Nobody likes runaway inflation, but its equal-and-opposite cousin, deflation, is pretty bad too – just ask those who lived through the Depression.

The entire world is built on debt. Heck, the United States is the biggest, wealthiest and most successful country in the history of the world…and the entire country is built on debt. The assumption is a little bit of inflation will enable us to pays today’s bills with slightly inflated dollars tomorrow. It’s the equivalent of buying a house you can afford…and then getting a slight pay raise. But what if the opposite happens? What if you borrow money today and then suffer a pay cut. It’s a little hard to make those payments. This is one way to look at deflation.

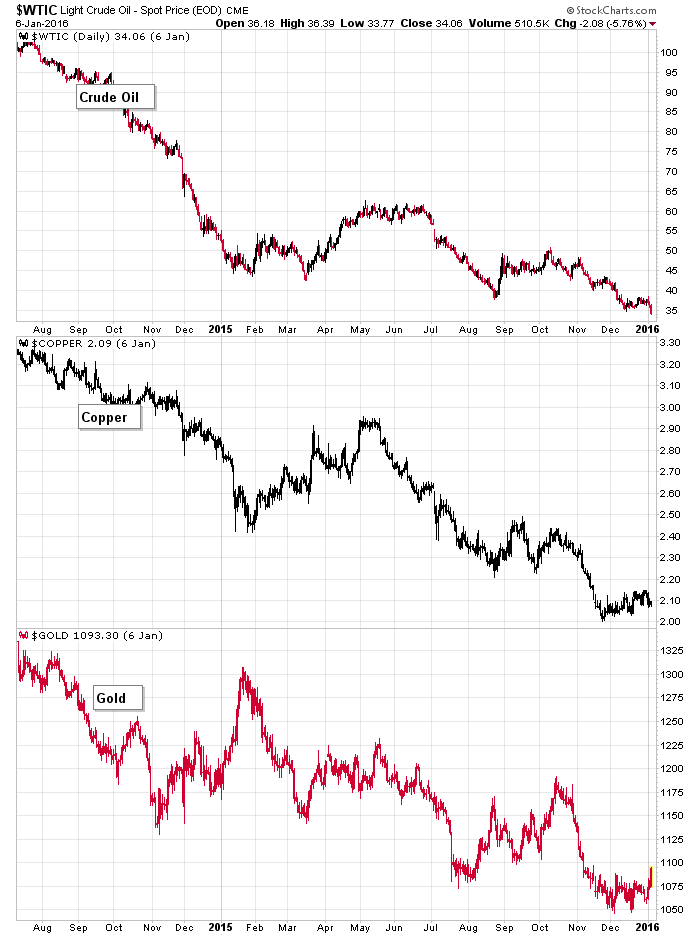

The deflationary warnings signaled by several commodities are not to be ignored. So far they haven’t pulled the market down much, but the implications could.

Here’s oil, copper and gold (although I’m not sure gold belongs here)

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()

0 thoughts on “Deflationary Pressures (9/12)”

Leave a Reply

You must be logged in to post a comment.

Deflation?? The fed fears deflation more than anything else at least that is what old Ben said. I agree deflation is the biggest threat to our markets. I and few others in the USA have ever experienced deflation. Deflation with the feds printing money would seem unlikely however what may even be worse is measures to prevent deflation. With China devaluing their currency Deflation is a real concern.