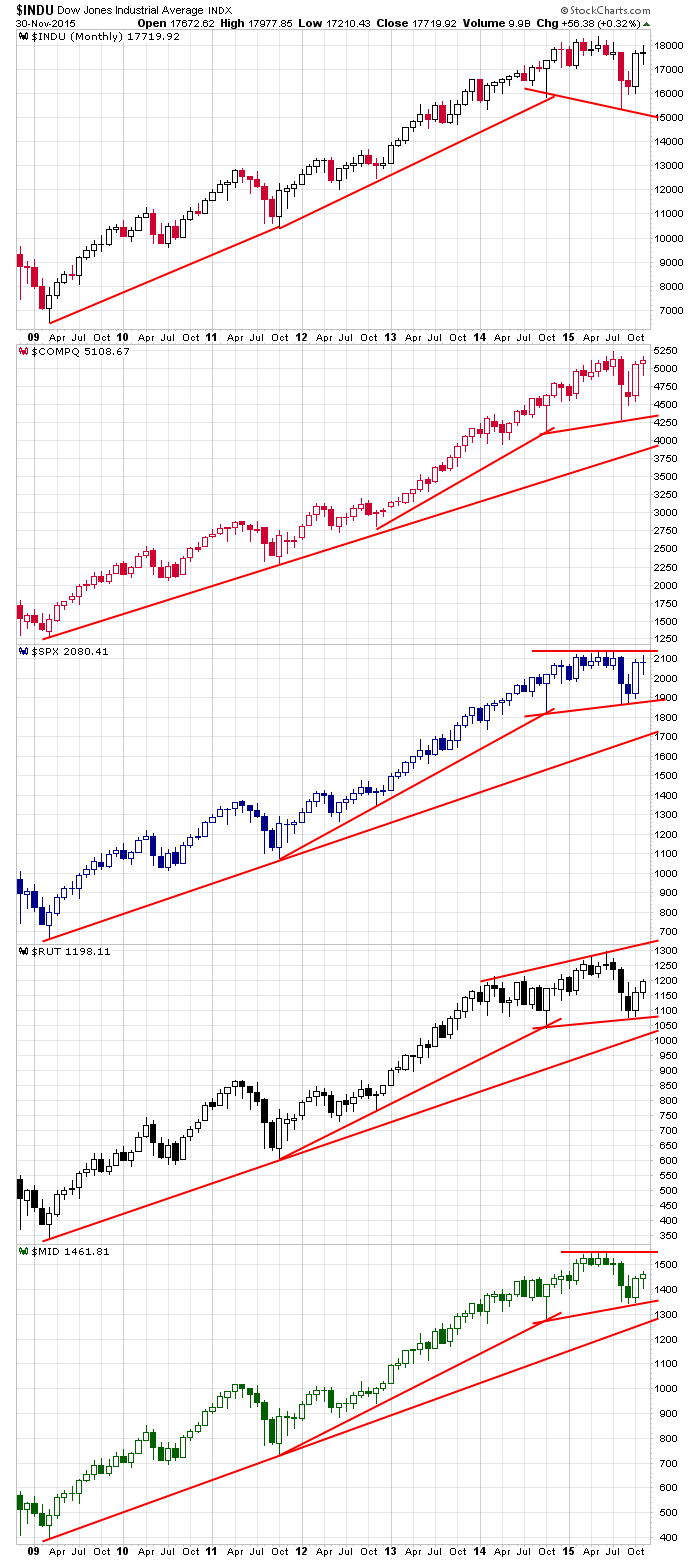

The Dow, SPX and Nas have resistance just overhead…the small and mid caps are lagging.

Here are the monthly charts. There’s no question the overall trends are up…they’ve been up for several years. But in the intermediate term, you could argue the indexes are in consolidation mode. Most are unchanged going back 6-12 months, and the small caps have been unchanged since the beginning of 2014.

Don’t force trades right now. Seasonality is favorable, but there are lots of headwinds. The quality and quantity of good set ups is low, so there isn’t a gentle breeze at our backs. More after the open.

Stock headlines from barchart.com…

Mattress Firm Holding (MFRM -2.95%) jumped over 9% in after-hours trading after the company said it will buy Sleepy’s for $780 million.

Infoblox (BLOX +0.40%) surged over 15% in after-hours trading after it reported Q1 adjusted EPS of 13 cents, more than double consensus of 6 cents, and then raised guidance on Q2 adjusted EPS to 12 cents-14 cents, higher than consensus of 7 cents.

Joy Global (JOY +1.93%) was downgraded to ‘Underperform’ from ‘Neutral’ at Bank of America.

Yum! Brands (YUM -0.62%) was raised to ‘Outperform’ from ‘Market perform’ at Cowen.

Allstate (ALL -0.13%) was upgraded to ‘Neutral’ from ‘Sell’ at Citigroup.

ITC Holdings (ITC +9.27%) confirmed that it has begun a strategic review that may lead to a possible sale of the company as it works to “maximize value for shareholders.”

Shoe Carnival (SCVL -2.79%) reported Q3 EPS of 47 cents, right on consensus, although Q3 revenue of $269.7 million was higher than consensus of $264.4 million.

Thor Industries (THO +0.73%) climbed nearly 4% in after-hours trading after it reported Q1 EPS continuing operations of 97 cents, higher than consensus of 83 cents.

UnitedHealth (UNH -1.43%) lowered guidance on fiscal 2016 revenue to $180 billion-$181 billion, below consensus of $182.5 billion, but still affirmed its fiscal 2016 EPS view of $7.10-$7.30, near the middle of consensus of $7.19.

Andarko Petroleum (APC -1.33%) was ordered to pay $159.5 million to resolve its liability for the 2010 Gulf of Mexico oil spill.

NQ Mobile (NQ +6.05%) sank 10% in after-hours trading after it reported Q3 net revenue of $87.9 million, below consensus of $110 million-$112 million.

The Chemours Company (CC -1.42%) said its plans to reduce its global workforce in 2016 by 400, or 5%.

Zumiez (ZUMZ -9.10%) was downgraded to ‘Market Perform’ from ‘Outperform’ at William Blair & Co.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Auto sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

12:45 PM Fed’s Evans: U.S. Economy

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 1)”

Leave a Reply

You must be logged in to post a comment.

Long for a while, then we will see if Janet is real. Long indices and dividends for window dressing. Bonds are saying they question any rate increase happens. The dollar is ready to decline. 90 cents in 2016? not that soon, but down.

Sometime you just don’t trade. Livermore mastered this.