Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Hong Kong, China, Singapore and Australia each rallied more than 1%. There we no big losers. Europe is currently mostly down. Germany, France, Austria, the Netherlands, Sweden, Switzerland, the Czech Republic, Greece, Denmark, Spain, Italy and Belgium are down more than 1%; Turkey is up more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

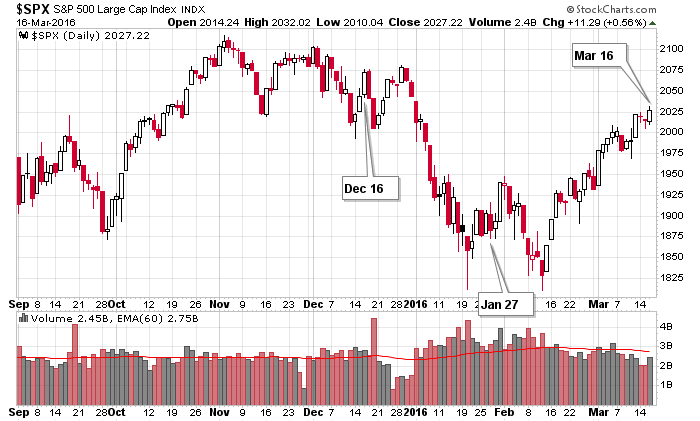

Yesterday was Fed day. It’s significant because the market has tended to reverse its Fed move the following day. It’s as if the initial knee-jerk reaction is wrong. Yesterday’s move was choppy and up.

Also note in the chart below the market’s movement in the month after the last two Fed meetings. In December, the market moved down, then up to a higher high and then down big. The movement in January was the exact opposite. The market moved up, then down to match its previous low, then up big.

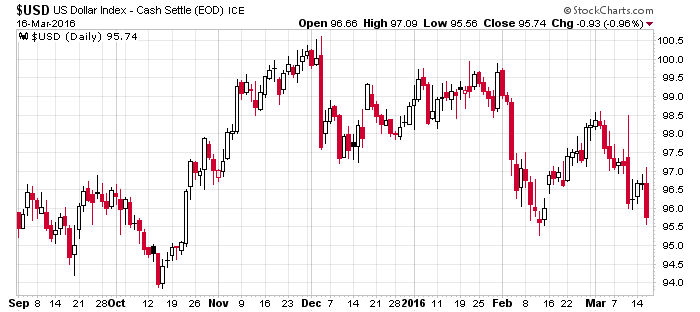

The dollar dropped quickly yesterday and is down another buck today. This puts the currency at its lowest level since October. Here’s yesterday’s chart.

Oil jumped…gold and silver surged…utilities and other dividend-paying stocks moved up. This has been the theme lately, so there’s no surprise our current trading list is mostly comprised of stocks from these groups.

I’ll never call trading easy, but it is made easier by sticking with the dominant themes at any given time. More after the open.

Stock headlines from barchart.com…

Caterpillar (CAT +2.62%) is down over 3% in pre-market trading after it lowered guidance on Q1 adjusted EPS to 65 cents-70 cents, below consensus of 95 cents.

Hyatt Hotels (H -0.61%) were downgraded to ‘Equalweight’ from ‘Overweight’ at Morgan Stanley.

Valeant Pharmaceuticals International (VRX +0.09%) is down over 2% in pre-market trading after Wells Fargo lowered its valuation on the stock to $30-$31 from $56-$58.

St. Jude Medical (STJ -1.54%) rose nearly 2% in after-hours trading after the stock was rated a ‘Buy’ at Nomura with a price target of $64.

FedEx (FDX +0.84%) climbed nearly 5% in after-hours trading after it reported Q3 adjusted EPS of $2.51, higher than consensus of $2.34, and then raised guidance on fiscal 2016 adjusted EPS to $10.70-$10.90 from a previous estimate of $10.40-$10.90, above consensus of $10.56.

Jabil Circuit (JBL +2.57%) sank nearly 9% in after-hours trading after it reported Q2 core EPS of 57 cents, below consensus of 60 cents, and said it sees Q3 core EPS of 12 cents-18 cents, well below consensus of 51 cents.

Herman Miller (MLHR +2.26%) gained over 2% in after-hours trading after it reported Q3 EPS of 46 cents, better than consensus of 39 cents, and said it sees Q4 EPS of 57 cents-61 cents, higher than consensus of 53 cents.

U.S. Silica (SLCA +2.98%) lost 3% in after-hours trading after it reported a stock offering of 8 million shares.

