Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed down across-the-board. Japan dropped more than 2%; China, South Korea and Australia fell more than 1%. Europe is currently mostly down. Greece, Poland and Turkey are down more than 2%; Sweden is down more than 1%; Germany, France, the Netherlands, Switzerland, the Czech Republic, Russia, Denmark, Finland and Spain are also weak. Futures in the States point towards an up open for the cash market. This of course may change after the employment data is released.

—————

VIDEO: My Forecast for 2016 …

or copy and paste this link

http://clicksecure.co/?a=52&c=2364&s1=leav

—————

The dollar is up. Oil and copper are up. Gold and silver are mixed and little changed. Bonds are up.

Here are the employment numbers…

unemployment rate: 5.0% (was 5.0% last month)

nonfarm payrolls: +211K

private payrolls:

average workweek: down 0.1 hours to 34.5 hours

hourly wages: up 0.2% to $25.25

labor participation rate: 62.5%

October payroll gains raised from 271K to 298K.

September gain raised from 137K to 145K.

The market moved up after the news…then dropped back down…and is now moving back up.

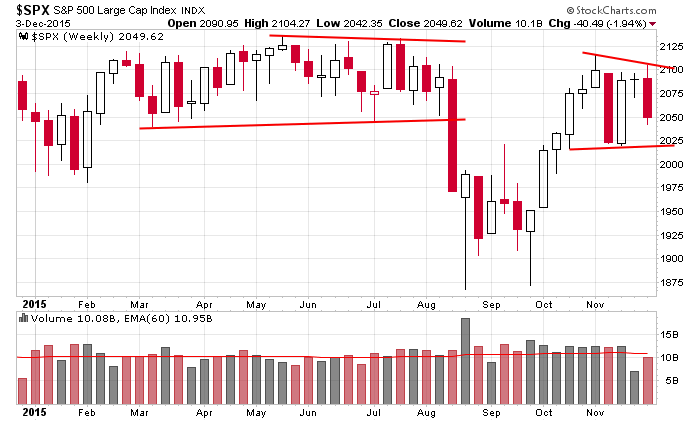

Here’s the weekly S&P chart. A range persisted the first seven months of the year…then a big drop and double bottom…then a big rally…now a range again.

A complete lack of good set ups has hovered over us the last two weeks. Despite some improvements from the breadth indicators, there haven’t been many charts to play. So despite my overall bullish bias, I’ve been less active and held for shorter periods. This is the environment we’ve been dealt. Deal with it or lose money forcing your style on a market that isn’t in sync with you.

I got this from Seeking Alpha…

The blowout year for mergers and acquisitions just keeps getting bigger. According to Dealogic, global M&A volume just soared to $4.304T, pushing 2015 to date ahead of 2007’s total, when the previous record of $4.296T of mergers was struck. U.S. targeted M&A volume hit a record high in September and currently stands above $2T for the first time ever. What’s driving the dealmaking? Cheap debt, increased boardroom confidence, pressure to become more efficient in a slow-growth economy and a desire to keep up with consolidating rivals.

Along with super high margin debt levels, these types of numbers should be kept in mind. They can persist for a while, but eventually the pent up leverage will need to unwind. Don’t force trades. More after the open.

Stock headlines from barchart.com…

Foot Locker (FL -3.01%) was rated a new ‘Buy’ at BB&T Capital with a price target of $80.

Electronic Arts (EA -3.06%) was upgraded to ‘Overweight’ from ‘Neutral’ at Atlantic Equities with a 12-month price target of $84.

EMC Corp. (EMC -0.97%) was upgraded to ‘Ourperform’ from ‘Underperform’ at CLSA with a price ratget of $30.

Symantec (SYMC +0.25%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

The Gap (GPS -0.46%) fell 2% in after-hours trading after it said its November comparable sales were down -8.0% y/y, a bigger decline than estimates of -6.0% y/y.

Zumiez (ZUMZ -6.96%) dropped over 11% in after-hours trading after it forecast Q4 sales of $226 million-$231 million, well below consensus of $254.6 million, and said it sees Q4 EPS between 40 cents and 46 cents, less than consensus of 63 cents.

Ulta Salon Cosmetics & Fragrance (ULTA -0.20%) climbed 6% in after-hours trading after it reported Q3 EPS of $1.11, higher than consensus of $1.05.

Cooper Cos. (COO -4.91%) sank over 10% in after-hours trading after it reported Q4 adjusted EPS of $2.00, below consensus of $2.11, and then lowered guidance on fiscal 2016 adjusted EPS to $7.60-$7.90, below consensus of $8.42.

Five Below (FIVE +0.83%) rose nearly 8% in after-hours trading after it reported Q3 EPS of 8 cents, higher than consensus of 7 cents.

Barnes & Noble (BKS -4.44%) tumbled over 10% in after-hours trading after it reported Q2 sales of $894.7 million, less than consensus of $918 million, as its Q2 core comparable sales (ex-Nook products) were down -0.5%, weaker than consensus of up +1.0%.

Ziopharm Oncology (ZIOP -3.94%) slipped nearly 4% in after-hours trading after the stock was rated a new ‘Underperform’ at Wells Fargo.

Ambarella (AMBA -4.27%) dropped over 6% in after-hours trading after it reported Q3 adjusted EPS of $1.08, better than consensus of 86 cents, but then lowered guidance on Q4 adjusted net income to $15 million-$17 million, below consensus of $21.1 million.

Fate Therapeutics (FATE -0.24%) jumped 10% in after-hours trading after the stock was rated a new ‘Outperform’ at Wells Fargo.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Non-farm payrolls

8:30 International Trade

1:00 PM Baker-Hughes Rig Count

3:45 PM Fed’s Bullard: “Neo Fisherianism”

4:10 PM Fed’s Kocherlakota “Monetary Policy Renormalization”

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 4)”

Leave a Reply

You must be logged in to post a comment.

2015–the year of distribution ,not accumulation

distribution to central banks and govt pension funds

2016–the big ponsi implodes

–the supreme super bear