Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across-the-board. India gained 3.4%; Hong Kong, China and Malaysia rallied better than 1%; Australia, New Zealand and Taiwan also did well. Europe is currently mostly up. Germany, Austria, the Netherlands, the Czech Republic, Finland, Spain, Italy and Portugal are up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil is up, copper is down. Gold and silver are up. Bonds are mixed.

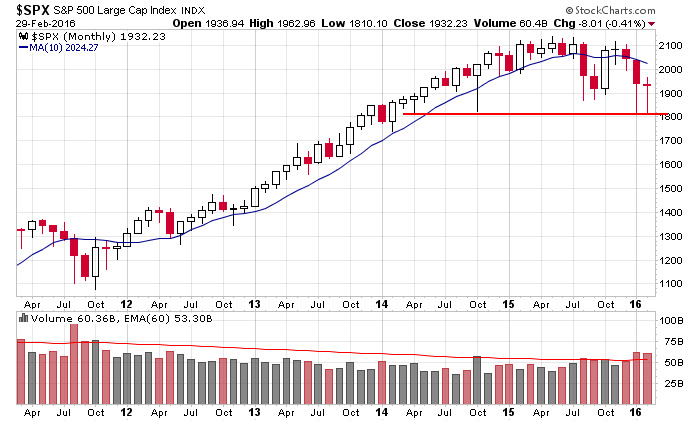

February is in the books. The market mostly fell the first two weeks and then finished the month strong and near its highs – or at least in the upper quarter of its intra-month range. January’s low was matched, which happens to be near the low of October 2014. Overall I’m still of the opinion a top is forming and a downtrend in its beginning stages. The 10-month moving average is a key level in by book. Here’s the chart.

Yesterday the S&P dropped about 16 points off last week’s close and started to cast doubt as to whether 1950 is indeed an inflection point. Today it’ll gap up about 15 points and recover virtually the entire loss.

Twice the index has moved above 1950, and neither time it was able to get any momentum going.

We’ve gotten off some good long trades lately, but since I’m treating this bounce like a bounce within a newly formed downtrend, all trades are short term, not expected to last more than a week or so.

That’s it for now. The market is spending the bulk of its time moving in ranges and very little time moving directionally. We need to adjust to this. More after the open.

Stock headlines from barchart.com…

Walgreens Boots Alliance (WBA -0.79%) was upgraded to ‘Buy’ from ‘Neutral’ at Mizhuho Securities USA with a target price of $95.

Signet Jewelers (SIG +9.35%) was upgraded to ‘Buy’ from ‘Neutral’ at CL King with a 12-month price target of $127.

Bank of America (BAC -1.42%) and Citigroup (C -1.65%) were both cut to ‘Neutral’ from ‘Overweight’ at Atlantic Equities.

Marathon Oil (MRO +2.24%) slid over 5% in pre-market trading after it said it intends to offer 135 million shares of common stock.

American Public Education (APEI +3.63%) jumped over 12% in after-hours trading after reported Q4 adjusted EPS of 75 cents, well above consensus of 54 cents.

Hertz Global Holdings (HTZ +2.78%) rose nearly 2% in after-hours trading after it reported Q4 adjusted EPS of 5 cents, better than consensus of 4 cents.

Crocs (CROX +0.20%) lowered guidance on Q1 revenue to $260 million-$270 million, below consensus of $270.8 million.

Qualys (QLYS -0.56%) climbed over 3% in after-hours trading after it announced that it will replace Hangar in the S&P SmallCap 600 Index.

Aegion (AEGN -1.20%) reported Q4 adjusted EPS continuing operations of 36 cents, better than consensus of 35 cents, although Q4 revenue of $330.7 million was below consensus of $341.7 million.

Halozyme Therapeutics (HALO -1.45%) rallied nearly 9% in after-hours trading after it reported Q4 revenue of $52.2 million, higher than consensus of $44.7 million.

Sykes Enterprises (SYKE +0.46%) slid nearly 2% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $1.73-$1.83, below consensus of $1.85.

Diplomat Pharmacy (DPLO +1.48%) plunged 16% in after-hours trading after it lowered guidance on fiscal 2016 EPS to 84 cents-89 cents, below consensus of $1.00.

PTC Therapeutics (PTCT -0.13%) dropped 2% in after-hours trading after it reported a Q4 adjusted loss of -$150 a share, wider than consensus of a loss of -$1.24.

TubeMogul (TUBE +3.46%) gained nearly 5% in after-hours trading after it raised guidance on 2016 revenue to $220 million-$228 million, above consensus of $213.8 million.

Earnings and Economic Numbers from seekingalpha.com…

Monday’s Key Earnings

Hertz (NYSE:HTZ) +1.7% AH after swinging to a profit in Q4.

Workday (NYSE:WDAY) -1.6% AH on light FQ1 sales guidance.

Today’s Economic Calendar

Auto Sales

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

2:00 PM Gallup US ECI

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 1)”

Leave a Reply

You must be logged in to post a comment.

The ball is rolling today as some vote today; I despair. My taxes are disguising and ISM data showing that things are slowing except in 84 month loan car sales which are healthy. Today is another up/down ride. Jason might be on to something with his 10 month curve. Any way topping. I am riding gold and up 290 dollars. Little rides count ….do they not?

little rides on high margin are the same as long term rides on no margin

best of all day traders 1 % margin on cfd’s –contracts for difference

i dont know what they are…contract for difference is for the indexs?

google cfd’–spread betting –you can bet on anything on 1 % down margin–weather /football

i bet on world wide index cash futures

which is a futures contract plus/minus fair value

i did…how many units do u like to trade for the dax?

usa has no cdf available..

best you stay with futures contracts as cfds are quite dangerouse if you dont know large margin bets

but many cfd providers –ig markets, cmc,mann

you can get a ratings list by goggleing –cfd providers

wonder when the bears r going to jump in?

looks like a exhaustion up day

i was just going to write about the volume on this +300 day… pretty weak…looks like the bears are helpin out the bulls to fatten them up…

imo this is not a topping process—that happened long ago with the broadening jaws of death

this is corrective overlapping sideways chop wave 2

mis this top and wave 3 down is fast and wont wait for swing traders,whom need to be more nimble

this top can ocure today or up to friday