Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the downside. China and India rallied more than 1%. Indonesia dropped more than 1%; Japan was also weak. Europe is currently mostly up. Germany, Belgium, Russia, Turkey, Spain and Italy are up more than 1%; the Netherlands, Norway and France are also doing well. Future here in the States point towards a moderate gap up open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is down slightly. Oil and cooper are down. Gold and silver are up. Bonds are down.

As is typically the case, I don’t have anything to say beyond what was already said in the weekly report posted over the weekend.

The market is mixed up right now. The big picture says the market has been in consolidation mode for two years. The intermediate term – going back a couple months – looks good and has looked more promising than the October rally. But the short term trend points down. Breadth has been declining for a month, and a several indicators point towards a need to recycle before supporting a rally attempt. When the three time frames tell different stories, as has been the case the last couple weeks, it’s wise to be defensive.

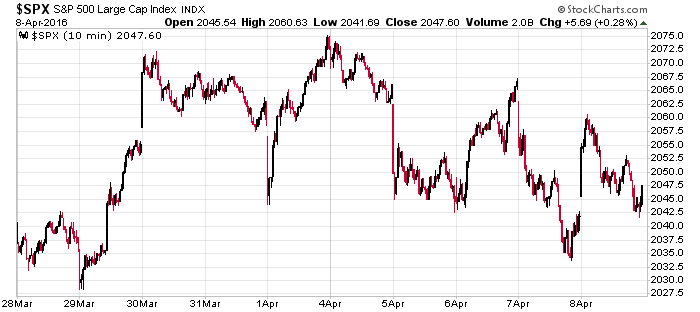

Here’s the 10-min, 10-day S&P chart. A big sloppy mess. Rallies get sold, dips get bought. Nothing sticks. No follow through. Make adjustments or get chopped up.

Stock headlines from barchart.com…

Alcoa (AA -1.16%) climbed over 3% in pre-market trading before it releases its Q1 earnings results after today’s close.

Yahoo! (YHOO -0.28%) rose over 1% in pre-market trading after the parent company of the UK’s Daily Mail said it is in talks with a number of potential bidders for Yahoo.

United Natural Foods (UNFI -1.10%) was downgraded to ‘Underweight’ from Equal Weight’ at Morgan Stanley.

NXP Semiconductors (NXPI +1.82%) was rate a new ‘Buy’ at Nomura with a price target of $95.

Potash Corp. of Saskatchewan (POT -0.50%) was downgraded to ‘Hold’ from ‘Buy’ at HSBC.

Noble (NE +1.92%) was downgraded to ‘Hold’ from ‘Buy at Societe Generale.

Restaurant Brands International (QSR -0.78%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital Markets.

Cummins (CMI +1.13%) was downgraded to ‘Neutral’ from ‘Outperform’ at Macquarie.

Valero Energy (VLO +2.27%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

United Continental (UAL -0.15%) slipped nearly 1% in after-hours trading after the company reported March traffic was down -1.5% and its Mar consolidated load factor fell -1.1 points versus Mar 2015.

QLogic (QLGC +6.80%) climbed over 2% in after-hours trading after Bloomberg reported the company hired Qatalyst Partners to explore strategic alternatives for the company, including a possible sale.

Boston Scientific (BSX +0.10%) fell nearly 1% in after-hours trading after it voluntarily recalled its Fetch 2 aspiration catheter due to complaints of shaft breakage.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

none

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 11)”

Leave a Reply

You must be logged in to post a comment.

Janet and Obama today? Can not be good. Doha and oil prices 16th they have price fixing in mind. Based on Fact Set data says this is shaping up to be the second-worst quarter in a decade as far as earnings warnings go, it appears that analysts came into 2016 way too biased to the upside. With the stock market up dramatically since the recent winter lows, the market has now priced in a lot of optimism.

Check Jason’s weekend review if you need to see some confirmation. I am in puts now and will be short into May 2016. Not expecting a good year; love them stops. And pick the indices inverse. Nervous.

Nice weekend update!

is the usd $100 note to be banned ,withdrawn ,cancelled,destroyed,,

well big notes have been cancelled in other currencies

its the first step to banning cash,so as big brother can rule in the cashless world

down with the world economy

lets have a debt depression and bears to rule