Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan, Hong Kong and Australia rallied more than 2%; Singapore, India, South Korea and Taiwan did better than 1%. Europe is currently mostly up. Germany, Norway, Russia, Denmark and Finland are up more than 1%; France, the Netherlands, Poland, Spain, Italy and Portugal are also doing well. Futures here in the States point towards an up open for the cash market.

—————

Top Shelf Trading – eMagazine – I was featured in here this month.

—————

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are down.

The market has logged its first 3-day win streak since December and its biggest 3-day gain since September. Not bad. The biggest rallies take place within downtrends, so this is par for the course.

In my opinion, the “wrong” groups are leading. Industrial metals, gold, utilities – they’ve been doing very well. These groups aren’t big enough to lead – there aren’t enough stocks, and the combined market cap isn’t high enough to absorb serious demand.

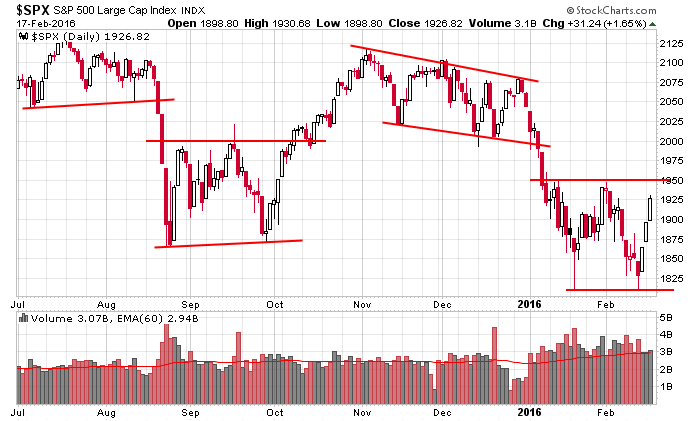

Here’s an update of the daily S&P chart. Over the last seven months, the indexes experienced a quick, 1-week drop in August, a month-long rally in October and a 2-week drop to start the year. Otherwise there’s been lots of up and down movement, lots of gaps, lots of volatility and a complete lack of directional movement. This is characteristic of a top/beginning of downtrend – most of the movement takes place in a small number of days.

There’ll be some resistance at 1950 (if it gets there), but the big number is 2000. More after the open.

Stock headlines from barchart.com…

NVIDIA (NVDA +2.48%) jumped nearly 8% in pre-market trading after it reported Q4 adjusted EPS of 52 cents, higher than consensus of 43 cents.

Wal-Mart (WMT +0.32%) slid 3% in pre-market tradng after it reported Q4 revenue of $129.7 billion, below consensus of $130.6 billion, and cut its yearly sales forecast to “relatively flat” from a previous view of up 3%-4%.

Brocade Communications Systems (BRCD +3.02%) rallied over 5% in after-hours trading after it reported Q1 adjusted EPS of 29 cents, above consensus of 24 cents.

Williams Cos. (WMB +4.53%) lost over 2% in after-hours trading after it reported Q4 adjusted EPS continuing operations of 1 cent, weaker than consensus of 27 cents.

Intercept Pharmaceuticals (ICPT +5.42%) rose over 5% in after-hours trading after departing CFO Barbara Duncan said she will delay her departure date of June 30 if no successor is in office by that time.

CF Industries (CF +1.80%) fell over 4% in after-hours trading after it reported Q4 adjusted EPS of 76 cents, below consensus of 82 cents.

Synopsys (SNPS +1.51%) climbed 6% in after-hours trading after it reported Q1 adjusted EPS of 68 cents, above consensus of 62 cents and then raised guidance on Q2 adjusted EPS to 78 cents-81 cents, above consensus of 70 cents.

Marriott International (MAR +2.49%) dropped over 2% in after-hours trading after it lowered guidance on Q1 EPS to 81 cents-85 cents, weaker than consensus of 89 cents.

Capital One Financial (COF +1.51%) gained over 1% in after-hours trading after it said its board authorized an additional $300 million to its stock buyback plan.

ARRIS International PLC (ARRS +2.11%) dropped 5% in after-hours trading after it said it sees Q1 adjusted EPS of 37 cents-42 cents, below consensus of 53 cents.

Tyler Technologies (TYL +3.47%) slip nearly 8% in after-hours trading after it reported Q4 adjusted EPS of 59 cents, below consensus of 66 cents, and then lowered guidance on fiscal 2016 adjusted EPS to $3.33-$3.45, below consensus of $3.55.

Jack in the Box (JACK +2.68%) tumbled 20% in pre-market trading after it reported Q1 adjusted EPS of 93 cents, below consensus of $1.03.

Lattice Semiconductor (LSCC unch) slid over 2% in after-hours trading after it reported Q4 revenue of $101.3 million, below consensus of $110.3 million.

Aerie Pharmaceuticals (AERI +6.46%) jumped 15% in after-hours trading after it reported successful 12-month safety results in its Phase 3 trial for its Rhopressa once-daily eye drop for its ability to lower intraocular pressure in patients with glaucoma or ocular hypertension.

Ingram Micro (IM +0.78%) surged over 20% in after-hours trading after Tianjin Tianhai bought the company for $6 billion or $38.90 a share.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Barrick Gold (NYSE:ABX) -2.4% AH despite a smaller quarterly loss.

CF Industries (NYSE:CF) -4.5% AH as fertilizer prices weakened.

GoDaddy (NYSE:GDDY) -5.2% AH after a strong dollar weighed on results.

Marriott (MAR) -2.5% AH as revenue fell short of estimates.

NetApp (NASDAQ:NTAP) +1.8% AH after disclosing major workforce cuts.

Newmont Mining (NYSE:NEM)-2.9% AH on weaker than expected earnings.

Noble Energy (NYSE:NBL) +6.2% after posting an unexepected profit.

Nvidia (NASDAQ:NVDA) +7.2% AH on higher chip demand, strong guidance.

Priceline (NASDAQ:PCLN) +11.2% following an increase in hotel bookings.

T-Mobile (NASDAQ:TMUS) +1.1% after tripling profits.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 18)”

Leave a Reply

You must be logged in to post a comment.

Congratulations 0n the recognition Jason, WELL DONE Today we try up again ,but we know things are slowing and the traders are expecting no FED rate increases, maybe more QE easing from the Fed – insurance policy so to speak. Be careful, 5 days up, is it part of an ABC down???? COULD BE.

per the chart above there is no way to tell yet if this is the finish of wave 4 [right shoulder to a H/S,with fast impulsive wave 5 down to come to spx 1500

or the finish of a wave 2 up and large 3 down starting

or this will be part of a corrective wave 2 [abc] up with a up finished or close to and b down to start

then c up

we just have to watch and form read

im short from earlier europe pre market

before QE infinity the fed will ban usd cash

nixion took the usd of the gold standard and turned it into the petro dollar reserve currency

now china wants to be the petro dollar[yaun] reserve currency

fed needs to be free to create fantasy usd’s

Jason,

i watched a very good webinar on day trader indicators inc the tick ind ,yesterday

sorry i did not watch any on swing traders as not my mind set

trouble with their news letter is when you sign up you get bombarded with emails from about 6 different traders with options and all sorts that you dont want

monthly opts level world wide is fairly clear

but next week will be interesting

how do u figure out the monthly options levels?

i use the rather amatureish method of the round price level the market makers try to push price to on the monday before expiry

ie ftse 6000 dax 9450 dow 16500 spx 1929 nas 100 4200 aussie xjo 5000

how can i get this data?

Cup and handle on SSRI? Possible. PS I own a lot of this stk so beware it be affecting my eye and mind.