Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan rallied 1.1%; Australia, India, Indonesia and South Korea also did well. Europe is currently mixed. Greece is down more than 1%; Russia, Sweden, Denmark, Finland, Hungary and Italy are also weak. Ukraine is up more than 1%; Norway and Spain are also doing well. Futures here in the States point towards gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are down.

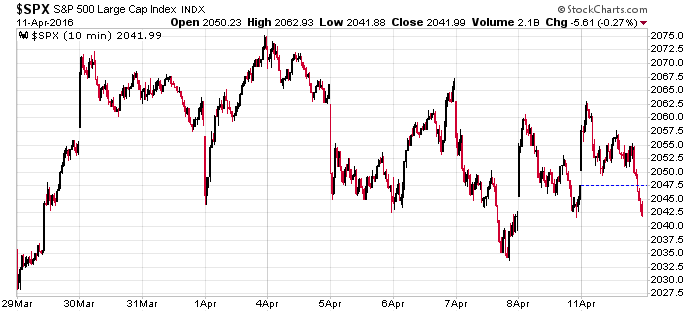

The market has churned in place for two weeks. There have been several moderate gaps and a few directional moves, but nothing has lasted more than a day. It’s been a spit-swapping affair. Here’s the S&P, via SPY to show the gaps.

But while the indexes tell us nothing is going on, beneath the surface, there are definitely groups worth playing. Gold and silver are doing great. Some oil stocks continue to act well. Heck, commodities in general are doing well. It helps the dollar has been weak, but that doesn’t matter from a trading standpoint. There’s an old saying on Wall St: There’s a bull market somewhere. It’s true. The indexes may be churning in place, but beneath the surface, money will be flowing into a few groups. If you play those, you’ll be fine despite the overall market not doing much. I’m going to talk about this is a report to be published later this week.

In the very near term I still lean to the downside. It’s unlikely there will be forceful buying until we get more earnings visibility. More after the open.

Stock headlines from barchart.com…

Corning (GLW +0.44%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs with a price target of $26.

Alcoa (AA +3.95%) slid over 4% in pre-market trading after it reported Q1 revenue of $4.95 billion, below consensus of $5.2 billion.

Starbucks (SBUX -0.23%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

ADT Corp. (ADT +0.02%) was downgraded to ‘Sell’ from ‘Hold’ at Argus Research.

Juniper Networks (JNPR -0.16%) dropped over 6% in after-hours trading after it lowered guidance on Q1 adjusted EPS to 35 cents-37 cents from a January estimate of 42 cents-46 cents, below consensus of 45 cents. Cisco Systems (CSCO -0.25%) fell over 1% and F5 Networks (FFIV -0.17%) dropped nearly 2% in after-hours trading after the Juniper news.

Mohawk Industries (MHK +0.23%) was rated a new ‘Buy’ at MKM Partners with a price target of $244.

Retrophin (RTRX -2.50%) was rated a new ‘Outperform’ at BMO Capital Markets with a 12-month price target of $25.

Yandex (YNDX +4.19%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs

Dycom Industries (DY +0.43%) was rated a new ‘Buy’ at Canaccord Genuity with a price target of $75.

Affimed NV (AFMD +2.37%) was rated a new ‘Outperform’ at BMO Capital Markets with a 12-month price target of $7.

Pandora Media (P -0.97%) gained over 2% in after-hours trading after it was rated a new ‘Buy’ at Citigroup with a price target of $16.

Marathon Oil (MRO -0.93%) climbed nearly 2% in after-hours trading after it said it will divest all of its Wyoming upstream and midstream assets for $870 million, ex-closing adjustments.

Sprint Realty Capital (SRC -0.95%) fell over 3% in after-hours trading after it began a 27 million share secondary offering of common stock.

Monday’s Key Earnings

Alcoa (NYSE:AA) -4.4% AH hurt by weak aluminum prices.

Today’s Economic Calendar

6:00 NFIB Small Business Optimism Index

8:30 Import/Export Prices

8:55 Redbook Chain Store Sales

9:00 Fed’s Harper: Economic Outlook

1:00 PM Results of $24B, 3-Year Note Auction

2:00 PM Treasury Budget

3:00 PM Fed’s Williams: Monetary Policy

4:00 PM Fed’s Lacker speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 12)”

Leave a Reply

You must be logged in to post a comment.

Earnings OPEN! Weak start, Alcoa was a mess. Futures weak today. Rumors that the Fed could be reorganized to remove the private owner banks. In college they said that part was of the design: private property and regionalism. But that was in the 1970s. Gold is likely to correct before more currency games where the dollar falls UDN???. I say careful today, could come down with vigor or something.

the narrow range tells a big move is coming

it does not tell if up or down and maybe opts ex and bank earnings related

the largest share exch in world is controlling markets

london and ftse stuck at 6200 main piviot

spx main piviot is 2052

up openings down finishes

bears picnic coming soon