Most middle class people have the bulk of their net worth tied up in a house. It’s not a great investment – more like a forced savings program – but considering how bad people are at saving, home ownership carries more positives than negatives.

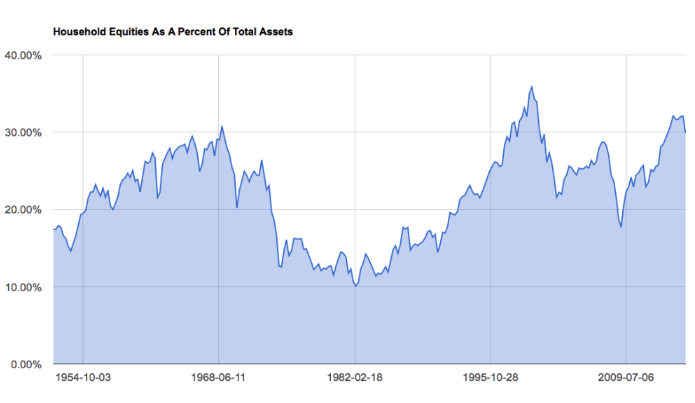

One would think the rebound in housing would result in most people having even more of their net worth tied up in a house, but that’s not the case. The general public is heavily invested in the stock market, as a percentage of their assets. It’s not that people aren’t diversified; it’s that they’re much less diversified than historical norms.

Housing values can fluctuation or flat-line, and unless you plan on selling, you don’t care. But fluctuations in a stock portfolio feel much more real and tangible. If the market starts to head south, diversifying out of stocks to get the housing/stocks balance back in line with historical norms would put additional pressure on the market.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()