Good morning. Happy Wednesday.

The Asian/Pacific markets posted big, across-the-board gains. China and Japan rallied better than 4%; Hong Kong > 3%; Singapore, Australia, India, Indonesia, Malaysia and South Korea did better than 1%. Europe is currently mixed and quiet – there are very few big movers. Greece is up more than 2%; Turkey, Hungary and Spain are up more than 1%. Futures in the States point towards a down open for the cash market.

The dollar is up. Oil is up, copper is down. Gold and silver are up. Bonds are down.

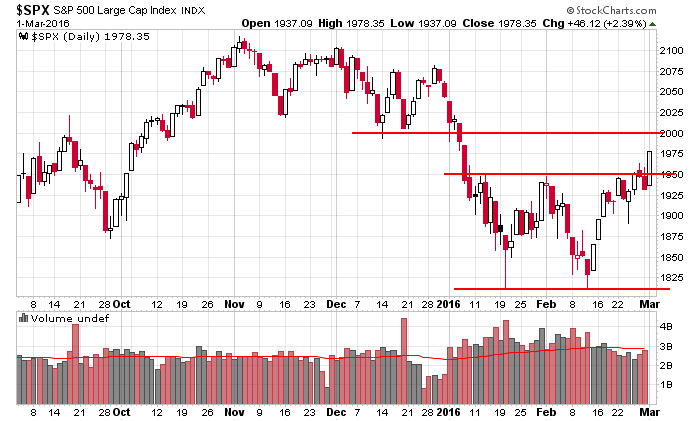

After two days of hesitation near SPX 1950, the market posted a big gain yesterday. The buying pressure was as steady and consistent as I’ve seen in a long time. Here’s the daily chart. 1950 was my first target. Check. Next target is 2000.

Over the weekend I noted the surge in some indicators to very high levels.

Now we’re starting to get improvement elsewhere. Financials, which have been weak and under-performing, closed at their highest level since the second week of January. And junk bond funds (JNK, HYG) continue to surge, suggesting fear of the worst is subsiding.

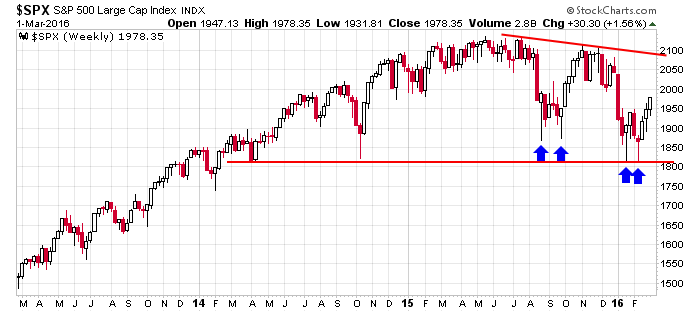

Here’s a longer term chart of the S&P. As of a couple weeks ago, the index was unchanged over the prior two years. There have been lots of overlapping candles and very few directional moves. Make slight adjustments or get chopped to pieces.

Unlike during an uptrend, the market will not rescue you from below-average performers. Be selective. Only trade the good ones. More after the open.

Stock headlines from barchart.com…

Dollar Tree (DLTR +2.22%) was downgraded to ‘Market Perform’ from ‘Strong Buy’ at Raymond James.

Amazon.com (AMZN +4.80%) was rated a new ‘Outperform’ at BMO with a price target of $700.

Weatherford International PLC (WFT -3.28%) dropped over 3% in after-hours trading after it announced an offering of 80 million shares of common stock.

Ross Stores (ROST +2.27%) gained almost 1% in after-hours trading after it reported Q4 EPS of 66 cents, higher than consensus of 64 cents.

Ascena Retail Group (ASNA +4.73%) slid over 4% in after-hours trading after it reported Q2 revenue of $1.84 billion, weaker than consensus of $1.88 billion, and then lowered guidance in Q3 EPS to 10 cents-14 cents, below consensus of 19 cents.

Veeva Systems (VEEV +3.25%) dropped over 2% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to 54 cents-56 cents, below consensus of 57 cents.

Bob Evans Farms BOBE reported Q3 adjusted EPS of 62 cents, better than consensus of 55 cents.

NeoPhotonics (NPTN +5.75%) rose over 5% in after-hours trading after it reported Q4 adjusted EPS of 16 cents, better than consensus of 10 cents.

Chuy’s Holdings (CHUY +2.34%) climbed over 6% in after-hours trading after it reported Q4 adjusted EPS of 18 cents, higher than consensus of 13 cents.

Guidewire Software (GWRE +2.62%) jumped 8% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to 64 cents-71 cents from a prior view of 57 cents-66 cents, above consensus of 64 cents.

Darling Ingredients (DAR +1.44%) rose over 3% in after-hours trading after it reported Q4 pro forma adjusted Ebitda of $103.1 million, above estimates of $97.1 million.

Big 5 Sporting Goods (BGFV -2.99%) slumped over 12% in after-hours trading after it lowered guidance for Q1 EPS to between a net -5 cent loss to a 2 cent profit, below consensus of a 6 cent profit.

Earnings and Economic Numbers from seekingalpha.com…

Tuesday’s Key Earnings

Medtronic (NYSE:MDT) -4.2% on slipping profit margins.

Dollar Tree (NASDAQ:DLTR) +2.2% after increasing same-store sales.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

10:00 Fed’s Williams: Economic Outlook

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 2)”

Leave a Reply

You must be logged in to post a comment.

since the jan low we have only had overlapping chop that makes this a corrective wave 2

with a false break low in feb that i posted on 9th or 10th feb as it happened and confirmed by a fast move

which lasted 3 days and more chop

if we get to fib level 2000 it will still be corrective with fast 3 down to follow

feels like yesterday was important for the bears as we get ready to eat some bull and destroy a few more long only govt pension funds