Just as a healthy, “risk-on” market sees money flowing to small cap stocks, money also flows from safe-havens to less proven companies that have greater upside potential. A quick glance at the leader and loser board each week tells us where money is flowing.

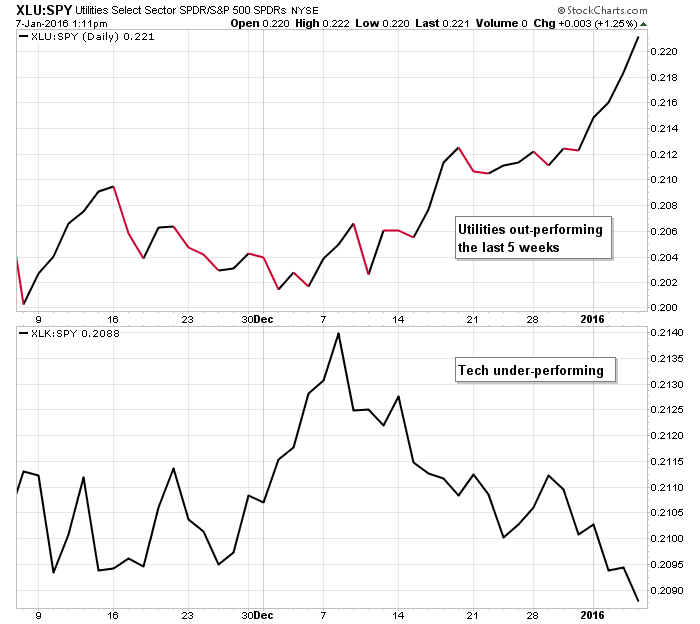

Over the last several weeks, utilities, the ultimate safe-have group that pays a decent dividend, has been out-performing the S&P, while tech, a true leader during good times, has been under-performing.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()

0 thoughts on “Defensive Leadership (4/12)”

Leave a Reply

You must be logged in to post a comment.

…but isn’t it someway strange when interest rates are growing?

Yes and by not raising rates sooner, the Fed has many less options going forwards.

I agree with you here but buying defensive stocks here is like buying NASDAQ stocks on 3/10/2000.