Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped 1.4%, and India fell 0.9%. Australia, Malaysia and New Zealand posted small-to-moderate gains. Europe currently leans to the downside. Italy and Portugal are down more than 1%; Austria, Sweden, Spain and Belgium are also weak. Futures here in the States point towards a moderate gap down open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is up a small amount. Oil and copper are down. Gold and silver are up. Bonds are up.

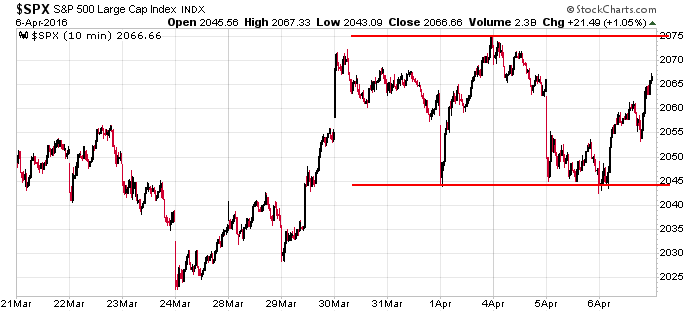

The market is still trying to find itself. Over the last 12 days, 6 have been up, and 6 have been down. The net change is up, but several breadth indicators have moved down. My stance over the last two weeks has been that the market is in (or is about to enter) a consolidation range, so a more defensive posture was warranted. This has mostly kept us out of trouble. We’ve had trades, but there’s been very little follow through.

I haven’t had much to talk about the last week. Each day I look at the charts, and it seems like the situation is the same. Then I look at the 10-min, 12-day chart (see below) and see that over the six days nothing has change. The market has moved in a range, and with today’s opening gap down, the index won’t approach either of its boundaries.

Don’t force things right now. The market spends more time trading in a range than trading directionally, and given move off the February low, the declining breadth indicators, the lack of good set-up, it’s best to pull back on the aggressiveness. More after the open.

Stock headlines from barchart.com…

Fiat Chrysler Automobiles NV (FCAU -1.36%) is down nearly 3% in pre-market trading after Reuters reported that it is indefinitely laying off 1,300 employees at a Michigan factory.

Verizon Communications (VZ -1.05%) was downgraded to ‘Hold’ from ‘Buy’ at Jeffries.

Wynn Resorts Ltd (WYNN -1.51%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Telsey Advisory Group.

Valeant Pharmaceuticals International (VRX +18.93%) rose nearly 4% in after-hours trading after it won support from a majority its lenders to waive a default and ease some restrictions on its $32 billion debt load.

Harley-Davidson (HOG -7.02%) was downgraded to ‘Market Perform’ from ‘Outperform’ at William Blair & Co.

Intercept Pharmaceuticals (ICPT +8.27%) gained almost 1% in after-hours trading after it was initiated with an ‘Outperform’ at BMO Capital Markets.

Ebay (EBAY -0.59%) fell over 1% in after-hours trading after it reported March same-store-sales fell -0.2%, a decline from February’s +9.5% increase.

Bed Bath & Beyond (BBBY -0.51%) rallied over 3% in after-hours trading after it reported Q4 comparable sales rose +1.7%, more than double consensus of +0.8%.

Apollo Education (APOL +0.12%) slid over 2% in after-hours trading after it reported a Q2 adjusted EPS loss of -31 cents continuing operations, a much wider loss than consensus of -10 cents, and said it will not provide future guidance at this time.

Terex (TEX +1.82%) jumped over 3% in after-hours trading after Reuters reported that Zoomlion Heavy Industry Science and Technology told Terex that it will cover the risk of its acquisition of Terex being approved by Chinese authorities.

Alder Biopharmaceuticals (ALDR +7.06%) dropped over 4% in after-hours trading after it began a $100 million secondary offering of stock.

Sprint (S +2.57%) climbed over 2% in after-hours trading after it said it agreed to sell and lease back network assets to generate $2.2 billion in funding to cushion its liquidity position.

Apogee Enterprises (APOG +3.22%) rose almost 5% in after-hours trading after it reported Q3 EPS of 69 cents, higher than consensus of 64 cents.

Ollie’s Bargain Outlet Holdings (OLLI +0.93%) gained almost 6% in after-hours trading after it raised guidance on full-year adjusted EPS to 83 cents-85 cents, above consensus of 76 cents.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Bed Bath & Beyond (NASDAQ:BBBY) +4.5% AH following a big earnings beat.

Constellation Brands (NYSE:STZ) +5.9% on wine purchase, upbeat results.

Monsanto (NYSE:MON) +1.1% after canceling its “large-scale” M&A strategy.

Today’s Economic Calendar

Chain Store Sales

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

3:00 PM Consumer Credit

4:30 Money Supply

4:30 Fed Balance Sheet

5:30 PM Janet Yellen in conversation with former Fed Chairs

8:15 PM Fed’s George: Economic Outlook

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 7)”

Leave a Reply

You must be logged in to post a comment.

Shift in the winds today- down for a while. We live in the greatest tax haven in the world. But I have trouble learning, still paying —and delighted, sort of. Expect that we commence the “May go away” soon. Hero’s die but once. but this move is on my mind. ABC down in the dollar underway. Sell the Euro buy the pound looks interesting, but be careful if Briext passes.

the indicator currency for equities ATM is the jap yen

the fed is doing more damage to the world and needs to be jailed