Good morning. Happy Friday.

The Asian/Pacific markets closed with relatively big, across-the-board gains. China gained more than 3%, and Malaysia, Taiwan, Japan, Hong Kong and Singapore rallied more than 2%. Europe is currently mostly up. London, Belgium, Switzerland, Turkey, Spain and Italy are up more than 1%; France, Germany and the Netherlands are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is up. Oil is up, copper is up. Gold is flat, silver is up. Bonds are up.

Japan has adopted negative interest rates for the first time ever. Excess reserves parked at the central bank (I don’t know how much is considered excess) will now pay 0.1%. Japan surged almost 3%.

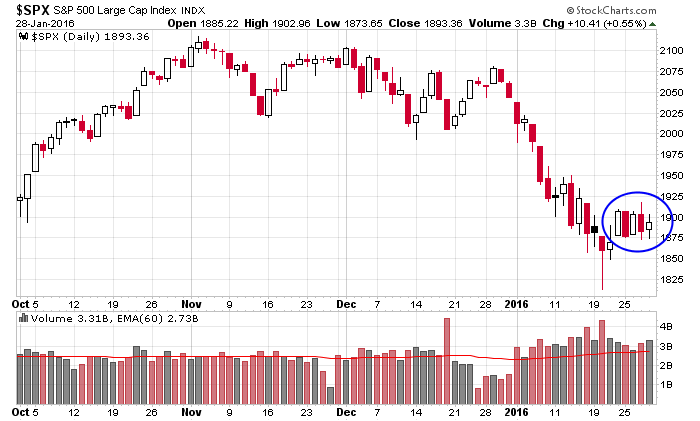

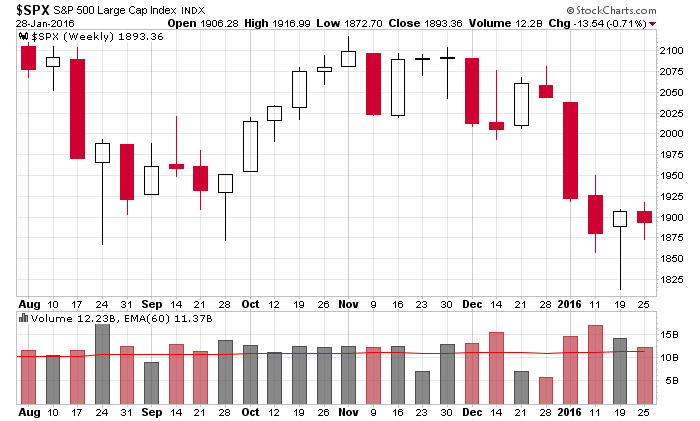

It’s been a choppy week. Going back to last Friday, the S&P has moved nowhere. Up, down…no directional moves have lasted more than a day.

The weekly is posting a loss, and the small range reflects the market’s indecision this week.

The biggest news right now is earnings. There have been many big post-earnings moves – big gaps in both directions and no way to comfortably guess which way stocks will go.

Under Armour has been a mess for several months…yesterday it rallied almost 23%.

Apple underwhelmed and paid the price. Ebay got crushed.

Facebook did great and was rewarded. Amazon missed and will get hit at today’s open.

Be careful out there. My overall bias remains to the downside. But in the near term anything goes…and especially anything goes with individual stocks.

Stock headlines from barchart.com…

Microsoft (MSFT +1.64%) is up over 3% in pre-market trading after it reported Q2 adjusted EPS of 78 cents, above consensus of 71 cents.

Amazon.com (AMZN +8.91%) slumped over 10% in pre-market trading after it reported Q4 EPS of $1.00, well below consensus of $1.55, and said it sees Q1 operating income pf $100 million-$700 million, below consensus of $731.7 million.

Electronic Arts (EA +0.43%) tumbled 8% in pre-market trading after it said it sees Q4 adjusted EPS of 40 cents, below consensus of 50 cents, and then forecast fiscal 2016 adjusted EPS of $3.04, below consensus of $3.11.

Colgate-Palmolive (CL +1.12%) reported Q4 EPS of 73 cents, better than consensus of 72 cents.

Phillips 66 (PSX +1.25%) reported Q4 EPS of $1.31, higher than consensus og $1.26.

Amgen (AMGN -1.41%) rose over 1% in after-hours trading after it reported Q4 adjusted EPS of $2.61, higher than consensus of $2.29, and then raised guidance on fiscal 2016 adjusted EPS to $10.60-$11.00 from a November estimate of $10.35-$10.75, above consensus of $10.66.

Western Digital (WDC +4.63%) slid over 1% in after-hours trading after it forecast Q3 sales of $2.8 billion-$2.9 billion, below consensus of $3.23 billion.

Visa (V -2.23%) gained over 2% in after-hours trading after it reported Q1 adjusted EPS of 69 cents, higher than consensus of 68 cents.

Synaptics (SYNA -1.18%) fell nearly 2% in after-hours trading after it reported Q2 revenue of $470.5 million, below consensus of $477.9 million, and then lowered guidance on Q3 revenue to $430 million-$470 million, less than consensus of $501.4 million.

QLogic (QLGC +2.38%) surged over 10% in after-hours trading after it reported Q3 non-GAAP EPS of 33 cents, above consensus of 26 cents, and then raised guidance on Q4 adjusted EPS to 23 cents-27 cents, higher than consensus of 23 cents.

Fortinet (FTNT +2.05%) jumped over 7% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to 67 cents-69 cents, above consensus of 67 cents.

Flextronics (FLEX -0.63%) climbed 4% in after-hours trading after it reported Q3 adjusted EPS of 35 cents, higher than consensus of 30 cents.

Skyworks Solutions (SWKS +4.26%) fell over 4% in after-hours trading after it reported Q1 adjusted EPS of $1.60, better than consensus of $1.58, but then lowered guidance on Q2 adjusted EPS to $1.24, below consensus of $1.32.

According to the WSJ, Xerox (XRX unch) will split itself into two companies; one company grouping hardware operations, and another that will house its service business.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 GDP Q4

8:30 International trade in goods

8:30 Employment Cost Index

9:45 Chicago PMI

10:00 Reuters/UofM Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

3:00 PM Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 29)”

Leave a Reply

You must be logged in to post a comment.

Japan reinvigorate currency wars

In a surprise move, the BoJ cut to -0.1% the rate applied to a portion of the Japanese banks’ current accounts. In theory, the policy should boost the effectiveness of its QE program by encouraging the banks to spend rather than save the cash they receive in exchange for their JGB holdings. In reality, the measure is aimed at cheapening JPY.

The US GDP = .7 this is 4th quarter 2015. The Japanese are following the EU. Pay to hold money in a bank!!! We can expect to see this nonsense in the US, if Yellen notices the trick. But more to the point, they want your money. Get a plan of action.

i am seeing inverse h&s patterns in the majors (ES and TF more clear than NQ). they are rather small and short-in-duration formations, but ES can shoot up to 2000 in no time. after that, it’s unknown. but given the rally in oil and tendency of h&s patterns to mark major turns, i would take it seriously.

$SPX has a nice pivotal bounce off of the 200 EMA weekly chart. I would expect a short term run up. You can pretty much cherry pick some decent amount of stock call options.

spx 1929 was a good year for the bears

bears want a close on the highs

Buy volume below the average volume….

this is a nice close to wave 4 choppy overlap double abc bounce

if this is the end of wave 4 then wave 5 will be dow 2000 and spx 200 point down

the gaps have been filled

havent seen a +1k tick near the close in a long while…hmmmm

it was pensions rebalancing ,but looks like exhurstion to me