Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Hong Kong and China rallied more than 2%; Singapore, India and Taiwan did better than 1%. Japan dropped 1.3%. Europe is currently up across-the-board. Norway and Greece are up more than 2%; London, Germany, France, Austria, the Netherlands, Sweden, Poland, Turkey, Finland, Hungary, Spain, Italy, Belgium and Portugal are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

———————

Digital Stock Summit -> I was a panelist…you can register here and get a free day pass and listen to the podcast.

———————

The dollar is down. Oil is up, copper is down. Gold is down, silver is up. Bonds are mixed.

Janet Yellen played nice yesterday. After a few Fed officials talked tough the previous week, prompting discussion of the next rate hike being sooner instead of later, she cited global and financial uncertainties are reasons to be cautious. Wall St. of course cheered this because it desperately wants rates to remain low. The US market posted solid gains, and the Asian/Pacific and Europe markets have followed suit today. The bulls will now want to see follow through today. They’ll want to know yesterday wasn’t a 1-day knee-jerk reaction to Yellen’s comments.

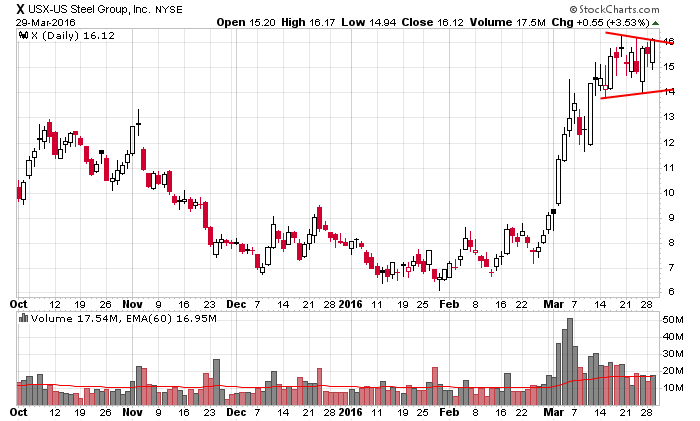

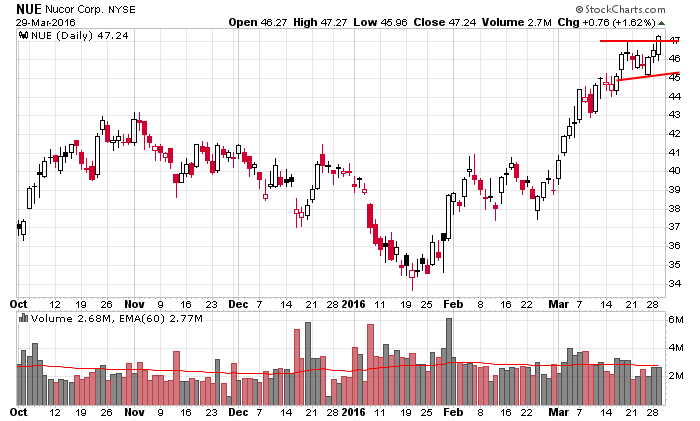

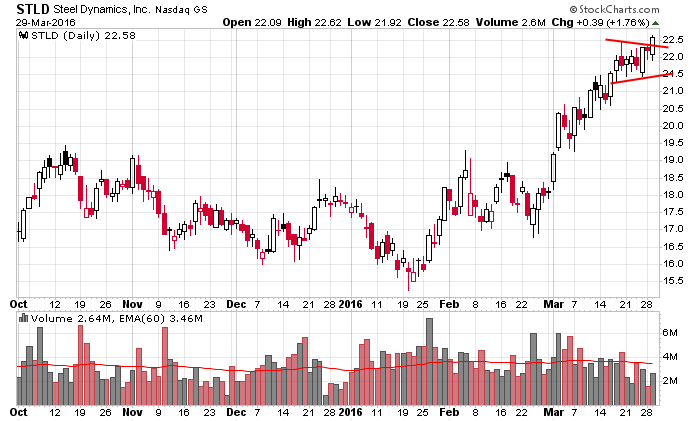

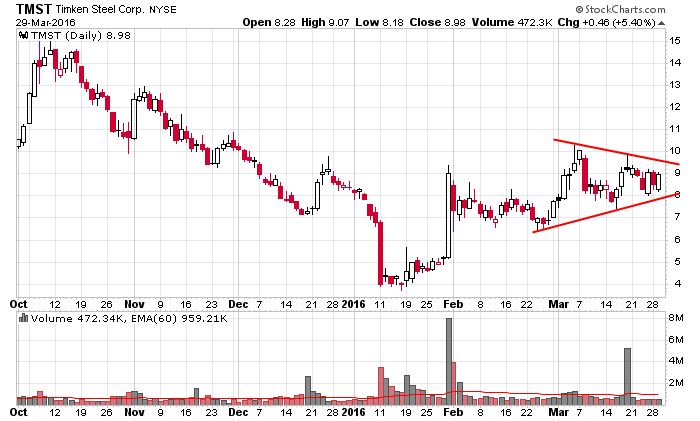

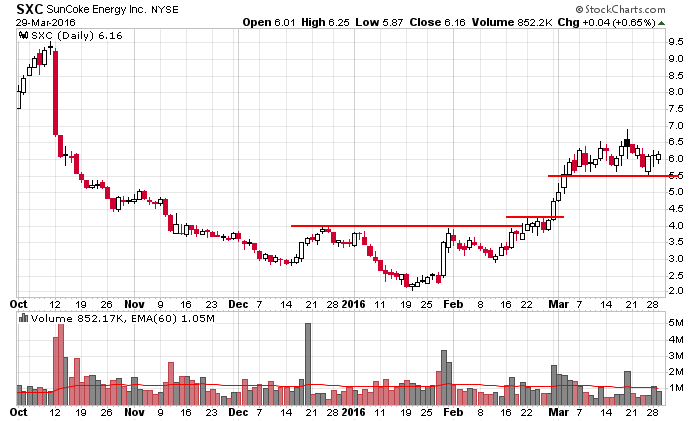

One of my favorite groups right now is steel. Here are a few charts from the group.

Big day today and tomorrow. Follow through or fizzle.

Stock headlines from barchart.com…

Valeant (VRX +0.42%) is seeking to extend its 10Q filing date to July 31 but the company said it is “comfortable” with its current liquidity position and that it is well positioned to meet its obligations.

AllScripts (MDRX +5.43%) was raised to overweight by Morgan Stanley with a target of $16

State Street (STT +0.14%) agreed to buy GE Asset Management for up to $485 million

Foxxcon finalized a deal to buy Japan’s Sharp for $3.5 billion

