Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up, but gains were small. Japan dropped 0.8%. Taiwan rallied 1%; China, India, Indonesia and South Korea also posted gains. Europe is currently mixed and little changed. Greece is down 2%; Italy, Spain and Sweden are also weak. Portugal is up more than 1%; Germany is also doing well. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil is up, copper is down. Gold and silver are up. Bonds are down.

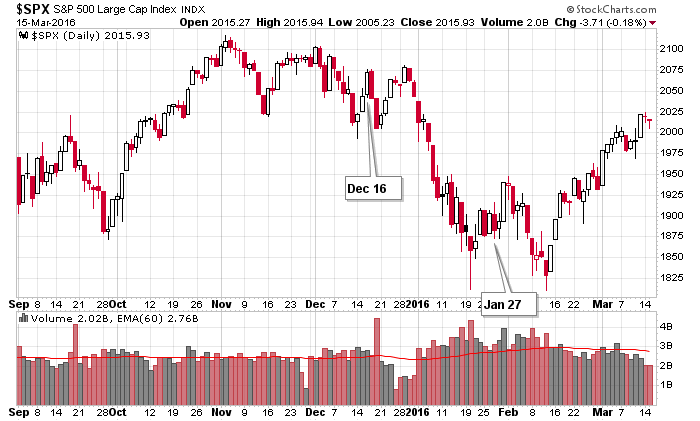

Today is Fed day. Nobody expects rates to be changed today but opinions about what the Fed may do the rest of the year vary. After the December meeting, the belief was there would be 3-4 more rate increases in 2016, but as of the January bottom, the odds of even a single rate increase were very low. But now that the market has rallied a bunch, and the S&P is only about 5% from its all-time high, rate hikes are back on the table. Besides the usual FOMC statement, Janet Yellen will host a news conference, so there could be several wild swings during the afternoon.

Here’s the daily SPX with the last two meetings noted. In December, the market moved down, then up to a higher high and then down big. The movement in January was the exact opposite. The market moved up, then down to match its previous low, then up big.

No big bets here. Anything goes in the near term. More after the open.

Stock headlines from barchart.com…

Oracle (ORCL +0.10%) rallied over 4% in pre-market trading after it reported Q3 adjusted EPS of 64 cents, higher than consensus of 62 cents.

Chipotle Mexican Grill (CMG -2.47%) is down nearly 6% in pre-market trading after it said it expects a Q1 EPS loss of -$1.00, much weaker than consensus for a 3 cent gain.

Kraft Heinz (KHC +0.27%) and Monster Beverage (MNST +0.02%) were both added to the ‘Conviction Buy’ list at Goldman Sachs.

Valeant Pharmaceuticals International (VRX -51.46%) slid 6% in pre-market trading after the stock plunged more than 51% yesterday.

LinkedIn (LNKD -1.45%) dropped nearly 5% in pre-market trading after it was downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley.

Achaogen (AKAO -1.63%) was downgraded to ‘Hold’ from ‘Buy’ at Needham & Co.

Casey’s General Stores (CASY +0.80%) reported that its February same-store-sales for grocery and other merchandise rose +12% y/y.

Relypsa (RLYP -9.95%) climbed over 3% in after-hours trading after it reported that 812 new patients started taking its Veltassa last month versus 409 in January.

Caleres (CAL -0.79%) dropped over 8% in after-hours trading after it lowered guidance on full-year adjusted EPS to $2.00-$2.10, below consensus of $2.22.

Osiris Therapeutics (OSIR -4.29%) reported that it received a subpoena from the SEC about its accounting practices.

Xcel Brands (XELB +4.58%) jumped nearly 7% in after-hours trading after it reported Q4 adjusted EPS of 10 cents, higher than consensus of 7 cents.

Tronox Ltd. (TROX -6.96%) rose over 3% in after-hours trading on signs of insider buying after Tronox SVP Willlem Van Niekerk reported that he bought another 4,600 shares of stock.

Earnings and Economic Numbers from seekingalpha.com…

Tuesday’s Key Earnings

Oracle (NYSE:ORCL) +5.1% AH on strong cloud growth, new buyback.

Valeant (VRX) -51.4% warning on guidance and a possible default.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

8:30 Housing Starts

9:15 Industrial Production

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:00 PM Chairman Press Conference

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 16)”

Leave a Reply

You must be logged in to post a comment.

Nothing from the Fed but assurances that Yellen wants avoid “inflation”. I am not impressed with her analysis. keep eyes on the effects of stock buy backs – that is what is keeping the markets from coming apart, not Yellen & Co. Recessionary rate increases are just beyond my mental capacity, but then we all know that. See you at 11am to hear the six impossible things Yellen wants us to believe.

unfortunetly the buy backs are a big ponsi

companies are borrowing money to do the buy backs to keep their share prices up because no earnings

oil companies and banks worry me

some big bankruptcies and failures directly ahead as the debt ponsi hits all

my crude chart is screaming 50, longer term charts pointing to trend change and the bottom being in, IF we can get to 50. big if, but prospects for oil and oil services stocks are exciting if things play out as the chart suggests.

My target remains the 40-45 range based on this chart. After that we’ll see.

http://leavittbrothers.com/charts/oil%2017.png

archangel gabriel told me in conference with the big insto bookmaking market makes that the quad witches

will out weigh the fed

massive opts ex at spx 2000 –so has to be well above or below or the instos loose