Good morning. Happy Tuesday. Hope you had a good weekend and enjoyed your extra day off. Time to get back to work.

Yesterday…

China dropped in its first day of trading after being closed for a week. Otherwise the Asian/Pacific markets did great. Japan rallied better than 7%; Hong Kong, Singapore, India, Australia and New Zealand also did well.

Europe posted solid, across-the-board gains. Greece rallied better than 7%, Denmark better than 5%, and France, Austria, Belgium, Norway, Sweden, Prague, Spain, the Netherlands and Italy moved up more than 3%.

Today…

The Asian/Pacific markets mostly posted solid gains. China gained 3.3%; Hong Kong, Singapore, Australia, South Korea and Taiwan rallied more than 1%.

Europe is currently mixed; very few markets have moved much. The Czech Republic is down 1.3%; otherwise Germany, Austria and Switzerland are weak; Russia and London are doing well.

—————

Webinar TOMORROW – click to sign up

—————

Futures here in the States point towards a big gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

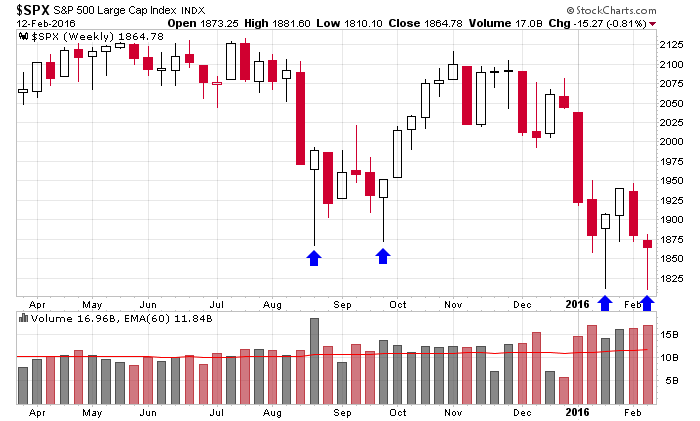

We finished last week with a relatively big lower tail on the weekly candle.

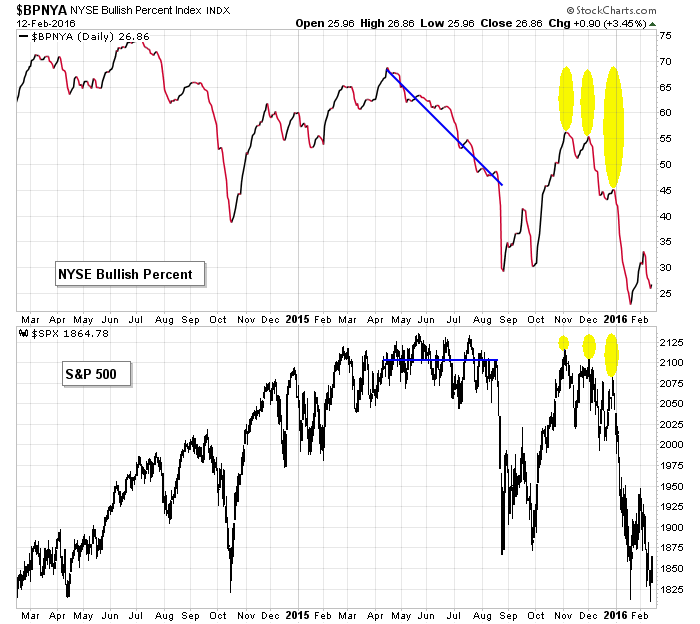

The NYSE was starting to form a positive divergence with its bullish percent chart.

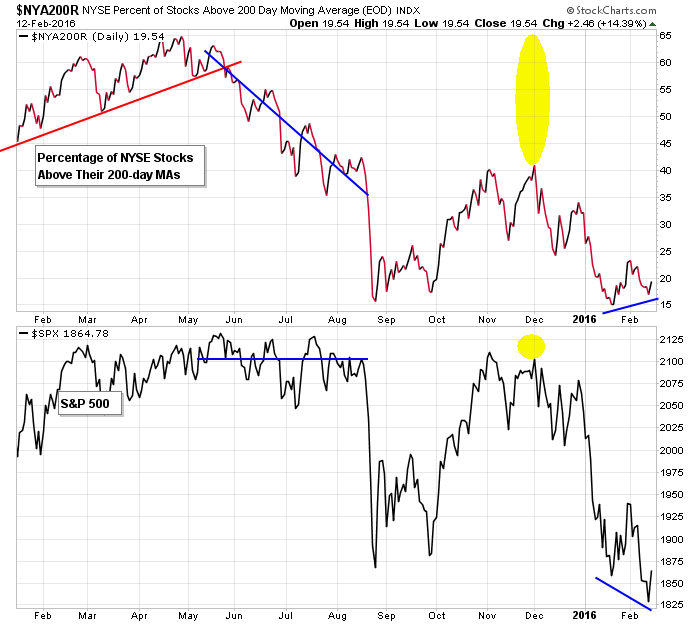

The percentage of NYSE stocks above their 200-day moving averages was forming a positive divergence.

