Good morning. Happy Tuesday. Happy snow day here in Colorado.

The Asian/Pacific markets closed mixed. Japan dropped more than 1%; India and Indonesia did well. Europe is currently posting big, across-the-board gains. Turkey is up 3%, and Germany, France, Austria, Norway, Spain, Italy and Portugal are up more than 2%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are down a little. Gold and silver are up a little. Bonds are down.

It’s all about the Fed right now. Today starts their 2-day meeting which will culminate in a decision on rates and a statement tomorrow. Almost everyone expects them to raise, so it should be no surprise tomorrow. Wall St. will be looking for clues as to whether this is a one-off event or the beginning of a hike cycle.

In the near term the Fed can influence the market (although the underlying tone of the market tends to resurface). I can’t remember a time when the Fed meeting was actually an important turning point.

Of course right there is nothing to turn. The S&P is down about 1.8% for the year, and other than the August dip and October recovery, it’s been range bound all year. With no trend to reverse, the question is whether the Fed can get a rally started. I doubt it.

The underlying tone of the market leans to the downside, so in my opinion, a rally, even if it extends into the new year, will get sold into.

Anything goes in the near term. No big bets right now.

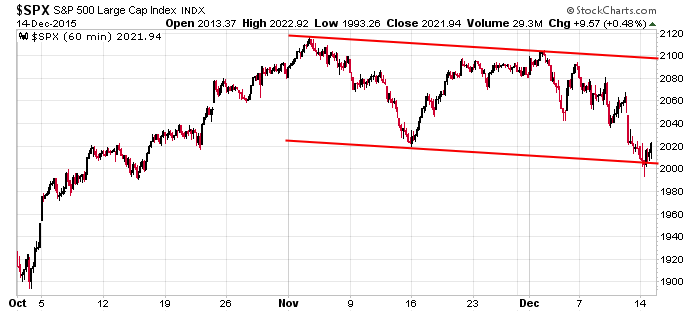

Here’s an update of the S&P chart I posted yesterday. The lower trendline was penetrate but then recaptured. Now the index is set to gap up today.

Stock headlines from barchart.com…

Amgen (AMGN +1.91%) rose nearly 2% in pre-market trading after it said it reacquired all product rights to Prolia, Xgeva and Vectibix from Glaxo in 48 countries.

Lumber Liquidators (LL +1.22%) surged over 15% in after-hours trading when short seller Whitney Tilson said he covered his short position in the company after he said he received new information that shows management wasn’t aware it was selling Chinese-made laminate with high levels of formaldehyde.

Amazon.com (AMZN +2.77%) was rated a new ‘Buy’ at MKM Partners with a price target of $800.

Verizon Communications (VZ +1.41%) was downgraded to ‘Neutral’ from ‘Buy’ at BTIG.

Occidental Petroleum (OXY +0.94%) was rated a new ‘Buy’ at CLSA with a price target of $83.

Chevron (CVX +3.34%) was rated a new ‘Outperform’ at CLSA with a price target of $95 and ConocoPhillips (COP +2.91%) was also rated a new ‘Outperform’ at CLSA with a price target of $52.

VeriFone Systems (PAY unch) climbed nearly 2% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $2.15-$2.17, higher than consensus of $2.12.

Xerox (XRX -1.79%) rose over 1% in after-hours trading after Carl Icahn reported he raised his stake in the company to 8.1% from 7.1%.

Lockheed Martin (LMT -0.29%) was awarded a $1.09 billion U.S. Army pact modification to foreign military sales for Patriot PAC-3 production.

Boeing (BA -1.12%) raised its quarterly dividend to $1.09 a share from 91 cents, higher than expectations of a hike to $1.02, and then raised its stock buyback authorization to $14 billion from $12 billion.

Kennametal (KMT -0.12%) slumped over 20% in after-hours trading after it said it expects its fiscal 2016 revenue may fall as much as 30% to 60% due to weakness in China’s auto market and in U.S. coal mining.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

FOMC meeting begins

8:30 Consumer Price Index

8:30 Empire State Mfg Survey

8:55 Redbook Chain Store Sales

10:00 NAHB Housing Market Index

4:00 PM Treasury International Capital

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

//