Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Japan, Hong Kong and Singapore fell more than 1%. China rallied 1.1%; India also did well. Europe is posting solid, across-the-board gains. Austria and Greece are up more than 3%; Germany, France, Norway, Sweden, Poland, Denmark, Finland, Spain, Italy and Portugal are up more than 2%. Futures here in the States point towards a moderate gap up open for the cash market.

—————

Webinar TODAY – click to sign up

—————

The dollar is flat. Oil and copper are up. Gold and silver are down. Bonds are down.

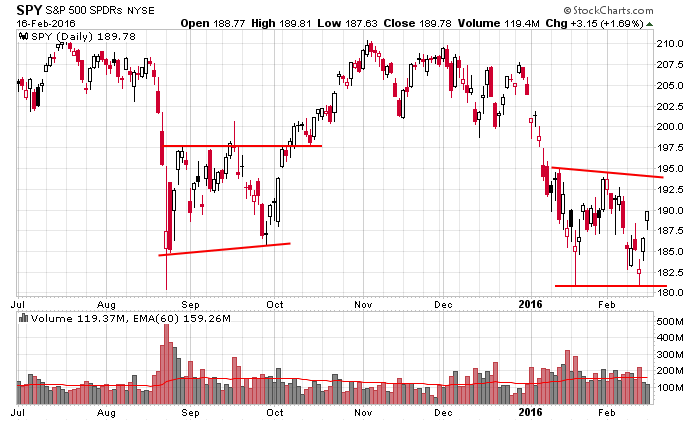

Yesterday the market followed through on last Friday’s big up day, and at today’s open it’ll follow through more. The S&P is now in the upper half of its 6-week range. Here’s SPY.

This chart highlights one of the difficulties playing bear markets. Despite the fact that the market topped last summer and fell 300 points off its high (S&P 500), most of the selling took place in a very small number of days. There was a plunge in August that lasted a week and a big sell-off to start the year. Those two bouts of selling went for 475 points, so the rest of the days combined for a 175-point gain. Think about that. Over the last seven months, if not for two bouts of sell that lasted a total of 3-4 weeks, the market would be up. It’s a characteristic of a bear markets. Most of the losses are contained in a small number of days. More after the open.

Stock headlines from barchart.com…

Boeing (BA +3.65%) gained over 1% in pre-market trading after it said it secured a $1.3 billion order for planes from China’s Okay Airways.

Kinder Morgan (KMI +4.41%) climbed over 9% in pre-market trading after a regulatory filing showed that Berkshire Hathaway added investment in the company in Q4.

HealthStream (HSTM +1.36%) was upgraded to ‘Buy’ from ‘Hold’ at Needham & Co. with a 12-month price target of $26.

Express Scrips (ESRX +1.95%) dropped over 1% in after-hours trading after it reported Q4 revenue of $26.2 billion, below consensus of $26.6 billion.

Fossil Group (FOSL +3.36%) jumped over 11% in after-hours trading after it reported Q4 GAAP EPS of $1.46, well above consensus of $1.30.

Icahn Associates Corp. said that it added almost 12 million shares of Hertz Global Holdings (HTZ +8.54%) and 4 million shares of Cheniere Energy (LNG +2.03%) to its holdings.

Concho Resources (CXO +1.14%) will replace Plum Creek Timber (PCL +5.44%) in the S&P 500 as of the close of trading Friday, Feb 19.

Agilent (A +2.37%) slid over 6% in after-hours trading after it lowered guidance on Q2 adjusted EPS to 37 cents-39 cents, below consensus of 43 cents.

Cerner (CERN +1.02%) fell 6% in after-hours trading after it reported Q4 bookings of $1.35 billion, below estimates of $1.45 billion-$1.55 billion

FMC Technologies (FMC +4.99%) lost almost 1% in after-hours trading after it reported Q4 adjusted EPS of 46 cents, below consensus of 48 cents.

Boyd Gaming (BYD +5.19%) rose over 1% in after-hours trading after it reported Q4 adjusted EPS of 16 cents, higher than consensus of 13 cents.

Terex (TEX -0.49%) jumped over 10% in pre-market trading after Zoomlion Heavy Industry Science and Technology Co. Ltd reiterated its committment to buy the company for $30 in cash.

Cheesecake Factory (CAKE +2.36%) slipped over 3% in after-hours trading after it reported Q4 revenue of $526.8 million, weaker than consensus of $528.8 million.

Kaiser Aluminum (KALU +2.29%) reported Q4 adjusted EPS of 60 cents, well below consensus of $1.09.

Earnings and Economic Numbers from seekingalpha.com…

Tuesday’s Key Earnings

Devon Energy (NYSE:DVN) -6.6% AH on slashing 20% of staff, cutting dividend.

Express Scripts (NASDAQ:ESRX) unmoved AH after meeting profit estimates.

Rackspace (NYSE:RAX) -6.6% AH following soft Q1/2016 sales guidance.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Producer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 E-Commerce Retail Sales

2:00 PM FOMC minutes

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 17)”

Leave a Reply

You must be logged in to post a comment.

Even in the 2000-2003 bear the ratio of up days to down days was about even.

The BLS housing, inflation data today is confusing to most,

but it suggests the economy is not well (or not growing). I have bought

into the rally with stops, bonds are still rising. But Aapl is

selling bonds, to allow it to do buy share backs and offer new products.

This run will continue for a time :1960 in S&P today. Then things will coast for a while – maybe UP into May 2016. SO no hurry.

my dead cats are exhausted and have catpitulated at key opts ex resistance points

non stop buying…lets see if it washes out all those puts…

bkx, transports and rut pulling back..ym melting up…nice divergence

hmmm fed minutes…lets see if there are any fireworks

1 to 4 day bounces are common in bear markets

imo the evil opts ex angles have gone to far or it turns into a sideways correction is unknown