Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed with solid, across-the-board gains. Japan, Hong Kong and Australia rallied more than 2%; Indonesia, South Korea and Taiwan posted gains better than 1%. Europe is currently also doing very well. Greece is up more than 3%; Austria, Poland, Hungary and Portugal are up more than 1%; London, Germany, France, Switzerland, Russia, Denmark and Finland are doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up a little. Oil is down, copper is up. Gold and silver are up. Bonds are down.

—————

Join our email list and get reports and videos sent directly to you.

—————

I don’t have anything to add to the Fed talk. Rates have been talked about for weeks, and beyond what I’ve already said, I don’t have anything new to add to the discussion.

The Fed is going to move rates today – not because they should based on their dual mandate, but because they said they would. They don’t have a reason to…or at the very least the current situation is no different than six months ago. They can’t say “we are raising because…” because nothing has changed. They are going to raise because they have an itchy trigger finger; they just feel like it.

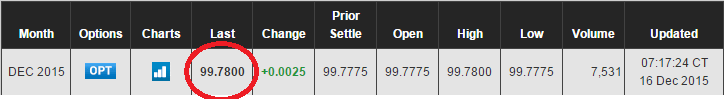

By the way, they don’t even have to raise to 25 basis points; rates are already there. Here’s an image grabbed from the CME website. See that number 99.7800? Subtract that from 100. You get 0.22, so rates are already at 22 basis points. A move to 25 is nothing.

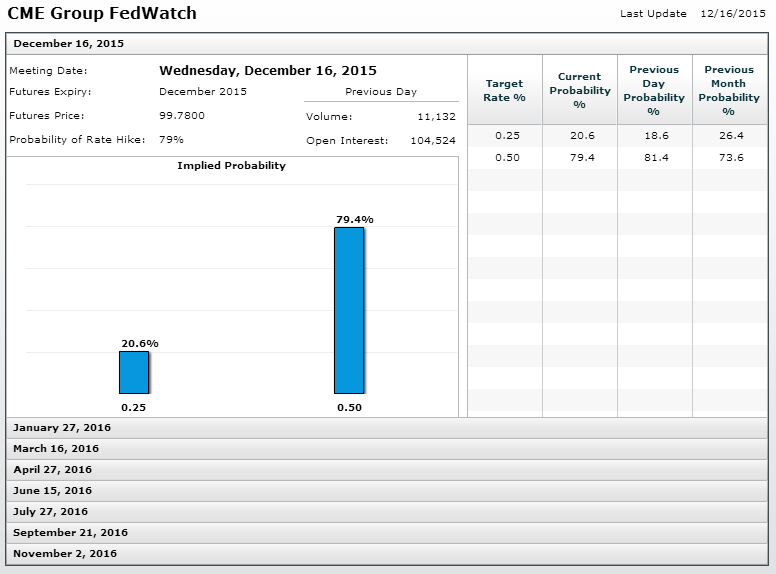

The bigger question is: Do they raise to 50? It does seem much to jump to 50 all at once, but odds favor it. Here’s another image from the CME website. Odds of 50 are 79.4%.

Besides the magnitude question (25 or 50), the expected trend is important. Will today be a one-off event or the beginning of a trend that sees rates increased several times this year. Wall St. can handle one (it’s already priced in); can it handle several?

After the Fed statement is released, Yellen will do a press conference, so there could be market movement beyond the initial reaction. Have fun.

Stock headlines from barchart.com…

Chevron (CVX +3.84%) was raised to ‘Buy’ from ‘Hold’ at Argus Research.

Boyd Gaming (BYD +2.32%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Northrop Grumman (NOC +0.41%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Newell Rubermaid (NWL +4.70%) was raised to ‘Top Pick’ from ‘Outperform’ at RBC Capital Markets with a 12-month price target of $60.

Valeant Pharmaceuticals (VRX +16.41%) fell over 5% in pre-market trading after it lowered guidance on Q4 adjusted EPS to $2.55-$2.65 from a prior forecast of $4.00-$4.20.

General Dynamics (GD -0.83%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

ConAgra Foods (CAG +0.81%) was rated a new ‘Buy’ at Jeffries with a price target of $50 and WhiteWave Foods (WWAV +3.04%) was also rated a new ‘Buy’ at Jeffries with a price target of $44.

Advanced Auto Parts (AAP +5.80%) rose over 1% in after-hours trading after StreetInsider, citing one unidentified person, reported the company was exploring a possible sale.

Dover (DOV +0.10%) slid over 3% in after-hours trading after the company lowered guidance on 2015 EPS continuing operations to $3.62 from a prior estimate of $3.73-$3.80, below consensus of $3.74.

AMC Entertainment Holdings (AMCX +2.43%) moved up over 1% in after-hours trading after the company named Starwood Hotels & Resorts interim CEO, Adam Aron, as the new CEO of AMC.

Heico (HEI +1.81%) rose over 4% in after-hours trading after it reported Q4 adjusted EPS of 56 cents, higher than consensus of 53 cents.

Ascent Retail Group (ASNA -2.21%) rallied nearly 5% in after-hours trading after the company reported a new $200 million stock buyback program.

Heartland Payment (HPY +2.82%) jumped nearly 12% in after-hours trading after Global Payments GPN said it will acquire the company for about $4.3 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Housing Starts

9:15 Industrial Production

9:45 PMI Manufacturing Index Flash

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:00 PM Chairman Press Conference

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 16)”

Leave a Reply

You must be logged in to post a comment.

I tend to sell gap ups. Not this one. I love to trade FMOC meetings. Not this one.

Agreed. This afternoon is bound to get very noisy and volatile.

i took my 10 ES points from today’s sell the gap trade and ran. normally i’d still be in it with a trailing stop. i’m a wuss when it comes to losing money, esp. after flashing a good chunk of it in an hour.

Niceeee…profit it king..

Think maybe the Yellen presser is 2:30 pm compared to 2:00 shown here, unless it’s been changed?

announcement is at 1400, press conf is at 1430. my ZB chart looks bullish, ZN chart looks bearish in the short term. so no clue what will happen. i don’t remember too many such instances, let alone on a fed day. if i had to handicap it (i am glad i don’t), i’d say a dud, non-event.

chief quadwitch eggbertaa is watching things very carefully

she has magical powers