Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across-the-board. Japan, Hong Kong, China, Indonesia and Taiwan all dropped more than 1%. Malaysia, Australia, Taiwan and Singapore were also weak. Europe is currently suffering big, across-the-board losses. Greece is down more than 4%, Sweden more than 2%, and London, Germany, France, the Netherlands, Norway, Switzerland, the Czech Republic, Poland, Denmark, Finland, Russia, Spain, Italy, Belgium and Portugal are down more than 1%. Futures here in the States point towards a big gap down open for the cash market.

—————

VIDEO: My Forecast for 2016 …

or copy and paste this link

http://clicksecure.co/?a=52&c=2364&s1=leav

—————

The dollar is down. Oil and copper are down. Gold and silver are down. Gold is up.

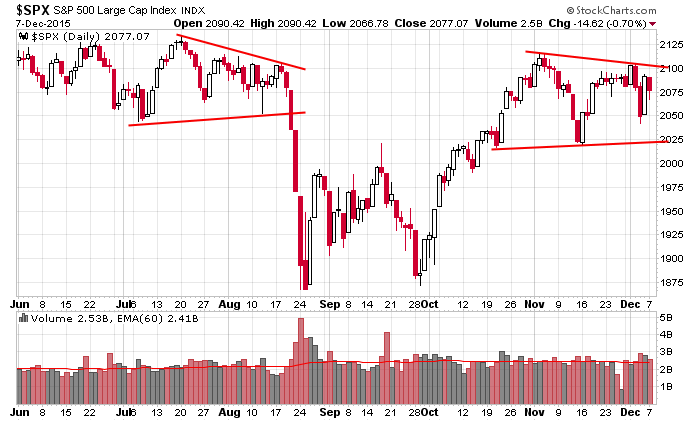

Here’s an update of the daily S&P chart. Yesterday the index was weak early and then rallied a little into the close to salvage some of the losses. Today it’s set to gap down 20+ points and open in the low 2050’s.

In my opinion the market is doing exactly what it did the first seven months of the year – trade in a range. Rallies get sold; dips get bought; nothing lasts. So instead of swing trading with loose stops and giving positions time and space to play out, you’ve needed to be content taking smaller profits. They do add up over time.

The two big fears right now are: 1) China weakening faster than previously thought and 2) losses in oil will cause margin calls which will bring other sectors/industries down.

I’ve been saying it for weeks…this is not a time to be aggressive. More after the open.

Stock headlines from barchart.com…

CBOE Holdings (CBOE -0.30%) was downgraded to ‘Underweight’ from ‘Equalweight’ at Barclays.

Chipotle Mexican Grill (CMG -1.68%) fell over 6% in after-hours trading after it said it closed a restaurant in Boston to investigate “a number” of illnesses among patrons who ate at the restaurant. Chipotle says there is no evidence to suggest the incident is related to previous E. coli cases.

AutoZone (AZO -1.16%) reported Q1 EPS of $8.29, higher than conensus of $8.24.

Comcast (CMCSA -0.63%) was rated a new ‘Buy’ at Nomura with a price target of $72.

Nike (NKE -0.55%) rose nearly 1% in after-hours trading after it said it signed NBA star LeBron James to a lifetime deal.

Casey’s General Stores (CASY +0.18%) rose nearly 1% in after-hours trading after it reported Q2 EPS of $2.00, well above consensus of $1.50, although Q2 revenue of $1.92 billion was below consensus of $1.96 billion.

H&R Block (HRB -0.54%) slid over 4% in after-hours trading after it reported Q2 revenue of $128 million, below consensus of $136.7 million.

United Natural Foods (UNFI +2.49%) dropped over 8% in after-hours trading after it reported Q1 EPS of 63 cents, below consensus of 68 cents, and then lowered guidance on fiscal 2015 adjusted EPS to $2.79-$2.89 from a prior estimate of $2.86-$2.98, weaker than consensus of $2.91.

Outerwall (OUTR -1.96%) plunged over 20% in after-hours trading after it lowered guidance on fiscal 2015 revenue to $2.17 billion-$2.19 billion from a previous forecast of $2.21 billion-$2.24 billion, below consensus of $2.22 billion.

Ventas (VTR +1.17%) was rated a new ‘Buy’ at Edward Jones.

HealthEquity (HQY +0.72%) fell 3% in after-hours trading after it reported Q3 adjusted EPS of 8 cents, better than consensus of 7 cents, but reported Q3 revenue of $30.6 million, below consensus of $31.1 million.

Smith & Wesson (SWHC +7.64%) climbed over 1% in after-hours trading on speculation its Q2 EPS results, to be released Tuesday, will be better than expected as recent mass shootings have boosted gun sales and have some lawmakers calling for more restrictions on firearms.

TherapeuticsMD (TXMD -4.95%) soared more than 40% in after-hours trading after the company said its trial of a hormonal treatment to reduce vaginal pain during intercourse for post-menopausal patients was successful.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $13B, 3-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 8)”

Leave a Reply

You must be logged in to post a comment.

Jason ,

you missed the most important one—-europe debt

even if dradoni and the ecb was to be beleived –germany cant and wont allow QE

AND NO ONE CAN BAIL OUT GREECE ,FRANCE POTUGAL SPAIN ITALLY ECT IMPENDING DEFAULTS

the ponsie is ending badly in europe–next japan

that said we may get a up day as central banks poor in every last cent to hold the markets up

but the chart structure with big reversals say this is the end

spx 2020 must hold

high noon and the currency change over of control may help

Please take a look at GLPG. Up today on good Phase 2 study re. cure for Crohn’s disease.

Too thin for me…too many gaps. As a trading candidate, it’s nothing I’d be interested in.