Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly down. Australia, South Korea and Japan dropped more than 2%; Hong Kong, Singapore, Malaysia, New Zealand and Taiwan were also weak. China rallied better than 2%. Europe is currently mostly down. Germany, Finland, Spain, Italy and Portugal are down more than 1%; Austria, the Netherlands, Norway, Russia and Turkey are also weak. Greece is up 1%. Futures in the States, which were up solidly overnight, are pointing towards a down open for the cash market.

The dollar is up. Oil and copper are down (oil now has a 34 handle). Gold and silver are down. Bonds are down.

—————

S&P Select Week in Review

—————

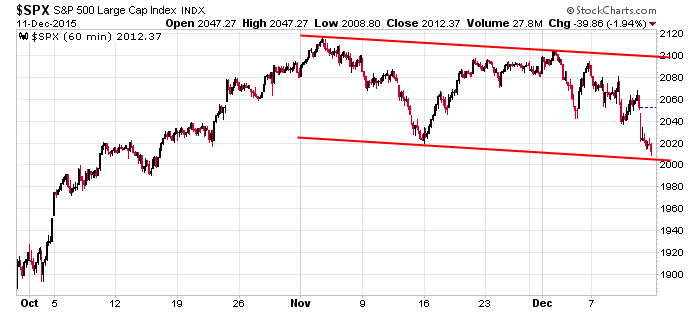

The market got hit hard Friday. There’s no way to sugar coat it. The number of big down days and big down weeks is adding up. The internals and lack of good set-ups have been hinting at internal weakness. Last week the price action started to reflect this.

The big event this week is the Fed. They very likely will raise the target on overnight rates to 25 basis points. They don’t really have a reason to raise – the current situation is the same as it was in September and last June – but they seem to want to raise, so they will. It’ll be the first time in 10 years rates will move up. Wall St. will continue focusing on their statement, but instead of looking for clues as to whether they’ll raise, they’ll look for clues as to how often they’ll raise and how quickly they’ll raise going forward. Will they raise 25 basis points and stop, or will this be the beginning of a trend?

Last weekend I said I wasn’t impressed with the market, and given what happened last week, I’m certainly not more impressed. The lack of participation is bothersome. We can’t have a handful of stocks doing very well and everything else doing so-so.

Near term bias is to the downside, but overall I’m don’t expect the market to completely fall apart. Start building a list of quality names you want to buy on a dip. The market isn’t going to just fall apart. There will be tradable bounces along the way.

Here’s the 60-min S&P to give us some perspective.

Stock headlines from barchart.com…

Prologis (PLD -1.38%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Hormel Foods (HRL +0.53%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Newell Rubbermaid (NWL -4.11%) said it will acquire Jarden Corp. ({=JAH for about $13 billion.

National Oilwell Varco (NOV -1.51%) was rated a new ‘Buy’ at KLR Group with a price target of $52, and Schlumberger Ltd. (SLB -2.32%) was also rated a new ‘Buy’ at KLR Group with a price target of $105.

Tyco International (TYC -1.52%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

DuPont (DD -5.51%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo Securities.

Mattel (MAT +2.66%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets..

Bloomberg reports that Shire is getting close to a deal to acquire Baxalta (BXLT -1.70%) after Baxalta rejected a previous $30 billion all-stock offer from Shire.

Blackstone reported a 13.86% stake in NCR Corp. (NCR -1.55%) .

Atmel (ATML -2.76%) jumped over 8% in after-hours trading after its board said it received an unsolicited proposal of $9 a share for the company.

The WSJ reports that Congress is likely to lift the crude oil export ban that has been in place for 40 years.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

none

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 14)”

Leave a Reply

You must be logged in to post a comment.

I don’t want to say it too loudly but I think we are at bottom.

sure hope ur right

Rut needs to get its act together…major lagger

bots are going crazy this morn

the market is already falling apart

junk bond yeilds are through the roof

hedge funds have closed their doors and not allowing redemptions,causing margin calls

company and munni junk bonds have had it causing world wide no liquidity

THE DEBT BUBBLE PONSI IS FALLING APART AND EUROPE KNOWS IT–SO DOES THE CARRY TRADE

their are many chart possibilities

as galacitic chief of the bears,the MOST BEARISH is if the spx stops here at 1992 [ or in the 1970 ish] and gives us a xmas rally ending on 6th jan 2016 for a 10 year crash to zero

their is a 135 day crash cycle allowing for holidays which ends on 6 /1/16 if a lower high in all indexes

this was the same crash cycle timing for the 1929 and 1987 crashes and is a mr Gann time cycle

their are many other possibilities

last weeks lower weekly high/low was also very bearish

i have contacted xzan [commander of the galactic confederation in the orion star system]

to let him know to prepare for a bear invasion

Niceeee…..