Good morning. Happy Monday. Happy Leap Day. Hope you had a good weekend.

The Asian/Pacific markets closed mixed. China fell 2.9%; Japan and Hong Kong dropped more than 1%. Singapore and Indonesia led to the upside, but there were no 1% winners. Europe is mixed and quiet. London, Russia and Greece are up more than 1%; Germany and the Czech Republic are down more than 1%. Futures here in the States point towards a slight down open for the cash market.

Leavitt Brothers Weekly

The dollar is up. Oil is up, copper down. Gold and silver are up. Bonds are flat.

The market did well last week. Not fantastic, not pretty well. Across-the-board gains were recorded, but the indexes closed off their intraweek highs.

Several breadth indicators surged to levels not seen in months. Here’s the 10-day MA of the AD line as an example. It exceeded its October high. This means over the last 10 days, advancers have beaten decliners by a bigger margin than any other 10-day period going back to last summer. Unlike downward spikes, that often pinpoint bottoms, high prints signal strength and high odds the strength continues. Even if a top is inevitable, it’ll take a few weeks to form, so our short term up bias remains in place.

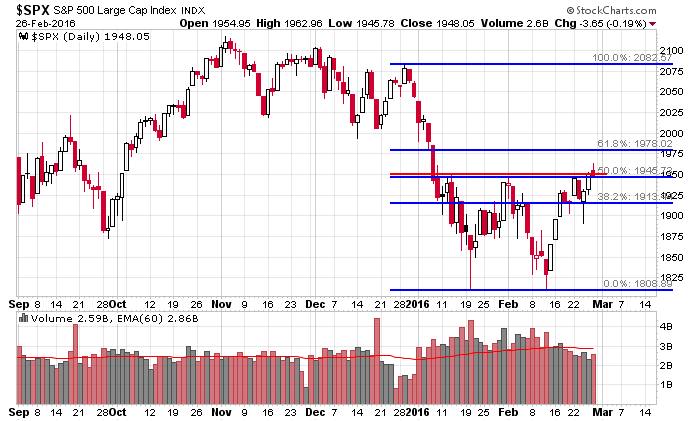

The S&P closed right at an inflection point – 1950 is both a key resistance level and the 50% retracement of the January sell-off. This creates somewhat of a “line in the sand” level/time. The bulls will want to see the market accelerate through this area. Otherwise they’ll lose patience in fear of prices backing off.

I’m maintaining my up bias in the near term, but longer term I still don’t like what I see. With the indexes trading below their down-sloping 10-month moving averages and the “wrong groups” leading, I’m not confident a sustained rally is in the works. More after the open.

Stock headlines from barchart.com…

Morgan Stanley (MS +2.15%) and Goldman Sachs (GS +1.35%) are both down at least 1% in pre-market trading.

Valeant Pharmaceuticals (VRX -4.79%) slumped 7% in pre-market trading after the company withdrew its financial forecast and delayed releasing its quarterly results as its CEO returns from leave.

Federal-Mogul Holdings (FDML +12.93%) may be active today after Carl Icahn, the company’s biggest shareholder, offered to buy the rest of the company for $7 a share, well above Friday’s closing price of $4.98.

General Motors (GM +0.44%) was downgraded to ‘Hold’ from ‘Buy at Argus Research.

Dillard’s (DDS +3.73%) was downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank.

Southwestern Energy (SWN -5.76%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Raymond James.

Dynegy (DYN +3.06%) was upgraded to ‘Buy’ from ‘Neutral’ at Guggenheim with a price target of $22.

FormFactor (FORM +1.64%) said it sees Q1 revenue of $65 million-$70 million, below consensus of $70.3 million.

Cleco (CNL -1.03%) reported Q4 operating EPS of 38 cents, below consensus of 42 cents.

New Jersey Resources (NJR -2.58%) will replace StanCorp in the S&P MidCap 400 as of the close of trading on Monday, March 7.

Business Insider reports that Bank of America (BAC +3.08%) is preparing for “significant” job cuts of over 5% across its global investment banking and markets business.

Atlas Resource Partners LP (ARP -5.63%) was downgraded to ‘Sell’ from ‘Hold’ at Stifel.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

9:45 Chicago PMI

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Survey

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 29)”

Leave a Reply

You must be logged in to post a comment.

dull day…adv are up but market unsure…

Aussie is that your heavy thumb that sold this down? lol

it is called distribution