Junk bonds are bonds issued by companies that have low credit ratings. There is less confidence the company will make their payments, so they have to offer them at a higher rate.

When times are good and there is little fear of missing a debt payment, junk bonds offer an attractive and somewhat safe investment, especially for those seeking low volatility. But when the health of the economy weakens and the odds companies run into trouble increases, junk bonds sell off.

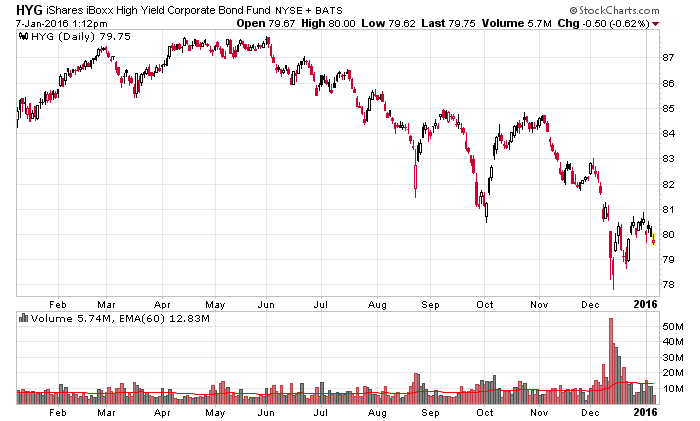

This is what’s been happening since last spring. It’s a subtle hint investors are not overly optimistic going forward.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()