Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly up. China rallied 2.4%; Japan, Hong Kong and Australia also did well. Europe is currently up across-the-board. Austria, Finland, Spain and Italy are up more than 2%; London, Germany, France, Belgium, the Netherlands, Russia, Poland and several others are up more than 1%. Futures here in the States point towards a relatively big gap up open for the cash market.

—————

Top Shelf Trading – eMagazine – I was featured in here this month.

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

The market posted a solid gain last week and closed in the upper-third of its range.

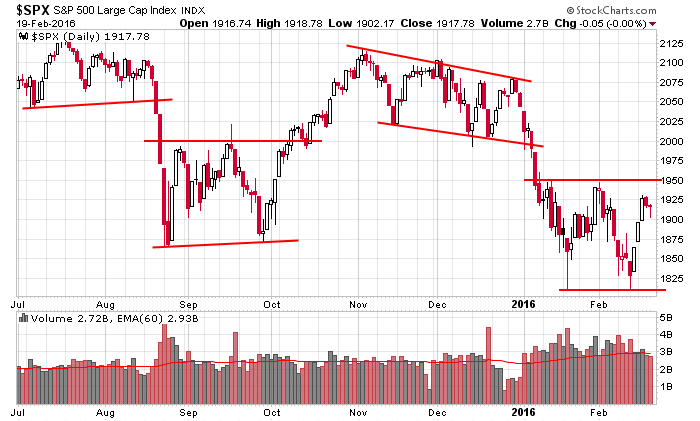

Here’s an update of the daily chart. Before we get too excited, let’s remind ourselves the index has traded in a 140-point range the last two months, and even if the index broke out and rallied up to the 2000’s, we’d simply back up the chart and note the bigger range is 300 points.

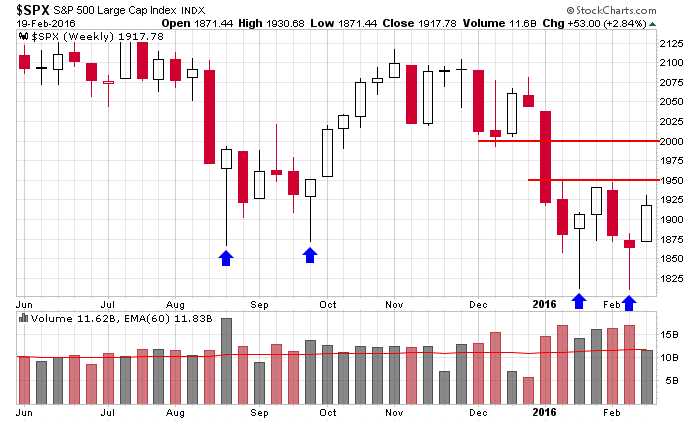

Backing up the chart, we see a formation that, for whatever it’s worth, closely matches the up and down movement of the Aug/Sept bottom. Resistance sits at 1950. There’s a thin area between 1950 and 2000, so getting through 1950 could lead to a quick trip to 2000. If it gets there, I say it goes a little higher, simply because the bears will be looking to go short there, and the market tends to go a little further than traders can tolerate.

Long term bias down, short term bias up. More after the open.

Stock headlines from barchart.com…

Yahoo! (YHOO +2.11%) rose nearly 2% in pre-market trading after people familiar with the matter said the company will approach potential buyers as soon as today as it seeks bidders for its core business.

Energy producers and energy service companies rallied in pre-market trading as the price of crude oil rose with Chevron (CVX -0.27%) up 1.5%, Exxon Mobile (XOM +0.06%) up 1.1% and Transocean Ltd. (RIG -3.81%) up 2.4%.

Union Pacific (UNP +1.58%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of America.

Lumber Liquidators (LL -1.46%) plunged 14% in pre-market trading after U.S. regulators reversed their own finding from earlier this month and now said that the company’s flooring was found to test three times higher the risk of causing cancer than previously stated.

TripAdvisor (TRIP +0.55%) was downgraded to ‘Sell’ from ‘Hold’ at Stifel with a 12-month price target of $53.

Flowserve (FLS -4.08%) was downgraded to ‘Hold’ from ‘Buy’ at Maxim Group.

Gamco reported a 18.04% stake in Journal Media Group (JMG +0.17%).

Western Union (WU -0.11%) said it was served a Federal Grand Jury subpoena on gaming from transactions by 43 Nicaraguan agents from Oct 2008-Oct 2013.

Gamco reported a 23.01% stake in Myers Industries (MYE unch).

Medtronic (MDT +0.55%) failed to win FDA panel backing on its DIAM Spinal Stabilization System after a FDA advisory panel voted 7-0 that benefits of the spinal device do not outweigh the risks.

Pfizer (PFE -0.20%) won FDA approval for treatment of breast cancer with its Ibrance in combination with fulvestrant in women with disease progression following endocrine therapy.

Healthcare insurers rallied in after-hours trading Friday with Anthem (ANTM -0.62%) up +1.5%, UnitedHealth Group (UNH +0.20%) up +1%, WellCare Health Plans (WCG -1.34%) up +0.8% and Aetna (AET -0.89%) up +0.3% after the Centers for Medicare and Medicaid Services (CMS) proposed that U.S. payments to private insurers that provide Medicare coverage will go up by about 1.35% next year.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Chicago Fed National Activity Index

9:45 PMI Manufacturing Index Flash

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 22)”

Leave a Reply

You must be logged in to post a comment.

Energy oil seems to be up for now and the market wants to follow: looking at XLY, XLK, UPW. Week review was good this weekend, Thanks Jason, My wife thinks it is best thing you do us.

Thanks whidbey. Soon I’ll be unbundling LB and giving investors/traders a chance to sub to just the weekly report, all the reports or the trading ideas. Right now LB is one big site with a big price. This will soon change. – Jason

hd earning tomorrow morning…

hd straddle 125c and 123p total cost 3.5