Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China fell 6.4%, and Hong Kong dropped more than 1%. Japan and Taiwan moved up more than 1%. Europe is currently up across-the-board. London, France, the Netherlands, Norway, Denmark, Spain, Italy and Portugal are up more than 2%; Germany, Austria, Switzerland and many others are up more than 1%. Futures here in the States point towards a flat open for the cash market.

The dollar is down a small amount. Oil is down; copper is up. Gold and silver are down small amounts. Bonds are down.

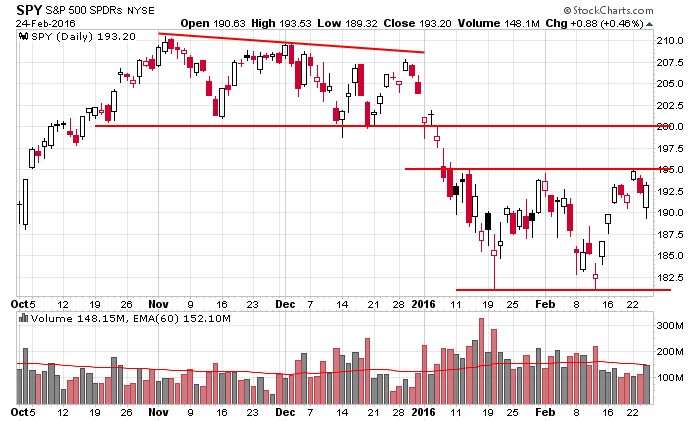

Over the last two weeks the S&P has rallied vertically from 1810 to 1950 and then backed off for a day and a morning session. Now it’s moving back up. Perfectly normal action as far as I’m concerned. I wouldn’t want the index to attempt a breakout immediately after having just rallied 140 points. A rest to allow weak hands to exit their positions and some bears to add/initiate positions is preferable.

Here’s the S&P, via SPY to show the gaps. Barring bad news, the index will make a run at filling that thin area between 195 and 200.

Short term I favor the upside; long term I favor the downside. Any trade to the upside is only meant to be short term. Get in, get out. Take the money and run. No big bets. More after the open.

Stock headlines from barchart.com…

Salesforce.com (CRM -0.60%) jumped over 9% in pre-market trading after it said it sees Q1 adjusted EPS of 23 cents-24 cents, above consensus of 21 cents, and raised guidance on fiscal 2017 adjusted EPS to 99 cents-$1.01, higher than consensus of 99 cents.

Best Buy (BBY +1.78%) dropped over 3% in pre-market trading after it said it sees Q1 ajusted EPS of 31 cents-35 cents, below consensus of 39 cents.

Charter Communications (CHTR +0.80%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase with a 12-month price target of $210.

Kohl’s (KSS +1.16%) reported Q4 EPS of $1.58, higher than consensus of $1.55.

Bankrate (RATE +2.51%) was downgraded to ‘Hold’ from ‘Buy’ at Topeka Capital Markets.

Imax Corporation (IMAX +2.39%) fell over 7% in after-hours trading after it reported Q4 EPS of 39 cents, below consensus of 42 cents.

La Quinta Holdings (LQ +1.88%) lost over 3% in after-hours trading after it said it sees 2016 pro forma adjusted Ebitda of $367 million-$384 million versus $394 million y/y.

Relypsa (RLYP -2.39%) slumped over 10% in after-hours trading after it reported a Q4 adjusted EPS loss of -$1.40, a wider loss than consensus of -$1.35.

AmSurg (AMSG -0.01%) climbed nearly 5% in after-hours trading after it reported Q4 adjusted EPS of $1.07, higher than consensus of $1.04.

Restoration Hardware (RH +1.29%) plunged over 20% in pre-market trading after it reported preliminary Q4 adjusted EPS of 99 cents, well below consensus of $1.40.

Andarko Petroleum (APC +2.58%) rose nearly 7% in after-hours trading after it sold its Springfield Pipeline LLC to Western Gas Partners for $750 million.

Malibu Boats (MBUU +2.41%) was rated a new ‘Buy’ at B. Riley with a 12-month price target of $22.

Diamond Resorts International (DRII -1.60%) jumped 17% in after-hours trading after it said it hired Centerview Partners to explore a wide range of strategic options to maximize shareholder value.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Annaly Capital (NYSE:NLY) flat as its discount to book value narrowed.

Chesapeake Energy (NYSE:CHK) +22.2% after beating estimates.

Energy Transfer Partners (NYSE:ETP) -9.5% AH following a big Q4 miss.

HP (NYSE:HPQ) -1.4% AH on weak PC and printing revenues.

Lowe’s (NYSE:LOW) +1% as comparable-store sales advanced.

Salesforce (NYSE:CRM) +8.8% AH boosted by solid guidance.

Target (NYSE:TGT) +4% as e-commerce growth overtook rivals.

TJX Companies (NYSE:TJX) +2% outpacing broad retail in Q4.

Transocean (NYSE:RIG) +0.4% AH after topping expectations.

Today’s Economic Calendar

8:30 Durable Goods

8:30 Initial Jobless Claims

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $28B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 25)”

Leave a Reply

You must be logged in to post a comment.

” Unlike most of the previous years, the most recent worsening in global growth prospects and global sentiment is therefore driven by the advanced economies rather than [emerging markets] … Below-potential global growth will likely reinforce disinflationary momentum and global growth could fall to even one percent or lower, (.1%)??? in the event of an even sharper AE downturn (including eg a U.S. recession)” Citi bank Extraction of the morning cheer.

More fear mongering. Today the herd is looking for another rally attempt. Confusion is probable use stops?

as chief grizely bear with a superior bear mind set ,i forbid a break out above 1950

spx 1942 cash price was hit in early asia trade today and that is all i will sanction for this wave 4

correction

i have enjoyed the fantasy bull since 2008,but it is now time for a mindset change as the big criminal

central banks ponsi unwinds

all global markets are now controlled by alien marsian computer –herbie

its purpose is to get rid of all bulls and bears and turn us into computers

were in the hell are the bears?

mind set mistake –march 2009

sept 2008 was a glorious sunday when leehaman bros crashed