Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia rallied more than 1%; Singapore dropped more than 1%. Indonesia and New Zealand also did well; Japan was also weak. Europe is currently mostly down. France, Finland, Spain and Italy are down more than 1%; London, Germany, Belgium, the Netherlands, Norway and Portugal are also weak. Futures here in the States point towards a slight down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

Yesterday the market had a chance to prove the previous day’s rally was not a knee-jerk reaction to Janet Yellen’s comments, that the buying was real and meaningful, not just a quick reaction. I wasn’t entirely convinced. The indexes moved up, but the activity level was low, and the closes were off the highs. This doesn’t mean I’m assuming the upside is finished. It just means given the warnings we’ve gotten the last two weeks, I’m maintaining my defensive position.

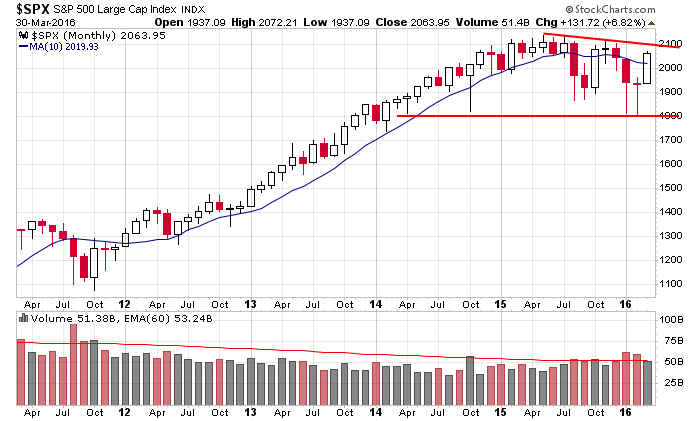

Today is the last day of March and Q1 2016. It’s been a great month. January was weak early but then finished off its low. February was weak early but then finished flat. March has been straight up. Here’s S&P monthly. If this was an individual stock, we’d be looking to buy dips and/or a breakout, so despite everything going on in the world, the market hasn’t done too badly.

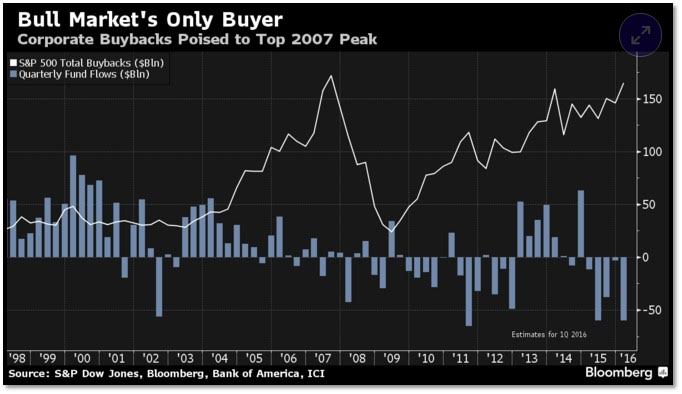

Overall I’m still giving the benefit of the doubt to the bulls, but if it’s true that stock buybacks have played an influential role in pushing stocks up, we may be in for soft patch. Currently buybacks are approaching the 2007 highs, which no doubt has helped the market.

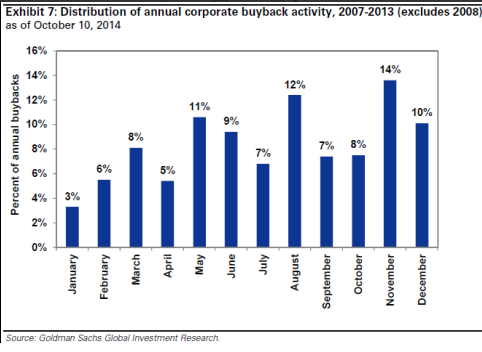

But it’s worth mentioning April has been a weak month for buybacks. Only January is weaker.

Stock headlines from barchart.com…

Tesla (TSLA -1.41%) is due to unveil its Model 3 electric car this evening.

IBM (IBM -0.62%) will reportedly buy Cloud Consulting for about $200 million.

WebMD (WBMD -0.48%) will will replace SunEdison (SUNE +3.51%) in the S&P MidCap 400 effective April 1 post-market.

SciClone Pharmaceuticals (SCLN +0.21%) will replace Affymetrix (AFFX -0.57%) in the S&P SmallCap 600 effective April 1 post-market.

Square (SQ +9.32%) rallied 10% in after-hours trading after Mizuho called the company an acquisition target

Terraform Global (GLBL) rallied 15% in after-hours trading after news that Brian Wuebbels resigned as CEO and a board member from both Terraform Global and Teraform Power (TERP -2.67%), SunEdison’s (SUNE +3.51%) yieldco units, effective immediately.

Micron Technology (MU +0.29%) reported Q2 EPS of -$0.05 2Q, which was a little better than the consensus of -0.08.

Progress Software (PRGS +1.11%) fell 11% in after-hours trading as its 2016 guidance missed estimates and as the CFO retired.

Medivation (MDVN -3.51%) is working with advisors to defend against a takeover, according to Reuters.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Carnival (NYSE:CCL) +5.5% on better-than-expected results.

Lululemon (NASDAQ:LULU) +10.7% after topping expectations.

Micron Technology (NASDAQ:MU) +1% AH despite a loss, soft guidance.

Today’s Economic Calendar

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:30 Fed’s Evans: U.S. Monetary Policy

9:45 Chicago PMI

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

5:00 PM Fed’s Williams Speech

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 31)”

Leave a Reply

You must be logged in to post a comment.

After Friday jobs and the investment of retirement money EOM, we need to pay close attention because we may see a major take-back start to run into summer. 4th qtr. 2016 may be better, in fact the best of the year but a lousy summer. I am running on my yearly calendar for want of anything saying I am wrong. Today first time claims were up Lay-offs starting??. Strong Fed Buying in SP Yesterday? WHY? Hate say I am seeing three drives to a top in the chart today. Could it be? Live it up friends.

I agree with Jason. This rally is running out of petro. I don’t see a big drop maybe 3-5 percent.