Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Singapore rallied 2.2%; Japan, Australia, India and New Zealand did better than 1%. Europe is currently mixed. Norway, Russia, Greece, Poland, Hungary and Portugal are up more than 1%; Switzerland and Denmark are down more than 1%. Futures in the States point towards a flat open for the cash market.

The dollar is down. Oil and copper are flat. Gold is up a little, silver down a little. Bonds are down.

Yesterday the market followed through on the previous day’s big gains. The near term still looks good. The rally that started in the middle of February has room to run both in terms of time and space.

A few more indicators have moved to over-bought territory, but unlike low prints, which are pretty good at pin-pointing reversals, high prints are a sign of strength that tends to continue for a few extra weeks. In fact, we usually don’t get a reversal until a negative divergence has formed.

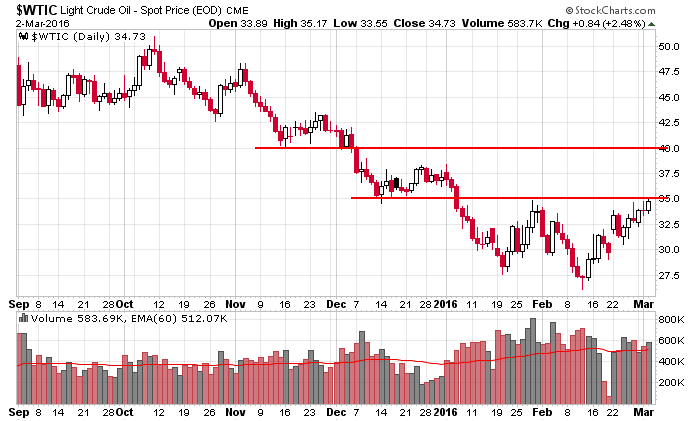

One key to the market progress over the next few weeks will be oil. If crude can get above 35, the market will get a big helping hand…partially in terms of rising oil stocks and partially in terms of sentiment (that the worst may be behind us). Here’s crude…

That’s it for now. The market looks good in the near term. Upside SPX targets are 2000 and 2025. And time wise, it should still have a week or two to run. More after the open.

Stock headlines from barchart.com…

Intel (INTC +0.56%) climbed nearly 2% in pre-market trading after it was upgraded to ‘Outperform’ from ‘Neutral’ at Robert Baird with a 12-month price target of $38.

Costco (COST +1.51%) fell over 3% in pre-market trading after it reported Q2 EPS of $1.24, less than consensus of $1.28.

Herbalife (HLF +0.37%) declined 6% in pre-market trading after it said it had errrors in data calculations that reported new U.S. active members up +71% when it should have been +30.7% and Q4 worldwide active new members ex China should be up +3.2%, not the originally reported +16.7%.

American Eagle Outfitters (AEO +0.32%) gained over 1% in after-hours trading after it raised guidance on Q1 EPS to 17 cents-19 cents, higher than consensus of 15 cents.

Sina Corp. (SINA +1.25%) dropped nearly 5% in after-hours trading after it lowered guidance on fiscal 2016 adjusted revenue to $850 million-$950 million, below consensus of $985.8 million.

Analogic (ALOG +1.04%) reported Q2 adjusted EPS of $1.18, higher than consensus of $1.04, but Q2 revenue of $127.9 million was below consensus of $132.7 million.

Weibo (WB -1.29%) rose 3% in after-hours trading after it reported Q4 adjusted EPS of 32 cents, more than double consensus of 13 cents.

Banc of California (BANC -0.94%) fell over 4% in after-hours trading after it announced a 3 million-share secondary offering.

Semtech (SMTC -3.30%) jumped over 12% in after-hours trading after it reported Q4 adjusted EPS of 17 cents, higher than consensus of 16 cents, and said it sees fiscal 2017 Q1 adjusted EPS of 26 cents-30 cents, above consensus of 24 cents.

TPG Specialty Lending (TSLX -0.12%) slid over 3% in after-hours trading after it announced a 5 million-share secondary offering.

SunEdison (SUNE +19.33%) tumbled over 9% in after-hours trading after it said it suspended the payment of quarterly dividends on its preferred stock.

Pure Storage (PSTG +4.87%) climbed over 3% in after-hours trading after it raised guidance on fiscal 2016 revenue to $685 million-$725 million, above consensus of $662.5 million.

Habit Restaurants (HABT +2.93%) dropped over 7% in after-hours trading after it lowered guidance in fiscal 2016 revenue to $286 million-$290 million, below consensus of $291.9 million.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Costco (NASDAQ:COST) -2.5% premarket hurt by higher costs.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

8:30 Gallup Good Jobs Rate

9:45 PMI Services Index

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

10:30 EIA Natural Gas Inventory

10:45 Fed’s Kaplan: Monetary Policy

4:30 Money Supply

4:30 Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 3)”

Leave a Reply

You must be logged in to post a comment.

Today is a set up for the NFPR tomorrow. What does that mean?? Yellen does nothing, another wander up/down the indices ending near 1982. Longer run the moves are up into May 2016. Dividends are working, WTIC stays near 33. Probable tech, consumer staples and energy are run of the mill holdings. OVERALL, some money might be made. After that? Not so good

bulls are steadily buying it up…adv 2259-760