Homeinns Hotel Group (HMIN -0.20%) reported Q4 revenue of $258.9 million, above an estimated range of $236.3 million-$240.4 million.

Silver Wheaton (SLW +5.51%) rose over 1% in after-hours trading after it reported Q4 adjusted EPS of 14 cents, better than consensus of 13 cents.

Williams-Sonoma (WSM +2.15%) slipped 4% in after-hours trading after it reported Q4 EPS of $1.55, below consensus of $1.58, and said it sees Q1 EPS of 48 cents-52 cents, weaker than consensus of 55 cents.

Guess (GES -1.84%) slumped over 9% in after-hours trading after it reported Q4 EPS of 57 cents, below consensus of 58 cents, and said it sees fiscal year 2017 EPS of 65 cents-85 cents, weaker than consensus of $1.05.

Barrick Gold (ABX +6.98%) CFO Shaun Usmar will leave the company to lead Elliot Management Venture and will be replaced by EVP Catherine Raw effective April 26.

Rofin-Sinar Technologies (RSTI -0.13%) surged over 40% in after-hours trading after Coherent (COHR +0.24%) agreed to buy the company for $32.50 a share or $942 million.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

FedEx (NYSE:FDX) +5.4% AH helped by holiday season, e-commerce growth.

Silver Wheaton (NYSE:SLW) +0.3% AH after topping expectations.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Philly Fed Business Outlook

8:30 Current Account

9:45 Bloomberg Consumer Comfort Index

10:00 Job Openings and Labor Turnover Survey

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 17)”

Leave a Reply

You must be logged in to post a comment.

No rate increase – The Fed chair is worried about the global system. Good, nothing she can do for anyone right now. Today’s data points show that USA PMI sales etc., are a the 50% point and sliding lower to negative. This is why management is buying back stock – to keep up appearances,avoid lay offs, pay bills. This morning a couple of banks are seeing bad energy loans going lower. Cat is showing slowing sales. By the way, futures are down this AM too. I may play gold today and sell a few puts on indices.

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2016/03/16/philly%20fed%20march%20table.jpg

I am wrong!! Diffusion index up big. Silver up too. Sorry.

i get the feeling that the fed tipped its hand and announced that it will keep the monetary policy loose as long as the markets or the economy is jittery. a self-fulfilling prophecy since the markets are hooked on easy money and they get jittery the minute the fed talks about economy being strong or labor market improving or returning to normalcy in rates. the only conclusion i can reach after looking at the market reaction yesterday, today and in general since the december hike is that everything (stocks, bonds, commodities) will be rallying together for the foreseeable future. until something big and external derails this train of course.

wall street is acting like a heroin junkie with all that free money… The dealer(fed) has created a world wide epidemic

the only thing keeping market up is lack of sellers,not many buyers

the insto market makers take the opposite side in the dec /jan panic selling

so till friday opts ex need to keep spx at 2040 resistance

may be some selling into close

quad witches are important for futures ,even though we have dayly/weekly /monthly opts ex now

took the ride down in europe,went to sleep,whilst they push it back up and now just gone short at horizonal pivot res

the bears will have a picnic soon as instos start selling

non stop buying…adv 2433 to decl 558… 30yr bond are up…thats a divergence…

what exactly is the divergence, stocks and bonds being up on the same day? why is that a divergence?

the internals

i always saw if bonds are up then stocks should be down…unlike today…

in my experience and trading philosophy, not at all. in fact, both stocks and bonds rallied together for 15-20 years until 2000. they move in tandem a lot.

i will definitely keep that in mind

why are so many guroos pushing opts trading

i hate opts

i love snipper/scalping day trading

some nice market maker opt ex targets are dax 10,000 ftse 100 6200 dow 17500 spx 2045-50 nas 100 4423

aussie spi cash market 5200 –all hit

most of opts ex are actioned prior to fri ex

nas 100 now the weakest

russell is usually to volitile for me and only instos trade it

i trades some mini russell(emd)…spread was horrible.

if by russell you mean russell 2000 mini futures (TF), i trade it the most among us stock indices. and i have done so for many years now. 30y bond (ZB) is my next largest trading vehicle.

depends on your time frame–i am a daytrader

do we have a corrective wave 2 top and a trend change

some would say not yet

printing presses have way too much paper…need a paper shortage…

archangel gabriel has told me he is blowing his horn at midnite usa eastern standard time

from the empier state building