Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Australia, Singapore and South Korea led to the upside, but gains were small. Taiwan dropped 1.7%. Europe currently leans to the upside, but movement is minimal too. London, France, Norway, Sweden, Switzerland and Italy are doing well. Turkey is down more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil is up $1.05, copper is down. Gold and silver are down. Bonds are down.

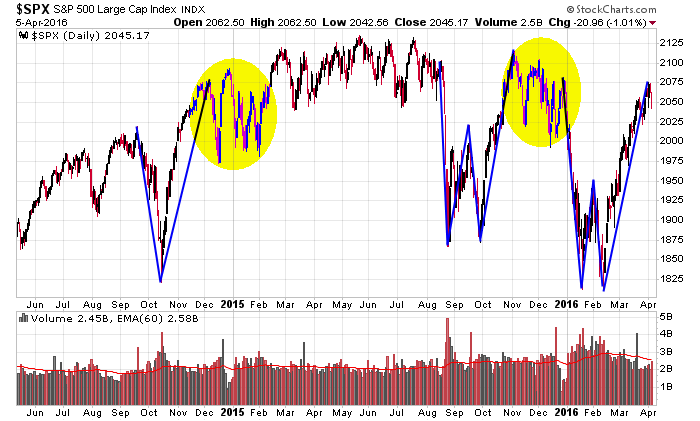

Despite the 2-month trend on the daily chart, the S&P is flat going back 2-1/2 weeks. This is pretty common and not a surprise. Two weeks ago I started suggesting a more defensive posture, given the lack of good set-ups and some lofty breadth indicators, which were starting to diverge from the price action. And here we are two weeks later, the market has gone nowhere.

FOMC Minutes get released today. Rates are hot topic nowadays, so getting a glimpse of the Fed officials’ thinking could move the market.

Here’s the daily chart going back 23 months. I’m still of the opinion we need to be defensive right now. We’ve come a long way in a short period of time, and there’s a lot of resistance over head. Could the market just push higher here? Sure, but the easy money has been made.

That’s it for now. Nothing else to say. My stance now is the same as it was two weeks ago.

Stock headlines from barchart.com…

Cisco Systems (CSCO -1.99%) rose over 2% in pre-market trading after it was upgraded to ‘Neutral’ from ‘Underweight’ at J.P. Morgan Chase.

Pfizer (PFE +2.08%) climbed over 1% in pre-market trading after people familiar with the matter said the company is terminating its $160 billion merger with Allergan Plc after new U.S. tax proposals aimed at curbing corporate inversions. Allergan Plc (AGN -14.77%) is down over 1% in pre-market trading following the news.

Wells Fargo (WFC -2.04%) was downgraded to ‘Neutral’ from ‘Buy’ at Guggenheim Securities.

Fifth Third Bancorp (FITB -1.85%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee CRT with a 12-month price target of $18.

Apple (AAPL -1.18%) was rated a new ‘Strong Buy’ at Needham & Co. with a 12-month price target of $150.

Huntington Bancshares (HBAN -1.05%) was upgradd to ‘Buy’ from ‘Neutral at Sterne Agee CRT with a 12-month price target of $11.50.

Nvidia (NVDA -0.14%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Biogen (BIIB +0.61%) was rated a new ‘Market Perform’ at BMO Capital Markets with a 12-month price target of $283.

PulteGroup (PHM +2.03%) was upgraded to ‘Equal-weight’ from ‘Underweight’ at Barclays.

Wynn Resorts Ltd. (WYNN -2.66%) dropped over 1% in after-hours trading after it reported preliminary Q1 Macau revenue of $603 million-$613 million, compared to $705.4 million in Q1 of 2015.

Cree (CREE -0.58%) slumped over 15% in after-hours trading after it reported preliminary Q3 adjusted EPS of 13 cents-15 cents, well below consensus of 24 cents.

SEI Investments (SEIC -0.75%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Keefe, Bruyette & Woods with a 12-month price target of $45.

Actuity Brands (AYI +2.19%) fell over 3% in after-hours trading in sympathy with the sharp decline in Cree Inc.

A Schulman (SHLM -0.38%) fell nearly 4% in after-hours trading after it reported Q2 revenue of $591.8 million, below consensus of $595.4 million.

Earnings and Economic Numbers from seekingalpha.com…

Tuesday’s Key Earnings

Cree (NASDAQ:CREE) -18.9% following a big preliminary FQ3 miss.

Darden Restaurants (NYSE:DRI) -3.7% after its chairman resigned from the board.

Walgreens (NASDAQ:WBA) -3.4% as sales fell short of expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Gallup U.S. Job Creation Index

10:30 EIA Petroleum Inventories

12:20 PM Fed’s Mester: Economic outlook and Monetary policy

2:00 PM FOMC minutes

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 6)”

Leave a Reply

You must be logged in to post a comment.

The Federal Reserve’s Path: Four Hikes, Two Hikes, Zero Hikes, QE4. The game played by tax evaders is played best in the USA. Panama gets the name of haven, but that is not the case. More international tax dodgers do business in Wash DC, Where former congressional persons sell expert services.

Jobs and debt levels are the big concerns for now. Today, up on hopes that crude will rise. The play today? Don’t get involved this market is being played with.