Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed with a lean to the upside. Japan moved up 1%; Singapore and Taiwan also did well. South Korea, New Zealand and India were weak. Europe is currently mostly up. Germany is up more than 2%; France, Switzerland, the Netherlands, Denmark, Finland, Belgium and Sweden are up more than 1%. Futures in the States point towards a flat open for the cash market.

—————

VIDEO: My Forecast for 2016 …

or copy and paste this link

http://clicksecure.co/?a=52&c=2364&s1=leav

—————

The dollar is up. Oil and copper are down. Gold is down, silver is up. Bonds are down.

The indexes closed flat or down last week, but considering the losses in place as of Thursday’s close, it wasn’t a bad weekly performance.

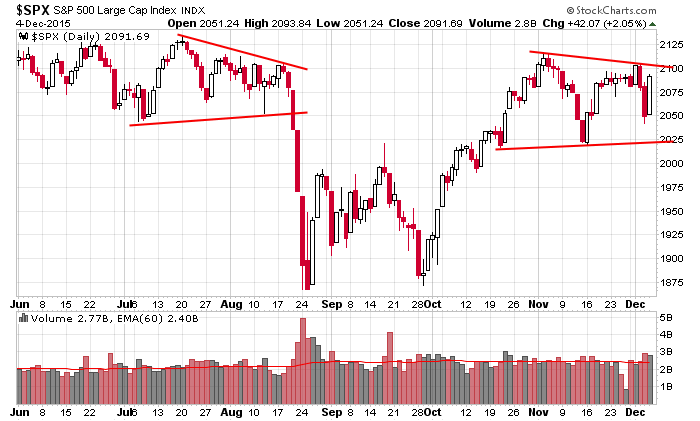

But let’s be honest. The market is range bound – has been for 7 weeks – and just like the summer, rallies are getting sold and dips are getting bought. We can’t assume anything is going to happen until it does. Moves aren’t lasting, so we must trade accordingly.

The indicators are doing fine. They’re not in fantastic shape, but they’re not bad either. A beneath-the-surface look doesn’t reveal strong support for a rally attempt, but it doesn’t tell us there’s lots of underlying weakness either. I’ll calling it somewhat neutral.

The quality of the set-ups has improved slightly.

Overall I continue to like the market, but I’m still not backing up the truck and going all in. Instead I’m content to swing for singles…little wins do add up over time.

Here’s the S&P daily. It has potential, but until the range resolves, don’t assume anything. More after the open.

Stock headlines from barchart.com…

Vail Resorts (MTN -0.59%) reported a Q1 EPS loss of -$.163, a smaller loss than consensus of -$1.75.

Polaris industries (PII -4.19%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Tyson Foods (TSN +1.09%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Stephens.

Philip Morris International (PM +2.70%) fell nearly 5% in pre-market trading on a report from Tass news service that a Russian senator proposes raising the smoking age in Russia to 21 from 18.

Mattress Firm (MFRM +2.06%) said it sees fiscal 2015 sales of $2.53 billion-$2.55 billion, on the low end of estimates of $2.55 billion.

New York REIT (NYRT +2.24%) rose over 3% in after-hours trading after a person with knowledge of the negotiations said that SL Green SLG is close to acquiring the company.

Groupon (GRPN +0.66%) fell over 1% in after-hours trading after it said that its Chief Technology Officer, Sri Viswanath, resigned as of Dec 2. This follows the departure of CEO Eric Lfkofsky a month ago.

Chipotle Mexican Grill (CMG -0.73%) tumbled nearly 10% in pre-market trading after it said it sees Q4 comparable sales down 8%-11% if recent sales trends continue.

Pep Boys-Manny Moe & Jack’s (PBY +3.22%) surged 12% in after-hours trading after billionaire investor Carl Icahn reported a 12% stake in the company.

Big Lots (BIG -6.32%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

ARM Holdings Plc (ARMH +0.55%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Northland Securities with a 12-month price target of $52.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Gallup US Consumer Spending Measure

10:00 Labor market condition index

11:30 Fed’s Bullard: U.S. Economy and Monetary Policy

12:30 PM TD Ameritrade IMX

3:00 PM Consumer Credit

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 7)”

Leave a Reply

You must be logged in to post a comment.

looking at one of the posted spx charts last week it sure looked like a one year distribution sideways

with any thing over spx 2000 as distribution not accumulation

that doesnt mean their cant be a new push to new highs on funny money central bank or pension fund buying

but really no appitite to push it higher

so are the instos getting ready to let it drop and to hell with the hot air of the central bankers

that traders see through and have lost trust in

good bear and bull traps by the instos last week