Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Japan and Indonesia dropped more than 1%; Australia was also weak. New Zealand and South Korea did moderately well. Europe is currently mostly down. Greece is down more than 2%; Norway, Russia, Spain, Italy and Portugal are down more than 1%; Germany, France, the Netherlands, Sweden and Prague are also weak. Futures in the US point towards a down open for the cash market.

—————

Top Shelf Trading – eMagazine – I was featured in here this month.

—————

The dollar is down a small amount. Oil is down, copper is up. Gold and silver are up. Bonds are up.

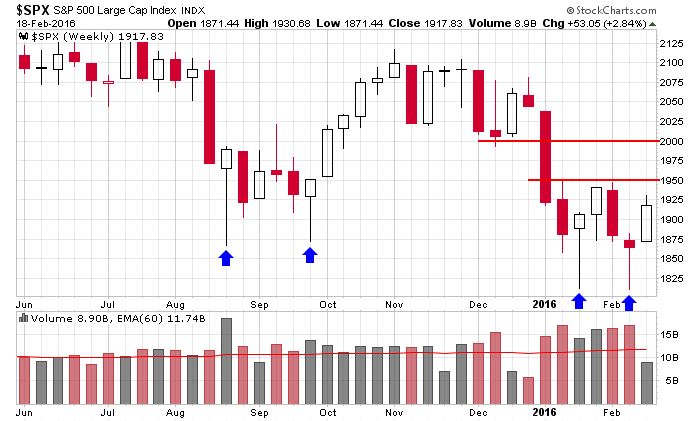

A bottoming candle formed on the weekly charts last week (long lower wick, close near the high), and so far this week we’ve gotten some nice follow through. The S&P is up almost 3% and barring a big sell-off today, this week’s candle will be constructive. Here’s the weekly.

Resistance at 1950 will be stiff. If it gets through there, considering the thin area between 1950 and 2000, it could be a quick trip to 2000.

This has not been an easy market to trade. Not much is lasting very long. Despite it seeming like a top is in place and a downtrend underway, the market has spent most of its time trading range bound and up. In fact if you eliminate the 1 week of selling in August and the 2 weeks of selling to start this year, the S&P would be well into new high territory. Think about that. If you simply eliminated three weeks of trading (out of 8 months), the market would be at new highs.

In a bear market, most of the movement takes place in a small number of days. It’s why they’re so hard to play. You don’t know when the bottom will fall out…and when it does, there are no second chances to get in.

The character of a bear market is different than a bull market. I talked about this in the seminar I gave two days ago.

Stock headlines from barchart.com…

Applied Materials (AMAT +0.18%) climbed 4% in pre-market trading after it reported Q1 net revenue of $2.26 billion, higher than consensus of $2.24 billion, and said it sees Q2 adjusted EPS of 30 cents-34 cents, above consensus of 27 cents.

Nordstrom (JWN +0.90%) tumbled over 8% in pre-market trading after it reported Q4 adjusted EPS ex-impairments of $1,17, weaker than consensus of $1.21, and then lowered guidance on fiscal 2017 adjusted EPS to $3.10-$3.35, below consensus of $3.55.

AMN Healthcare Services (AHS +0.20%) jumped over 7% in after-hours trading after it reported Q4 adjusted EPS of 47 cents, higher than consensus of 41 cents.

Flowserve (FLS -0.09%) lost over 3% in after-hours trading after it reported Q4 adjusted EPS of 89 cents, below consensus of 92 cents.

Allscripts Healthcare Solutions (MDRX -1.58%) dropped over 2% in after-hours trading after it reported Q4 adjusted EPS of 13 cents, right on consensus, but lowered guidance on fiscal 2016 revenue to $1.43 billion-$1.46 billion, below consensus of $1.48 billion.

Flour (FLR +0.06%) lost over 1% in after-hours trading after it reported Q4 continuing operations EPS of 68 cents, below consensus of 93 cents, and reported Q4 revenue of $4.12 billion, less than consensus of $4.54 billion.

Arista Networks (ANET -2.86%) gained almost 6% in after-hours trading after it reported Q4 adjusted EPS of 80 cents, higher than consensus of 61 cents.

Trinity Industries (TRN -4.17%) dropped over 13% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $200-$2.40, well below consensus of $3.64.

WageWorks (WAGE -5.01%) rose 7% in after-hours trading after it reported Q4 adjusted EPS of 33 cents, better than consensus of 28 cents.

Equinix (EQIX -0.12%) slid over 4% in after-hours trading after it reported Q4 FFO of $2.14 a share, well below consensus of $3.07.

Ambac Financial Group (AMBC +2.58%) climbed 4% in after-hours trading after it reported a Q4 operating EPS of $10.64, higher than consensus of $1.15.

Century Aluminum (CENX -1.33%) gained over 1% in after-hours trading after it reported a Q4 adjusted EPS loss of -53 cents, narrower than consensus of a -61 cent loss.

TrueCar (TRUE -2.20%) slumped over 15% in after-hours trading after it reported a Q4 adjusted EPS loss of -6 cents, wider than consensus of a -4 cent loss.

Nivalis Therapeutics (NVLS unch) jumped 6% in after-hours trading after it received FDA Fast Track designation for its N91115 drug to treat Cystic Fibrosis.

Earnings and Economic Numbers from seekingalpha.com…

Thursday’s Key Earnings

Applied Materials (NASDAQ:AMAT) +4% after a Q4 beat, strong guidance.

DISH Network (DISH) -6.3% as subscribers slipped.

Duke Energy (NYSE:DUK) +0.9% despite an EPS, revenue miss.

MGM Resorts (NYSE:MGM) -8.3% weighed down by Macau revenue.

Nordstrom (NYSE:JWN) -8.3% as promotions wrecked margins.

SodaStream (NASDAQ:SODA) +8.5% after topping estimates.

Wal-Mart (NYSE:WMT) -3.1% on soft e-commerce, comp-store sales.

Today’s Economic Calendar

8:00 Fed’s Mester: Economic Outlook

8:30 Consumer Price Index

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 19)”

Leave a Reply

You must be logged in to post a comment.

Jason,

Thank you for your views above and they are normal for this stage of the bear

whilst you acknowledge the bear,sub conciously you wish for a bull for they are easier to trade

look at the monthly/weekly the bear has hardly even began yet and you might even call it a topping chart

but that is not so in the rest of the world–china asia europe japan russia -mid east and they have been liquidating

whilst usa may be able to hold out the longest because of capital flows into usa ,but the writing is on the wall

the bear is easy to trade with the right mind set–and you said it big crashes lasting a few weeks followed by bid ups or corrective overlap sideways consolidations lasting months

that said a daytrader has no bias intraday and any other mindset is determental to the intraday ups/downs on the charts

even so i have closed my shorts [intraday and we may be heading higher in wave c up of corrective wave 2

only chart not participating is dow but nas 100 leding way up atm

SSRI is not moving today, ignore me. misery loves company, but some day the silver fundamentals will bloom. Next S&P could be up from 1900 towards 2100 for a whilst we wait for WTI to settle down. I am long heavy bond position and riding my reits earnings up. So far working but: Due for an ABC down soon as I see in my analysis of the technicals. sold DE put yesterday, almost smiling. Looking at a strangle.