Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the downside. China gained 1.35%; Australia, India and South Korea dropped more than 0.5%. Europe currently leans to the upside, but there are very few big movers. Greece is down more than 1%, and Russia is up more than 1%. Austria, Hungary, Spain, Italy and Romania are also doing well. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

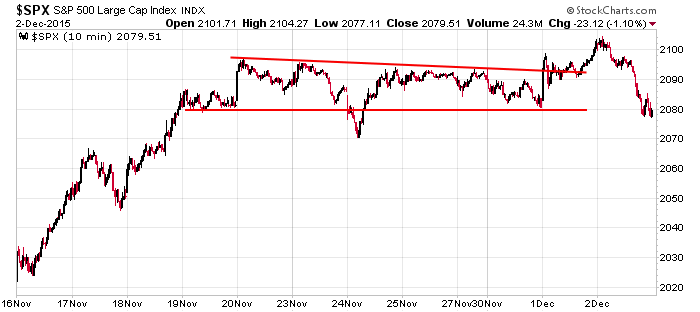

The market hasn’t been able to make up its mind this week. It moved down Monday, but stayed within its range. Then it broke out Tuesday…then it gave everything back, plus some, on Wednesday. Here’s the 10-min chart going back 12 days. It looks like a false breakout, but the bears aren’t yet in total control.

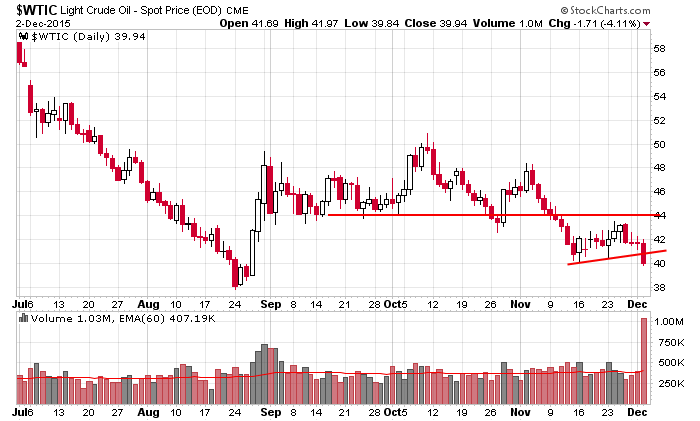

Oil took a big hit yesterday and closed at its lowest level since August. Overnight Saudi Arabia said it would be open to oil cuts if producers inside and outside the cartel participated. I’m not sure how that would work. It’s one thing for governments to agree, but what about all the independent oil companies? In any case, oil is up a little this morning after falling more than 4% yesterday. Here’s the daily chart.

Tomorrow we get the latest employment figures. The numbers have been decent for several months, so unless there’s an outlier move, I don’t see the numbers being overly important. More important are comments made be Janet Yellen yesterday that she looks forward to raising rates…because the move would imply we’re on the road to a successful economic recovery.

I don’t know. To me the inflation/deflation picture is more important. If you look at the cost of health care, there’s huge inflation in the system, but if you look at oil and copper, there are definitely deflationary pressures. I don’t know what the real situation is. I don’t know what’s supposed to count and what should be ignored.

December is the best month of the year, but as is typically the case, the faith of the bulls will be tested. More after the open.

Stock headlines from barchart.com…

Mallinckrodt PLC (MNK +1.23%) rose over 1% in pre-market trading after the stock was upgraded to ‘Overweight’ from ‘Equalweight’ at Morgan Stanley.

Disney (DIS -1.20%) boosted its semi-annual dividend to 71 cents a share from 66 cents.

Avago (AVGO -0.51%) climbed over 8% in pre-market trading after it reported Q4 adjusted EPS of $2.51, higher than consensus of $2.38.

Boyd Gaming (BYD +1.88%) gained over 1% in after-hours trading after Goldman Sachs upgraded the stock to ‘Neutral’ from ‘Sell.’

Dollar General (DG -0.56%) reported Q3 EPS of 88 cents, better than consensus of 87 cents.

Dyax (DYAX -0.83%) jumped over 10% in after-hours trading after it said its deal to acquire Shire Pharmaceuticals International cleared an anti-trust review by the U.S. Federal Trade Commission.

Tilly’s (TLYS +0.99%) dropped over 7% in after-hours trading after it reported Q3 adjusted EPS of 16 cents, above consensus of 14 cents, but then lowered guidance on Q4 EPS to 10 cents-12 cents, well below consensus of 21 cents.

PVH Corp. (PVH +1.26%) rallied over 3% in after-hours trading after it reported Q3 adjusted EPS of $2.66, better than consensus of $2.47.

Aeropostale (ARO +5.36%) slid nearly 3% in after-hours trading after it reported a Q3 adjusted EPS loss of -31 cents, a smaller loss than expectations of -34 cents, but then lowered guidance on Q4 EPS to a loss of -4 cents to -17 cents, below consensus of a 2 cent profit.

Verint Systems (VRNT -0.96%) tumbled 5% in after-hours trading after it reported Q3 adjusted EPS of 78 cents, below consensus of 79 cents, and then lowered guidance on fiscal 2016 adjusted EPS to $3.30 from a September estimate of $3.45, below consensus of $3.46.

Synopsys (SNPS -0.91%) reported Q4 adjusted EPS of 67 cents, above consensus of 66 cents, but then lowered guidance on Q1 adjusted EPS to 60 cents-63 cents, below consensus of 72 cents.

American Eagle (AEO +0.25%) rose over 2% in after-hours trading after it reported Q3 adjusted EPS of 35 cents, better than consensus of 34 cents, and said it sees Q4 EPS of 40 cents-42 cents, in line with consensus of 41 cents.

Photronics (PLAB +0.81%) rallied over 5% in after-hours trading after it reported Q4 adjusted EPS of 25 cents, higher than consensus of 19 cents.

Box (BOX +3.28%) fell over 1% in after-hours trading after it reported Q3 adjusted loss of -31 cents, right on consensus, although Q3 revenue of $78.7 million was above consensus of $76.8 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 PMI Services Index

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

10:00 Yellen testifies before the Joint Economic Committee

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 3)”

Leave a Reply

You must be logged in to post a comment.

long bond (30y, ZB) down more than 4 points. corresponds to 14 bps jump in yield, roughly from 2.93% to 3.07%. i don’t remember the last time, or how many times, i have seen such a large daily drop (or rally) in ZB. daily chart is still very range-bound though.

non stop selling…not quite a blood bath…