Good morning. Happy Friday.

The Asian/Pacific markets closed up across-the-board. Hong Kong rallied more than 2%; Indonesia and Singapore did better than 1%. Europe is currently mostly up. Greece is up more than 3%; London, Germany, France, Austria, the Netherlands, Switzerland, Russia, Denmark, Spain and Italy are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

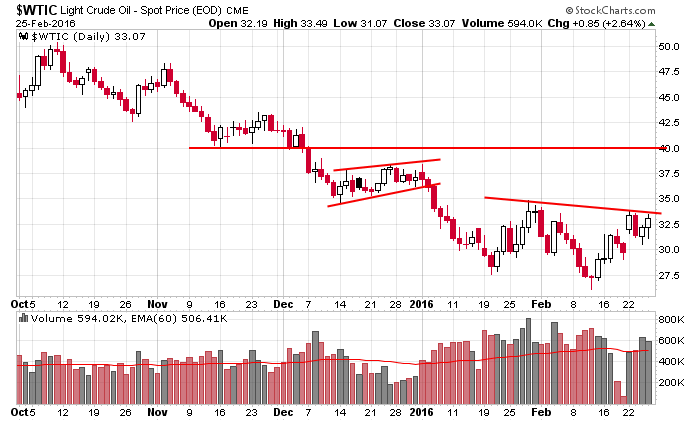

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

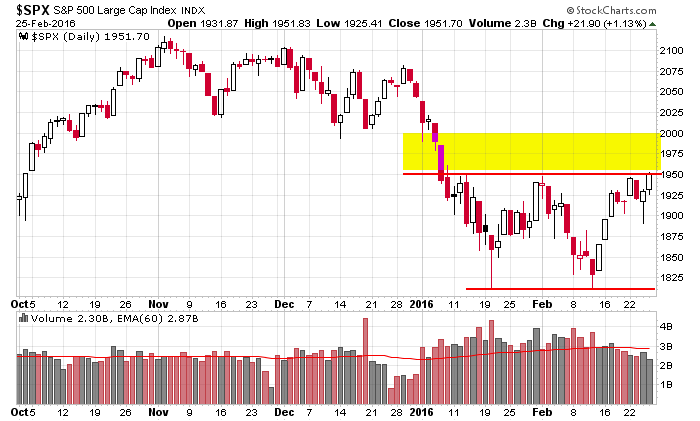

Here we go. Yesterday the S&P closed just above resistance at 1950, and today the index will gap up 8-9 points (as of this writing). The area above (between 1950-2000) is thin. Not much trading took place there are on the way down, so it could act as a gap on the way up and not offer much resistance.

If oil can also breakout, it’d be a pretty powerful 1-2 near-term punch. The market and oil have been correlated lately, so strong confirmation comes with crude strength.

I continue to like the market in the near term, but all long trades are relatively quick. I don’t trust the upside, so I’m not exactly giving positions much time and space to move around.

Overall I still lean to the downside. There are still a lot of things to not like about the market. More after the open.

Stock headlines from barchart.com…

Freeport-McMoRan (FCX -1.11%) and Alcoa (AA +1.26%) both ar up at least 1.5% in pre-market trading as copper prices moved higher.

J.C. Penney (JCP +8.57%) surged 10% in pre-market trading after it reported Q4 adjusted EPS of 39 cents, much higher than consensus of 21 cents.

Best Buy (BBY +2.45%) ws downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Live Nation (LYV -1.05%) reported a Q4 adjusted EPS loss of -39 cents, a wider loss than consensus of -32 cents, but reported Q4 revenue of $1.74 billion, higher than consensus of $1.66 billion.

Intuit (INTU +1.25%) gained 1% in after-hours trading after it reported Q2 adjusted EPS of 25 cents, higher than consensus of 19 cents.

Air Lease (AL +3.72%) jumped 15% in after-hours trading after it reported Q4 adjusted EPS of $1.21, well above consensus of 88 cents.

Kraft Heinz (KHC +2.70%) climbed 3% in after-hours trading after it reported Q4 adjusted EPS of 62 cents, better than consensus of 58 cents.

The Gap (GPS +1.17%) said it sees fiscal 2016 adjusted EPS of $2.20-$2,25, below consensus of $2.44.

Baidu (BIDU -2.78%) rose over 3% in after-hours trading after it reported Q4 revenue of $2.89 billion, above consensus of $2.84 billion.

Integra LifeSciences Holdings (IART +0.86%) reported Q4 adjusted EPS of 87 cents, above consensus of 86 cents.

Kindred Healthcare (KND -0.77%) reported Q4 core continuing operations EPS of 33 cents, higher than consensus of 24 cents, but said it sees fiscal 2016 revenue of $7.25 billion, below consensus of $7.38 billion.

Biomarin Pharmaceutical (BMRN +0.09%) reported Q4 adjusted EPS revenue of $227.9 million, above consensus of $224.4 million, but said it sees fiscal year revenue between $1.05 billion to $1.10 billion, below consensus of $1.15 billion.

Newfield Exploration (NFX +4.23%) fell over 5% in after-hours trading after it announced a 29 million-share secondary offering.

Private Bancorp of America (PBAM -6.34%) will replace Sirona Dental Systems (SIRO +4.99%) in the S&P MidCap 400 after the close of trading Monday, February 29.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

AB Inbev (NYSE:BUD) -1.9% as marketing failed to lift volumes.

Apache (NYSE:APA) -2.1% following a big slump in revenues.

Baidu (NASDAQ:BIDU) +10% AH after topping expectations.

Best Buy (NYSE:BBY) +2.5% despite slowing sales, soft outlook.

Gap (NYSE:GPS) -2.6% AH on light guidance.

Herbalife (NYSE:HLF) +15.1% after a Q4 beat, talks with FTC.

J.C. Penney (NYSE:JCP) +9% AH following an upbeat holiday quarter.

Kraft Heinz (NASDAQ:KHC) +4% AH with a set of strong earnings.

Monster Beverage (NASDAQ:MNST) -7% AH after missing estimates.

Seadrill (NYSE:SDRL) flat on mixed results.

Sears (NASDAQ:SHLD) +3.2% shrinking its footprint, layoffs.

SeaWorld (NYSE:SEAS) -9.2% after acknowledging spying claims.

Weight Watchers (NYSE:WTW) -15% as subscriptions continued to fall.

Today’s Economic Calendar

8:30 GDP Q4

8:30 International trade in goods

8:30 Personal Income and Outlays

10:00 Reuters/UofM Consumer Sentiment

10:15 Fed’s Powell and Williams: “Fed Communication Away from the Zero Lower Bound”

11:30 Results of $28B, 7-Year Note Auction

1:00 PM Baker-Hughes Rig Count

1:30 PM Fed’s Reserve Gov. Lael Brainard speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 26)”

Leave a Reply

You must be logged in to post a comment.

Looks like a wait and see day,ends up, but come Monday: wear your bear suit with the gold buttons. DXY on way down – soon. Having fun yet?

a false break high today will destroy the bull

loving it

today’s high may have created a small broadening jaws of death for either a corrective wave 4 of 1 down

or a larger wave 2 up if wave 1 ended with the last false break low

confusing but definitly corrective overlap chop

it is important as the next crash down depends on which of the above it is

viva the bears

1963 is the 50 % retracement and a very good year it was too