Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. India and Indonesia dropped more than 1%; China was also weak. New Zealand and Singapore posted moderate gains. Europe is currently mostly down. Switzerland and Portugal are down more than 1%; Germany, London, France, the Netherlands, Hungary and Italy are also weak. Turkey, Greece and Denmark are doing well. Futures here in the States point towards a down open for the cash market.

The dollar is down slightly. Oil and copper are down. Gold and silver are up. Bonds are down.

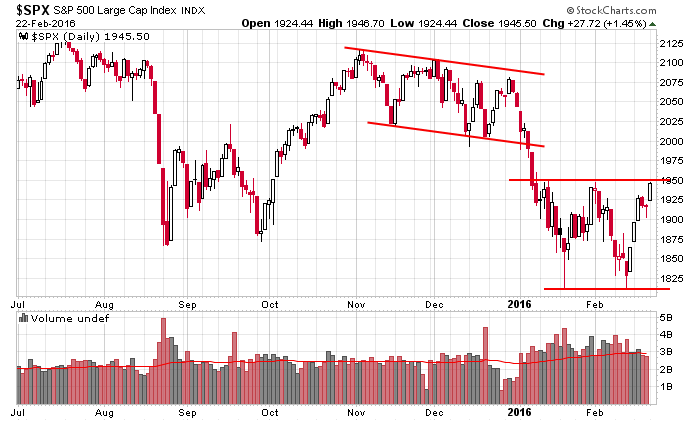

The S&P closed yesterday within striking distance of resistance at 1950. The day marked the forth time in six days the market gapped up, rallied and closed near its intraday high. Volume has been falling off, so there’s definitely some hesitation up here as resistance is approached. Plus the S&P is 135 points off its low. If traders didn’t buy last week, they’re not exactly going to jump in with vigor at these elevated levels.

Left alone (a lack of news) I think the S&P gets through resistance and moves up to 2000…and if it makes it to 2000, why not push a little further? Rallies often go a little further and last a little longer than traders think is possible.

But bad news can derail everything. The market is increasingly becoming correlated with oil, so news that production won’t be capped or cut could push oil down. The market, per the recently connectivity, would likely follow.

Near term I continue to like what I see, but overall my bias is still to the downside. More after the open.

Stock headlines from barchart.com…

Home Depot (HD +0.95%) climbed nearly 1% in pre-market trading after it reported Q4 EPS of $1.17, higher than consensus of $1.10.

SolarCity (SCTY +1.38%) slid over 2% in pre-market trading after JPMorgan Chase downgraded it to ‘Neutral’ from ‘Overweight.’

Twitter (TWTR -0.05%) advanced over 1% in pre-market trading after it was upgraded by Raymond James to ‘Outperform’ from ‘Market Perform.’

Thermo Fisher Scientific (TMO +0.98%) said it will offer the first test kits available in the U.S. to enable serological detection of the Zika virus in research applications.

McDermott International (MDR +4.94%) reported Q4 revenue of $667.4 million, well below consensus of $757.9 million.

Tenet Healthcare (THC +7.05%) reported Q4 adjusted EPS of 35 cents, higher than consensus of 34 cents.

Alliant Energy (LNT +1.01%) reported Q4 adjusted EPS of 32 cents, weaker than consensus of 43 cents.

Chegg (CHGG +2.69%) slumped over 20% in after-hours trading after it lowered guidance on fiscal 2016 GAAP revenue to $230 million-$250 million, below consensus of $281.8 million.

Texas Roadhouse (TXRH +0.54%) climbed 3% in after-hours trading after it reported Q4 EPS of 32 cents, better than consensus of 30 cents.

Motorola Solutions (MSI +1.14%) raised guidance on fiscal 2016 adjusted EPS continuing operations to $4.45-$4.65, well above consensus of $4.04.

Valeant Pharmaceuticals (VRX -10.67%) sank over 8% in after-hours trading after the WSJ reported that company said it will restate earnings from late 2014 into early 2015 after an internal review showed discrepancies with sales of its drugs to Philidor RX Services.

Fitbit (FIT +5.90%) plunged 18% in pre-market trading after it lowered guidance on Q1 adjusted EPS to breakeven to 2 cents, well below consensus of 23 cents.

BHP Billiton Ltd. (BHP +5.46%) cut its first-half dividend to 16 cents from 62 cents a year earlier, a bigger cut than expectations of a cut to 31 cents.

Huron Consulting Group (HURN -2.94%) lowered guidance on fiscal 2016 adjusted EPS to $3.20-$3.40, below consensus of $3.69.

Earnings and Economic Numbers from seekingalpha.com…

Monday’s Key Earnings

Allergan (NYSE:AGN) +3.5% after topping expectations.

Fitbit (NYSE:FIT) -17.7% AH on dim first-quarter guidance.

Motorola (NYSE:MSI) +1.9% AH as cost savings drove a profit beat.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

10:00 Richmond Fed Mfg.

10:00 Existing Home Sales

1:00 PM Results of $26B, 2-Year Note Auction

8:30 PM Stanley Fischer

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 23)”

Leave a Reply

You must be logged in to post a comment.

What drives the herd today? WTI? No. The China currency deals seem to be in consort with concern that cash hording as required to cope with central banks desire to control the value of currencies. A Deep set Fear of deflation. Could affect precious metals. Live it up.