Good morning. Happy Friday.

The Asian/Pacific markets closed with a lean to the downside. China, Indonesia and Australia closed down; Japan, Hong Kong and Taiwan closed up. Europe is currently mostly up. Italy is up more than 3%; Germany, France, Austria, Sweden, the Czech Republic, Greece, Finland, Spain and Portugal are up more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is up a small amount. Oil is up big ($1.45), but copper is down. Gold is down, silver is up. Bonds are down.

The market cannot decide what it wants to do right now. It posted a moderate loss on Tuesday and Thursday and a moderate gain on Wednesday. Today we’ll start with a moderate gap up.

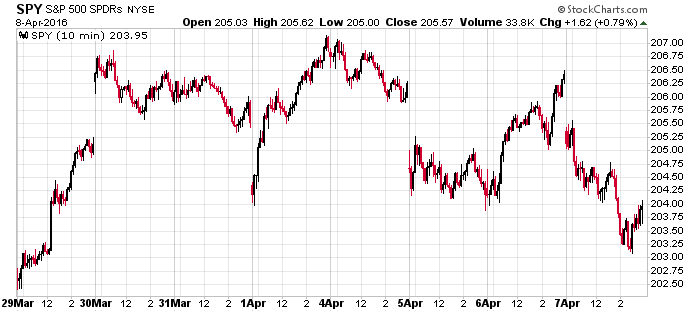

Up, down, up, down. Nothing sticks. There is no follow through. Here’s the S&P, via SPY, going back eight days. Including today, we’ll have two big gap ups and three big gap downs. The only directional move that continued was March 29/30. From a swing trading standpoint it’s been frustrating (although we’ve gotten some nice moves in oil). Don’t fight this. Recognize the market’s current personality and make needed adjustments.

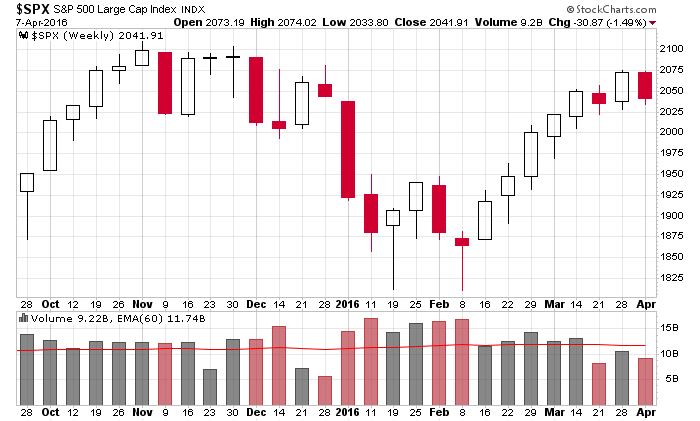

Here’s the S&P weekly. Barring a huge rally today, the index will post its biggest down week since the beginning of February. Given the declining internals, this should surprise no one. Remember, tops take time to form, so even if a top is forming, it’ll take several weeks of up and down movement before a directional move begins. And if a top isn’t forming, well, this is just a normal pullback within an uptrend.

Stock headlines from barchart.com…

Ulta Salon Cosmetics & Fragrances (ULTA -0.28%) rose nearly 4% in after-hours trading after it was announced that it will replace Tenet Healthcare in the S&P 500 as of the close of trading Friday, April 15.

Molson Coors Brewing (TAP -1.80%) was downgraded to ‘Neutral’ from ‘Buy’ at Bryan Garnier & Cie.

LinkedIn (LNKD -2.02%) was downgraded to ‘Neutral’ from ‘Buy’ at MKM Partners.

The Gap (GPS -4.09%) slid over 3% in pre-market trading after it reported March comparable sales were down 6%, a bigger decline than consensus of down 5%.

PriceSmart (PSMT -0.43%) fell -0.2% in after-hours trading after it reported comparable sales for the 4-weeks ended March 27 were down -5.4%.

Helmerich & Payne (HP -1.75%) was rated a new ‘Buy’ at Nomura with a price target of $66.

Schlumberger Ltd (SLB -1.57%) was rated a new ‘Buy’ at Nomura with a price target of $81.

Duluth Holdings (DLTH +2.47%) climbed over 5% in after-hours trading after it reported 2016 net sales of $370 million-$380 million, higher than consensus of $369.8 million.

WD-40 (WDFC -0.62%) fell over 1% in after-hours trading after it said it sees 2016 revenue of $385 million-$394 million, below estimates of $394.5 million.

Ruby Tuesday (RT +0.77%) slumped over 15% in after-hours trading after it lowered guidance in fiscal 2016 adjusted EPS to 5 cents-8 cents from an earlier estimate of 12 cents-17 cents, below consensus of 12 cents.

Depomed (DEPO +1.15%) climbed nearly 7% in after-hours trading after Starboard Value LP disclosed a 6.8% stake in the company.

AngioDynamics (ANGO +3.38%) dropped over 5% in after-hours trading after it lowered guidance on fiscal year adjusted EPS to 54 cents-58 cents from a January estimate of 59 cents-63 cents, below consensus of 60 cents.

Compass Minerals International (CMP -0.94%) lowered guidance on 2016 EPS to $3.25-$3.65 from a prior estimate of $3.80-$4.20, below consensus of $3.94.

Earnings and Economic Numbers from seekingalpha.com…

Thursday’s Key Earnings

Rite Aid (NYSE:RAD) -0.5% on declining same-store sales.

Today’s Economic Calendar

8:30 Fed’s Williams Speech

10:00 Wholesale Trade

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 8)”

Leave a Reply

You must be logged in to post a comment.

Special fed met today. Why? Duck! Currencies and commodities are moving today: beans, wheat, and yen look to be probable movers. I am in calls. Food is critical.

Look at Zero Hedge today:The federal government was unable to demonstrate the reliability of significant portions of its accrual-based financial statements as of and for the fiscal years ended September 30, 2015, and 2014, principally resulting from limitations related to certain material weaknesses in internal control over financial reporting and other limitations affecting the reliability of these financial statements. For example, about 34 percent of the federal government’s reported total assets as of September 30, 2015, and approximately 19 percent of the federal government’s reported net cost for fiscal year 2015, relate to three CFO Act agencies—the Department of Defense (DOD), the Department of Housing and Urban Development, and the U.S. Department of Agriculture—that received disclaimers of opinion on their fiscal year 2015 financial statements. As a result, we were prevented from providing an opinion on the accrual-based financial statements.

believe it? I am all shook up. No one is driving? Hold on.