Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. China dropped almost 3%, but while there were no big winners, Taiwan, Australia, Hong Kong and Singapore did well. Europe currently leans to the downside. Italy is down more than 2%, and Germany, Belgium, Sweden, Switzerland, Denmark and Spain are down more than 1%. Norway and Poland are up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is flat. Oil is up, copper is down. Gold is up, silver is down. Bonds are mixed.

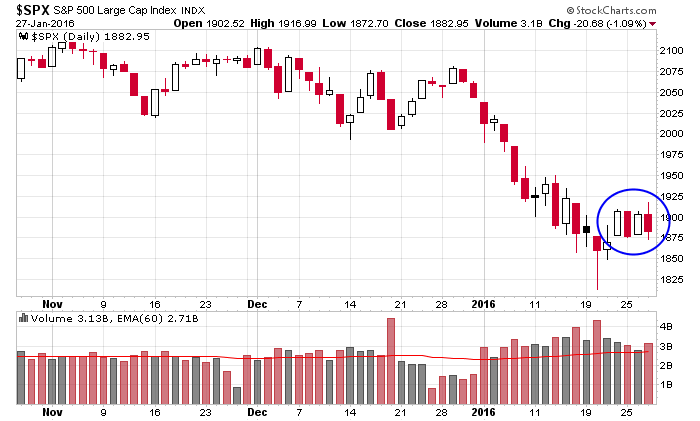

The market hasn’t been able to make up its mind lately. Big up, big down, big up, big down. Back and forth, back and forth. It’s not the type of action you typically see off a bottom, so I’m thinking a bottom isn’t in place, even though a continuation of the bounce is likely before heading south again. Here’s the S&P 500. Lots of movement. Lots of opportunities for day traders. Frustrating for swing traders.

Big cap tech has been weak lately; Facebook will buck that trend today when it gaps up to its highs. But AAPL, NFLX and TSLA have been weak. AMZN, GOOGL and MSFT aren’t much better off. These were the stocks that led in 2015. If Sovereign Wealth Funds are taking profits, what other groups are going to step forward and lead the market. Something has to lead, and so far there are no candidates.

Besides the indicators rolling over and suggesting the trend is now down, this is another reason to question the market’s performance going forward. Lack of leadership.

My overall bias remains to the downside. Don’t get chopped up out there.

Stock headlines from barchart.com…

Facebook (FB -2.97%) is up over 12% in pre-market trading after it reported Q4 adjusted EPS of 79 cents, above consensus of 68 cents.

Hallibuton (HAL +0.41%) was upgraded to ‘Buy’ from ‘Accumulate’ at KLR Group with a price target of $44.

Ford Motor (F -3.34%) reported Q4 adjusted EPS of 58 cents, better than consensus of 51 cents.

EBay (EBAY -0.86%) sank over 10% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $1.82-$1.87, below consensus of $1.98, and said it sees Q1 adjusted EPS of 43 cents-45 cents, weaker than consensus of 48 cents.

Paypal (PYPL -1.19%) rose 5% in after-hours trading after it reported Q4 adjusted EPS of 36 cents, higher than consensus of 34 cents.

Juniper Networks (JNPR -0.41%) slumped over 9% in after-hours trading after it lowered guidance on Q1 adjusted EPS to 42 cents-46 cents, below consensus of 47 cents.

Discover Financial Services (DFS +0.68%) tumbled over 7% in after-hours trading after it reported Q4 EPS of $1.14, below consensus of $1.30.

SanDisk (SNDK +0.19%) gained over 1% in after-hours trading after it reported Q4 adjusted EPS of $1.26, higher than consensus of 90 cents.

Texas Instruments (TXN -0.06%) rose over 2% in after-hours trading after it reported Q4 GAAP EPS ex-benefits of 71 cents, above consensus of 69 cents.

United Rentals (URI -1.85%) sank over 10% in after-hours trading after it reported Q4 adjusted EPS of $2.19, below consensus of $2.33.

ServiceNow (NOW -3.32%) slumped over 12% in after-hours trading after it reported Q4 billings of $365.7 million, below forecasts of $370 million-$375 million, and said it sees 2016 revenue of $1.34 billion-$1.37 billion, below consensus of $1.37 billion.

Teradyne (TER +0.61%) jumped 10% in after-hours trading after it reported Q4 adjusted EPS of 13 cents, higher than consensus of 10 cents, and then raised guidance on Q1 EPS to 23 cents-29 cents, above consensus of 18 cents.

Mellanox Technologies (MLNX +0.46%) climbed over 6% in after-hours trading after it reported Q4 EPS of 90 cents, well above consensus of 70 cents.

InvenSense (INVN -5.78%) dropped 6% in after-hours trading after it lowered guidance on Q4 EPS to $0.00 to up 2 cents, below consensus of 12 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Durable Goods

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 28)”

Leave a Reply

You must be logged in to post a comment.

Buying FB this morning on the proposition that its uses are so far ahead I need the risk of a major innovation in communications and accounting for services.

Today more pouting and disappointment over Fed mess, and GDP: Duck and plan. Jason has some ideas which we will ride today. Keeping ones head is the first requirement and having a plan is the second. I am trying. Best to all.

Not GDP but Durable goods, and other questionable govt statistics.

lol, questionable government statistics. what exactly is questionable here though, the government or the statistics, or both?