Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. China and India rallied more than 1%; Malaysia, New Zealand, Taiwan, Hong Kong and Singapore also did well. Japan dropped 1.3%. Europe currently leans to the upside. Austria, the Czech Republic, Russia and Hungary are up more than 1%; Norway, Spain, Italy and Portugal are also doing well. Switzerland is down more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil is up, copper is down. Gold is down, silver is up. Bonds are up.

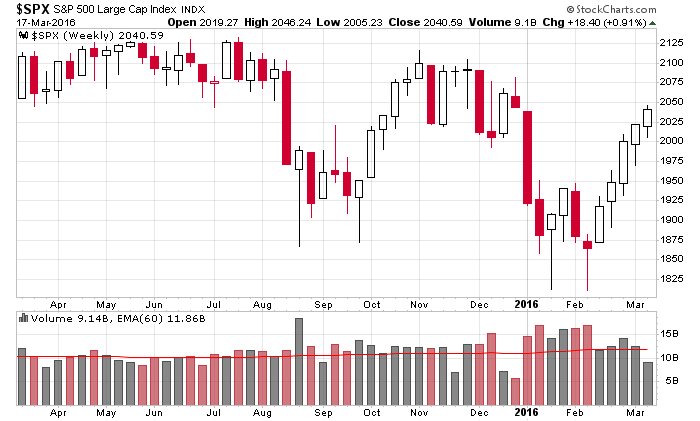

So far we have two up days and two down days this week. The net is a decent gains, so the market is working on a 5-week win streak. Here’s the weekly S&P chart. The index has rallied 230 points in six weeks. I’m not one for guessing tops (mostly because they take time to form, so there tends to be some up and down movement as one forms), but I’ll definitely say the easy money has been made. Over the last month, you could have bought almost anything and made money because during a strong rally, a rising tide raises all ships. But we’re going to move into a time when a rising tide doesn’t raise all ships. The market may continue up, but you’ll have to be a better stock picker to make money.

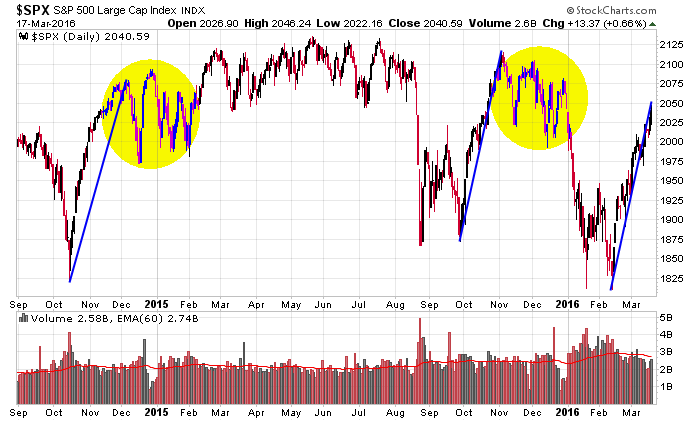

Here’s the daily S&P. The last two such rallies we’ve gotten have led to two months of up and down movement. It’ll happen eventually. The market isn’t going to just rally uninterruptedly. Be mentally ready for a change in character coming soon. Maybe next week. Maybe not until the week after. It’ll happen soon enough.

Stock headlines from barchart.com…

Adobe Systems (ADBE +2.03%) rallied over 5% in pre-market trading after it reported Q1 adjusted EPS of 66 cents, better than consensus of 61 cents, and then raised guidance on fiscal 2016 adjusted EPS to $2.80 from a prior estimate of $2.70, above consensus of $2.76.

Tiffany & Co. (TIF -0.23%) reported Q4 adjusted EPS of $1.46, higher than consensus of $1.40.

JPMorgan Chase (JPM -0.29%) rose 1% in after-hours trading after its board authorized an additional $1.88 billion to be added to its $6.4 billion stock repurchase program authorized last year.

Continental Resources (CLR +4.40%) was rated a new ‘Outperform” at RBC with a price target of $35.

Micron Technology (MU +1.40%) was downgraded to ‘Neutral’ from ‘Positive’ at Susquehanna.

Avista (AVA +1.33%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Titan Machinery (TITN +4.67%) reported a preliminary Q4 adjusted loss of -$1.31, a much bigger loss than consensus of -12 cents.

Adecoagro (AGRO +0.23%) reported Q4 net sales of $209.8 million, above consensus of $202.3 million.

Regency Centers (REG +2.12%) was downgraded to ‘Hold’ from ‘Buy’ at Argus Research.

Shoe Carnival (SCVL +5.55%) rose nearly 6% in after-hours trading after it reported Q4 EPS of 21 cents, well above consensus of 14 cents.

Columbia Pipeline Group (CPGX +2.22%) climbed over 5% in after-hours trading after TransCanada agreed to buy the company for $25.50 a share or $10.2 billion. TransCanada (TRP +3.76%) is down over 4% in after-hours trading after the announcement.

Turquoise Hill Resources (TRQ +3.51%) reported Q4 EPS of 10 cents, well above consensus of 1 cent.

Earnings and Economic Numbers from seekingalpha.com…

Thursday’s Key Earnings

Adobe (NASDAQ:ADBE) +6% AH following an FQ1 beat, strong guidance.

Aeropostale (NYSE:ARO) -42.5% AH after launching a strategic review.

Today’s Economic Calendar

10:00 Reuters/UofM Consumer Sentiment

10:00 Atlanta Fed’s Business Inflation Expectations

1:00 PM Baker-Hughes Rig Count

3:00 PM Fed’s Bullard: U.S. Monetary and Economic Policy

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 18)”

Leave a Reply

You must be logged in to post a comment.

Quad witching today. A mess. By the way, Jason Tif has changed its earnings tale to down big and a renewal of is buy backs. Not a good sign. Currencies are confused, no one is sure what central banks want to do and most of us know the banks are concerned that this market can reverse quickly. This Breeds lies in high places. Riding a few muni bonds, some puts to fade junk bonds, and MCD. own what you eat. Live it up. WTIC looking up.