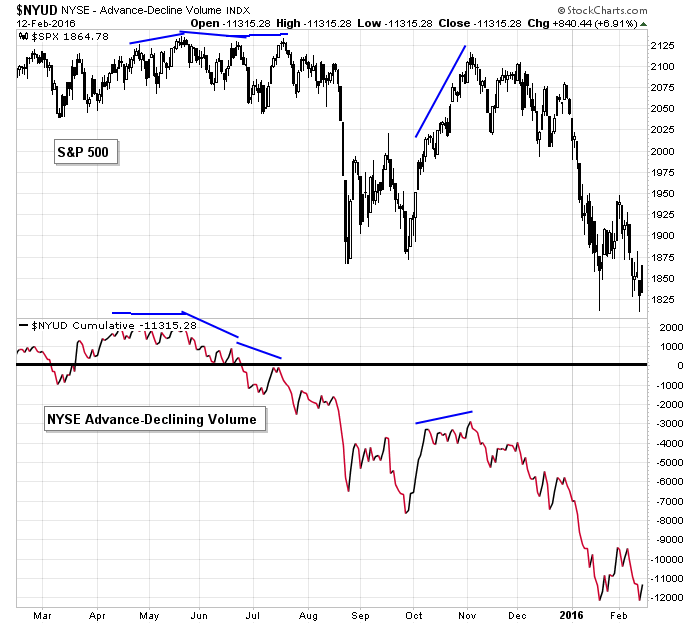

The cumulative AD volume line was putting in a higher low.

Japan surged yesterday, and China did not collapse after being closed for a week.

Add in a couple bright spots on the technical side, and the stage is set for a rally attempt.

Overall I remain bearish and think new lows will be hit. But in the near term respect the possibility of bounce. More after the open.

Stock headlines from barchart.com…

ADT Corp. (ADT +1.90%) surged over 40% in pre-market trading after it agreed to be purchased by Apollo Global affiliates for $6.9 billion or $42 a share.

Freeport McMoRan (FCX +13.09%) jumped almost 8% in pre-market trading after it agreed to sell an additional stake n one of its biggest mines to Sumitomo Metal Mining for $1 billion.

Goldman Sachs (GS +3.87%) was upgraded to ‘Overweight’ from ‘Underweight’ at JPMorgan Chase.

Hormel Foods (HRL -0.46%) reported Q1 EPS of 43 cents, better than consensus of 39 cents.

Flowers Foods (FLO -6.54%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T Capital Markets.

AutoZone (AZO +2.37%) was upgraded to ‘Outperform’ from ‘Neutral’ at Wedbush.

Peabody Energy (BTU +2.97%) was downgraded to ‘Underweight’ from ‘Hold’ at BB&T Capital Markets.

EMC Corp. (EMC -0.12%) gained over 1% in after-hours trading after Baupost Group LLC Holdings reported that it purchased 29.2 million shares in the company.

USG Corp. (USG +7.05%) fell over 1% in after-hours trading after Appaloosa Management LP Holdings said it sold its stake in USG.

Groupon (GRPN +29.02%) climbed over 2% in after-hours trading after BABA reported a 5.6% stake in the company.

Energy Transfer Partners LP (ETP +8.38%) rose 1% in after-hours trading after Perry Corporation Holdings and Appaloosa Management LP Holdings reported new stakes in the company.

Waterstone Financial (WSBF +0.81%) CFO Allan Hosack will resign effective March 1 and Mark Gerke was named interim CFO.

Anworth Mortgage (ANH +0.24%) reported Q4 core EPS of 15 cents, better than consensus of 14 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Empire State Mfg Survey

9:00 Fed’s Harker speech

10:00 NAHB Housing Market Index

10:30 Fed’s Kashkari speech

4:00 PM Treasury International Capital

7:30 PM Fed’s Rosengren: Economic Outlook

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 16)”

Leave a Reply

You must be logged in to post a comment.

Go long or be wrong

You must believe something to trade today. I am just holding on waiting for a decline as they rearrange the deck chairs. think Fed bonds. But maybe no too.

closed mondays longs for all indices at dow cash 16220 just after europe open

still short

all bulls have been slaughtered and are now extinct forever

there are now only bears and dead cats

my dead cats did well yesterday

old bull market trading plans need to be thrown out and new ones followed for bear markets for the next

10 years as the credit ponsi implodes

looks like a nice H/S on your weekly spx chart with a round top

and a target of about spx 1500 and that would complete wave 5 down of larger wave 1