Sonic (SONC -0.18%) rallied 4% in after-hours trading after beating earnings (18 cents vs 16-cent consensus) and boosting guidance.

Dave & Busters (PLAY +2.19%) reported Q4 EPS of 53 cents, better than the consensus of 43 cents.

Verint Systems (VRNT +0.95%) fell sharply by 12% in after-hours trading after reporting Q4 EPS of 90 cents, below the consensus of $1.17.

Landec Corp (LNDC +0.94%) fell -12% in after-hours trading after reporting EPS of 1 cents, below the consensus of 3 cents.

Dole Foods’ (DOLE +0.74%) outlook was revised to stable from positive by S&P.

Novartis (NVS -1.05%) is investigating allegations of bribery in Turkey, according to Reuters report.

Spotify is raising $1 billion in debt financing from TPG, Dragoneer and Goldman Sachs, according to Dow Jones.

Agios Pharm (AGIO +2.24%) rallied 2% in after-hours trading after being rated as a New Buy at SunTrust.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

10:30 EIA Petroleum Inventories

1:00 PM Results of $28B, 7-Year Note Auction

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Mar 30)”

Leave a Reply

You must be logged in to post a comment.

So… Yellen is worried about the global markets?? She lies, its the US markets that chill the chairlady. It is up for a short time, then we test the lows. Be careful out there because of the lies being told. The jobs report will top the list. 200k jobs.

Hawaii is due west of Mexico City. They never tell you anything. Beware the horse latitudes drug dealers have boats too.

By the way, the one year cycle seems to be holding this year: slow april , down into june. Bear market year. 5% stops??

INDU and SPX merely 3% below all-time highs, Qs 5%. looking at longer term charts (say 5-year) suggests this one-year sharp correction will end up being a little blip in a long and steady bull market.

Thursday,March 31,2016 marks the end of the 1st Q, which seems to end up on a green note, not quite on a high note. Seems to be a hanging man candlestick on at the top, which makes me skeptical. April may indeed seem to be April’s fools for a potential bull trap. Be wary, be alert.